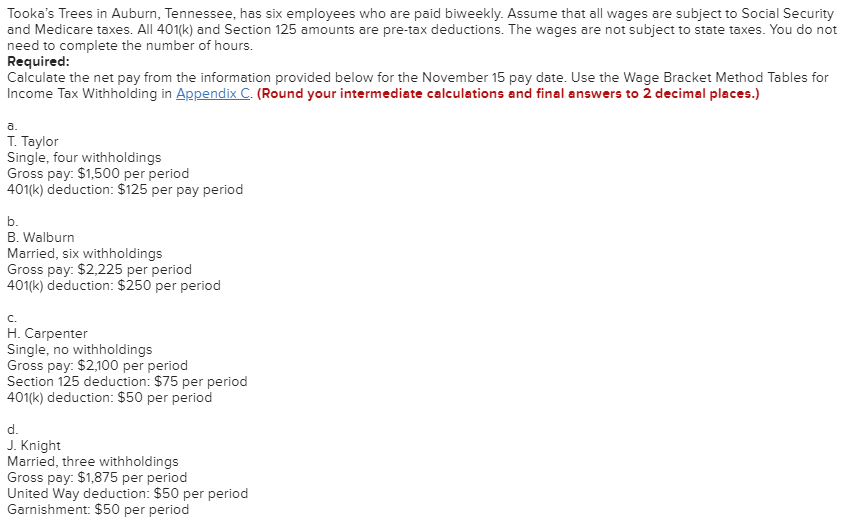

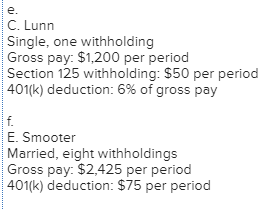

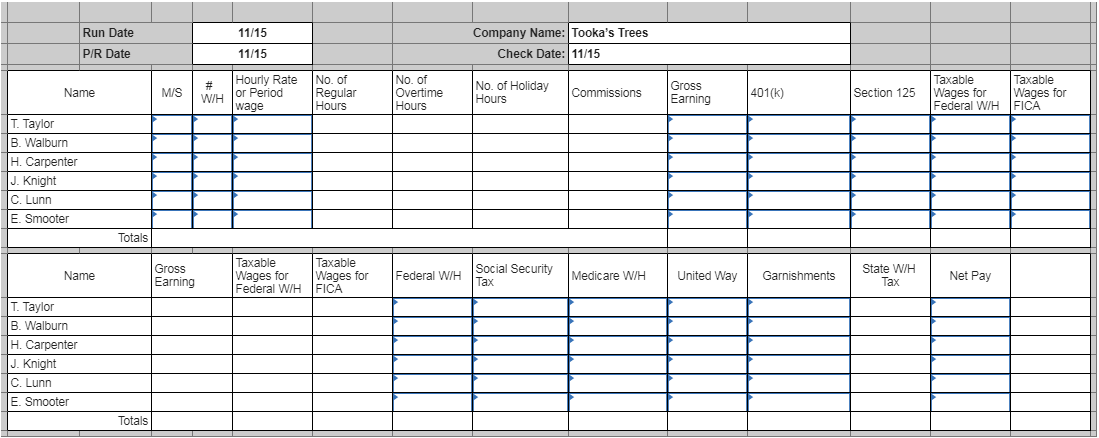

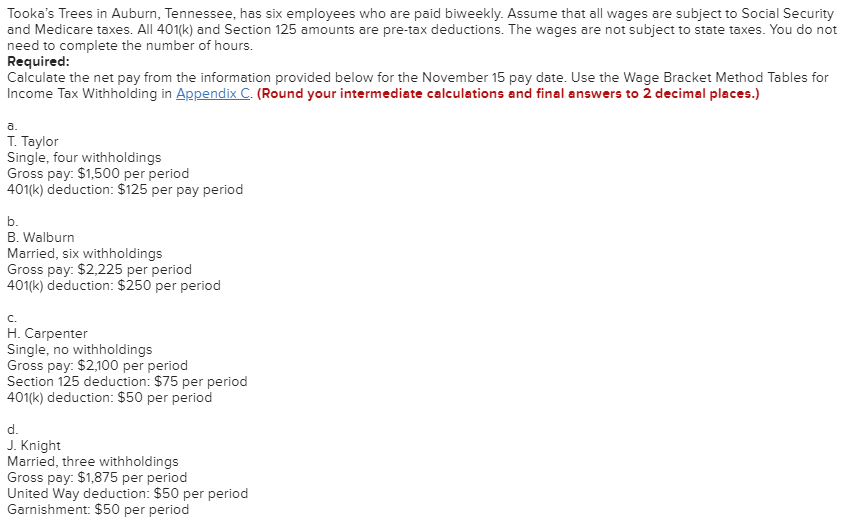

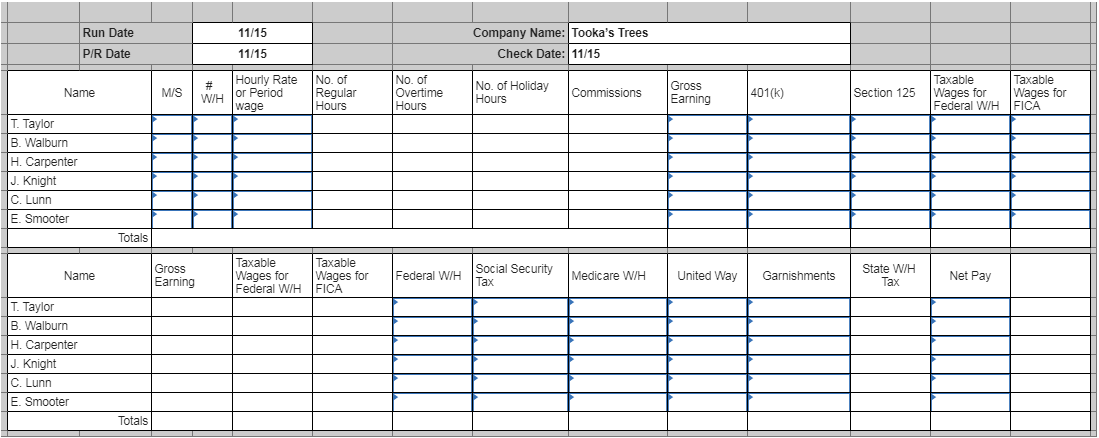

Tooka's Trees in Auburn, Tennessee, has six employees who are paid biweekly. Assume that all wages are subject to Social Security and Medicare taxes. All 401(k) and Section 125 amounts are pre-tax deductions. The wages are not subject to state taxes. You do not need to complete the number of hours. Required: Calculate the net pay from the information provided below for the November 15 pay date. Use the Wage Bracket Method Tables for Income Tax Withholding in Appendix C. (Round your intermediate calculations and final answers to 2 decimal places.) T. Taylor Single, four withholdings Gross pay: $1,500 per period 401(k) deduction: $125 per pay period b. B. Walburn Married, six withholdings Gross pay: $2,225 per period 401(k) deduction: $250 per period H. Carpenter Single, no withholdings Gross pay: $2,100 per period Section 125 deduction: $75 per period 401(k) deduction: $50 per period d. J. Knight Married, three withholdings Gross pay: $1,875 per period United Way deduction: $50 per period Garnishment: $50 per period C. Lunn Single, one withholding Gross pay: $1,200 per period Section 125 withholding: $50 per period 401(k) deduction: 6% of gross pay E. Smooter Married, eight withholdings Gross pay: $2,425 per period 401(k) deduction: $75 per period Run Date 11/15 Company Name: Tooka's Trees Check Date: 11/15 P/R Date 11/15 Name M/S WH Hourly Rate or Period wage No. of Regular Hours No. of Overtime Hours No. of Holiday Hours Commissions Gross Earning 401(k) Section 125 Taxable Wages for Federal W/H Taxable Wages for FICA T. Taylor B. Walburn H. Carpenter J. Knight C. Lunn E. Smooter Totals Name Gross Earning Taxable Wages for Federal W/H Taxable Wages for FICA Federal W/H Social Security Medicare W/H Tax United Way State W/H Tax Garnishments Net Pay T. Taylor B. Walburn H. Carpenter J. Knight C. Lunn E. Smooter Totals Tooka's Trees in Auburn, Tennessee, has six employees who are paid biweekly. Assume that all wages are subject to Social Security and Medicare taxes. All 401(k) and Section 125 amounts are pre-tax deductions. The wages are not subject to state taxes. You do not need to complete the number of hours. Required: Calculate the net pay from the information provided below for the November 15 pay date. Use the Wage Bracket Method Tables for Income Tax Withholding in Appendix C. (Round your intermediate calculations and final answers to 2 decimal places.) T. Taylor Single, four withholdings Gross pay: $1,500 per period 401(k) deduction: $125 per pay period b. B. Walburn Married, six withholdings Gross pay: $2,225 per period 401(k) deduction: $250 per period H. Carpenter Single, no withholdings Gross pay: $2,100 per period Section 125 deduction: $75 per period 401(k) deduction: $50 per period d. J. Knight Married, three withholdings Gross pay: $1,875 per period United Way deduction: $50 per period Garnishment: $50 per period C. Lunn Single, one withholding Gross pay: $1,200 per period Section 125 withholding: $50 per period 401(k) deduction: 6% of gross pay E. Smooter Married, eight withholdings Gross pay: $2,425 per period 401(k) deduction: $75 per period Run Date 11/15 Company Name: Tooka's Trees Check Date: 11/15 P/R Date 11/15 Name M/S WH Hourly Rate or Period wage No. of Regular Hours No. of Overtime Hours No. of Holiday Hours Commissions Gross Earning 401(k) Section 125 Taxable Wages for Federal W/H Taxable Wages for FICA T. Taylor B. Walburn H. Carpenter J. Knight C. Lunn E. Smooter Totals Name Gross Earning Taxable Wages for Federal W/H Taxable Wages for FICA Federal W/H Social Security Medicare W/H Tax United Way State W/H Tax Garnishments Net Pay T. Taylor B. Walburn H. Carpenter J. Knight C. Lunn E. Smooter Totals