Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2.- A binomial model is used to explain the changes in the price of a stock. The current spot price is $100. The u

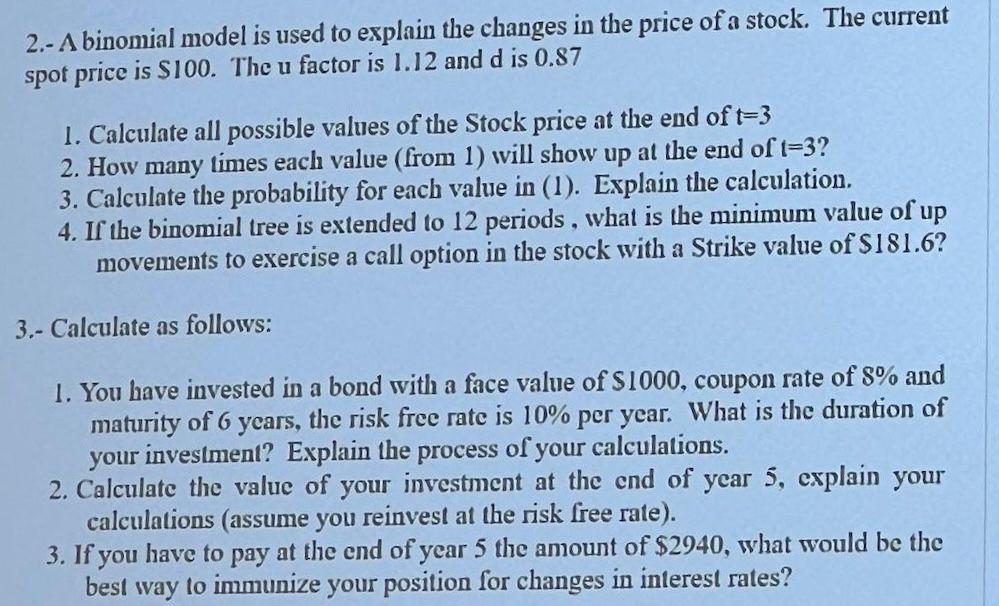

2.- A binomial model is used to explain the changes in the price of a stock. The current spot price is $100. The u factor is 1.12 and d is 0.87 1. Calculate all possible values of the Stock price at the end of t=3 2. How many times each value (from 1) will show up at the end of t=3? 3. Calculate the probability for each value in (1). Explain the calculation. 4. If the binomial tree is extended to 12 periods, what is the minimum value of up movements to exercise a call option in the stock with a Strike value of $181.6? 3.- Calculate as follows: 1. You have invested in a bond with a face value of $1000, coupon rate of 8% and maturity of 6 years, the risk free rate is 10% per year. What is the duration of your investment? Explain the process of your calculations. 2. Calculate the value of your investment at the end of year 5, explain your calculations (assume you reinvest at the risk free rate). 3. If you have to pay at the end of year 5 the amount of $2940, what would be the best way to immunize your position for changes in interest rates?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

2 A binomial model is used to explain the changes in the price of a stock The current spot price is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started