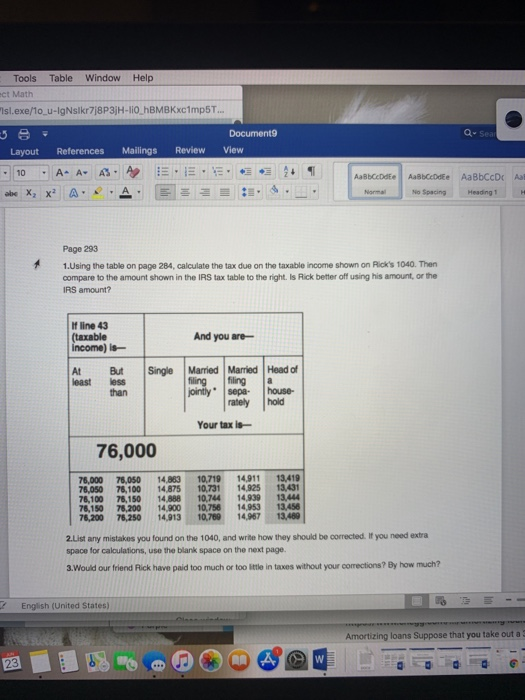

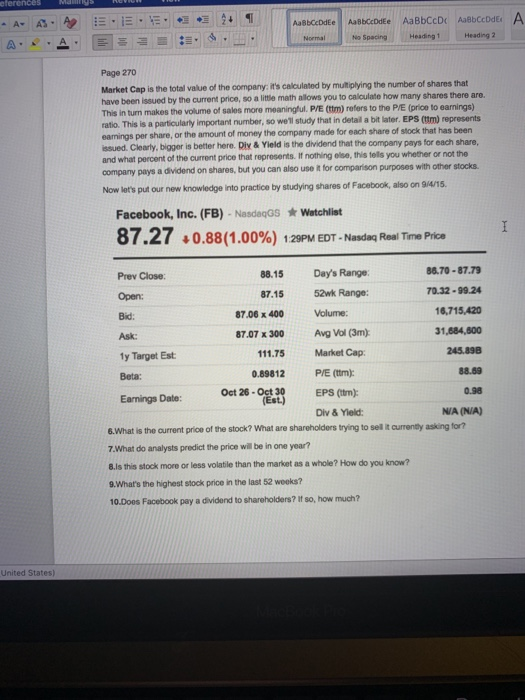

Tools Table Window Help ct Math Isl.exe/1o u-lgNslkr7j8P3jH-lio hBMBKxc1mp5T... Q-Seal Document9 View Mailings Review Layout References EEE A A- 10 AabCcDdEe AaBbCcDdEe AaBbCcD Aaf abe X x2 A Normal No Spacing Heading 1 Page 293 1.Using the table on page 284, calculate the tax due on the taxable income shown on Rick's 1040. Then compare to the amount shown in the IRS tax table to the right. Is Rick better off using his amount, or the IRS amount? If line 43 (taxable income) is- And you are- Married Married Head of filing sepa- rately At least Single But less than a house- hold filing jointly is Your tax i 76,000 10.719 13,419 13.431 13,444 13,456 13,480 76.000 76,050 14.911 14.863 14,875 14,888 14.900 14.913 14.925 75,050 10.731 10,744 76,100 14,939 10,756 14,953 10.769 76,100 76,150 76,150 78,200 76.250 76,200 14,967 2.List any mistakes you found on the 1040, and write how they should be corrected. If you need extra space for caloulations, use the blank space on the next page. 3.Would our friend Rick have paid too much or too little in taxes without your corrections? By how much? English (United States) Amortizing loans Suppose that you take out a w 23 eferences Mamnga A AaBbCcD AaBbCcDdE EEE AabCcDdEe AaBbCcDdEe Heading 2 No Spacing Heading 1 Normal Page 270 Market Cap is the total value of the company: it's calculated by multiplying the number of shares that have been issued by the current price, so a little math allows you to caloulate how many shares there are. This in turn makes the volume of sales more meaningful. P/E (ttm) refers to the P/E (price to eanings) ratio. This is a partioularly important number, so we'll study that in detail a bit later. EPS (ttm) represents eamings per share, or the amount of money the company made for each share of stock that has been issued. Clearly, bigger is better here. Div & Yield is the dividend that the company pays for each share, and what percent of the current price that represents. If nothing else, this tels you whether or not the company pays a dividend on shares, but you can also use it for comparison purposes with other stocks. Now let's put our new knowledge into practice by studying shares of Facebook, also on 9/4/15. Facebook, Inc. (FB) NasdaqGS Watchlist 87.27 0.88(1.00%) 129PM EDT-Nasdag Real Time Price 86.70-87.79 Day's Range: 88.15 Prev Close 70.32-99.24 52wk Range: 87.15 Open: 16,715,420 Volume: 87.06 x 400 Bid: 31,684,600 Avg Vol (3m) 87.07 x 300 Ask: 245.898 Market Cap: 111.75 1y Target Est 88.69 P/E (ttm): 0.89812 Beta: Oct 26-Oct 30 (Est.) 0.98 EPS (tm) Earnings Date: N/A (N/A) Div & Yleld 6.What is the current price of the stock? What are shareholders trying to sel it currently asking for? 7.What do analysts predict the price will be in one year? 8.ls this stock more or less volatile than the market as a whole? How do you know? 9.What's the highest stock price in the last 52 weeks? 10.Does Facebook pay a dividend to shareholders? If so, how much? United States)