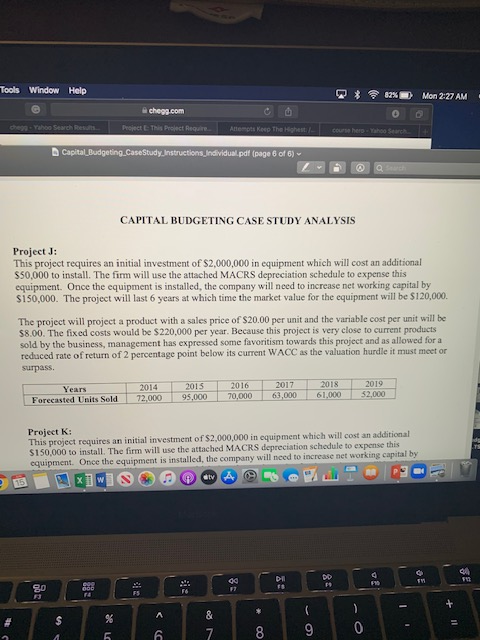

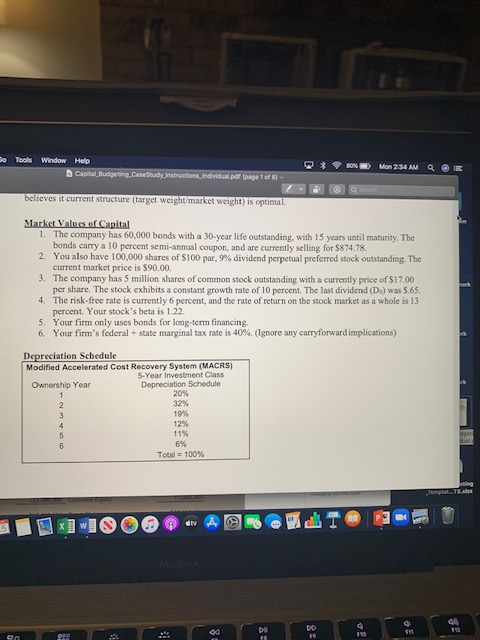

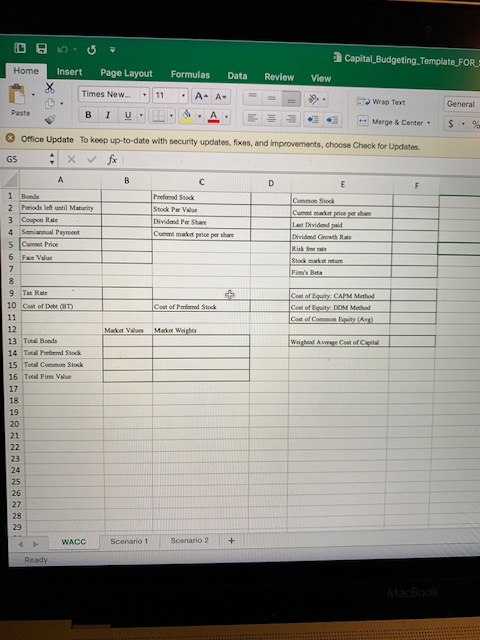

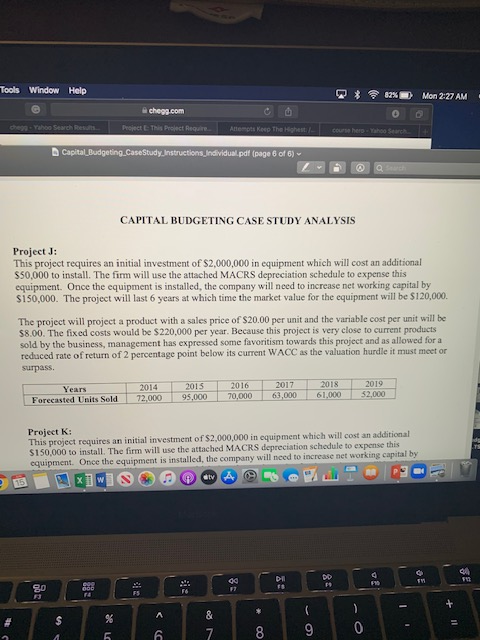

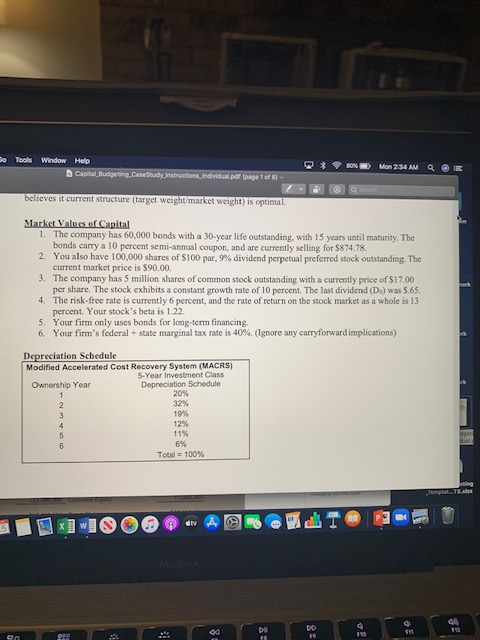

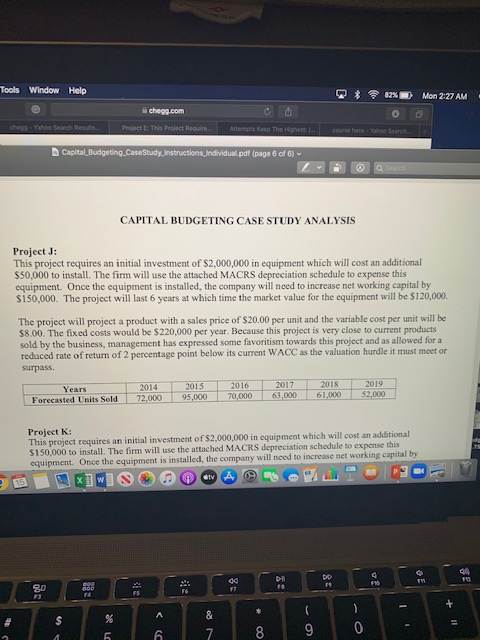

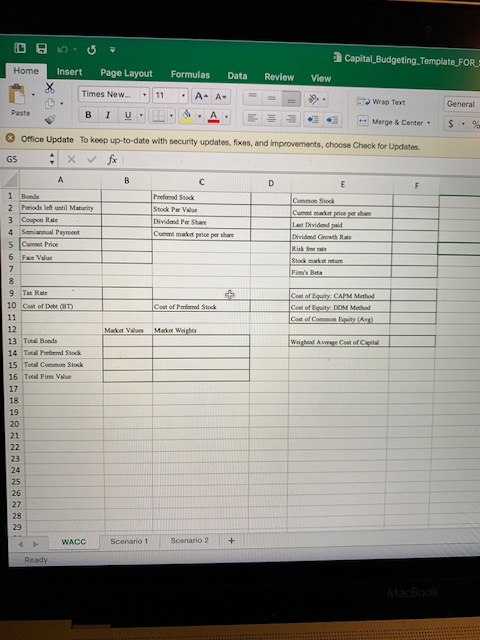

Tools Window Help 82%) Mon 2:27 AM chegg.com Project This Project Require chego-ruloo Search Results Attempts Keep The Highest course here Yahoo Search Capital_Budgeting Case Study Instructions Individual.pdf (page 6 of 6) CAPITAL BUDGETING CASE STUDY ANALYSIS Project J: This project requires an initial investment of $2,000,000 in equipment which will cost an additional $50,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by $150,000. The project will last 6 years at which time the market value for the equipment will be $120,000 The project will project a product with a sales price of $20.00 per unit and the variable cost per unit will be $8.00. The fixed costs would be $220,000 per year. Because this project is very close to current products sold by the business, management has expressed some favoritism towards this project and as allowed for a reduced rate of return of 2 percentage point below its current WACC as the valuation hurdle it must meet or surpass. Years Forecasted Units Sold 2014 72,000 2015 95,000 2016 70,000 2017 63.000 2018 61.000 2019 52,000 Project : This project requires an initial investment of $2,000,000 in equipment which will cost an additional S150,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by aty 15 C TM DI FS DO FS si od F2 SE F 80 000 000 14 FS + A % & ( - . $ 5 6 7 0 9 oo Bo Tools Window Help Capital Budgeting.Case Study Instruction Individual pdf (page 1 of 6) - 80% Mon 234 AM QE believes it current structure (target weight market weight) is optimal Market Values of Capital 1. The company has 60,000 bonds with a 30-year life outstanding, with 15 years until maturity. The bonds carry a 10 percent semi-annual coupon, and are currently selling for $874.78. 2. You also have 100,000 shares of $100 par, 9% dividend perpetual preferred stock outstanding. The current market price is $90.00 3. The company has 5 million shares of common stock outstanding with a currently price of $17.00 per share. The stock exhibits a constant growth rate of 10 percent. The last dividend (D.) was 5.65 4. The risk-free rate is currently 6 percent, and the rate of return on the stock market as a whole is 13 percent. Your stock's beta is 1.22 5. Your firm only uses bonds for long-term financing. 6. Your firm's federal + state marginal tax rate is 40%. (Ignore any carryforward implications) Depreciation Schedule Modified Accelerated Cost Recovery System (MACRS) 5-Year Investment Class Ownership Year Depreciation Schedule 1 20% 2 32% 3 19% 4 12% 5 11% 6 6% Total = 100% ing DD 79 2 Tools Window Help 82%) Mon 2:27 AM chegg.com Project This Project Require chego-ruloo Search Results Attempts Keep The Highest course here Yahoo Search Capital_Budgeting Case Study Instructions Individual.pdf (page 6 of 6) CAPITAL BUDGETING CASE STUDY ANALYSIS Project J: This project requires an initial investment of $2,000,000 in equipment which will cost an additional $50,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by $150,000. The project will last 6 years at which time the market value for the equipment will be $120,000 The project will project a product with a sales price of $20.00 per unit and the variable cost per unit will be $8.00. The fixed costs would be $220,000 per year. Because this project is very close to current products sold by the business, management has expressed some favoritism towards this project and as allowed for a reduced rate of return of 2 percentage point below its current WACC as the valuation hurdle it must meet or surpass. Years Forecasted Units Sold 2014 72,000 2015 95,000 2016 70,000 2017 63.000 2018 61.000 2019 52,000 Project : This project requires an initial investment of $2,000,000 in equipment which will cost an additional S150,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by aty 15 C TM DI FS DO FS si od F2 SE F 80 000 000 14 FS + A % & ( - . $ 5 6 7 0 9 oo a Capital_Budgeting_Template FOR_= Home Insert Page Layout Formulas Data Review View Times New... 11 A- A+ Wrap Text General Paste B IV. Merge & Center $. Office Update To keep up to date with security updates, fixes, and improvements, choose Check for Updates GS x fx B C D E F Pred Stock Stock Par Value Divides Per Share Cum price per she Common Stock Cum ma prica per she Last Dividend paid Dividend Growth Rae Risk free Stock Cost of Pod Stock Coat of Equity CAPM Method Cost of Equity DOM Mehed Cost of Equity Al Mwa Mae Weighs Wrighted Aveare Cost of Capit 1 2 Periods left until Maturity 3 Coupon Rate 4 Seal Payment 5 Cur Price 6 Face Value 7 8 9 Tax Rate 10 Cost of DD 11 12 13 Total Boda 14 Total Preford Stock 15 Total Common Stock 16 Tool Fire Value 17 18 19 20 21 22 23 24 25 26 27 28 29 WACC Scenario 1 Scenario 2 + Ready MacBOOK Tools Window Help 82%) Mon 2:27 AM chegg.com Project This Project Require chego-ruloo Search Results Attempts Keep The Highest course here Yahoo Search Capital_Budgeting Case Study Instructions Individual.pdf (page 6 of 6) CAPITAL BUDGETING CASE STUDY ANALYSIS Project J: This project requires an initial investment of $2,000,000 in equipment which will cost an additional $50,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by $150,000. The project will last 6 years at which time the market value for the equipment will be $120,000 The project will project a product with a sales price of $20.00 per unit and the variable cost per unit will be $8.00. The fixed costs would be $220,000 per year. Because this project is very close to current products sold by the business, management has expressed some favoritism towards this project and as allowed for a reduced rate of return of 2 percentage point below its current WACC as the valuation hurdle it must meet or surpass. Years Forecasted Units Sold 2014 72,000 2015 95,000 2016 70,000 2017 63.000 2018 61.000 2019 52,000 Project : This project requires an initial investment of $2,000,000 in equipment which will cost an additional S150,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by aty 15 C TM DI FS DO FS si od F2 SE F 80 000 000 14 FS + A % & ( - . $ 5 6 7 0 9 oo Bo Tools Window Help Capital Budgeting.Case Study Instruction Individual pdf (page 1 of 6) - 80% Mon 234 AM QE believes it current structure (target weight market weight) is optimal Market Values of Capital 1. The company has 60,000 bonds with a 30-year life outstanding, with 15 years until maturity. The bonds carry a 10 percent semi-annual coupon, and are currently selling for $874.78. 2. You also have 100,000 shares of $100 par, 9% dividend perpetual preferred stock outstanding. The current market price is $90.00 3. The company has 5 million shares of common stock outstanding with a currently price of $17.00 per share. The stock exhibits a constant growth rate of 10 percent. The last dividend (D.) was 5.65 4. The risk-free rate is currently 6 percent, and the rate of return on the stock market as a whole is 13 percent. Your stock's beta is 1.22 5. Your firm only uses bonds for long-term financing. 6. Your firm's federal + state marginal tax rate is 40%. (Ignore any carryforward implications) Depreciation Schedule Modified Accelerated Cost Recovery System (MACRS) 5-Year Investment Class Ownership Year Depreciation Schedule 1 20% 2 32% 3 19% 4 12% 5 11% 6 6% Total = 100% ing DD 79 2 Tools Window Help 82%) Mon 2:27 AM chegg.com Project This Project Require chego-ruloo Search Results Attempts Keep The Highest course here Yahoo Search Capital_Budgeting Case Study Instructions Individual.pdf (page 6 of 6) CAPITAL BUDGETING CASE STUDY ANALYSIS Project J: This project requires an initial investment of $2,000,000 in equipment which will cost an additional $50,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by $150,000. The project will last 6 years at which time the market value for the equipment will be $120,000 The project will project a product with a sales price of $20.00 per unit and the variable cost per unit will be $8.00. The fixed costs would be $220,000 per year. Because this project is very close to current products sold by the business, management has expressed some favoritism towards this project and as allowed for a reduced rate of return of 2 percentage point below its current WACC as the valuation hurdle it must meet or surpass. Years Forecasted Units Sold 2014 72,000 2015 95,000 2016 70,000 2017 63.000 2018 61.000 2019 52,000 Project : This project requires an initial investment of $2,000,000 in equipment which will cost an additional S150,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by aty 15 C TM DI FS DO FS si od F2 SE F 80 000 000 14 FS + A % & ( - . $ 5 6 7 0 9 oo a Capital_Budgeting_Template FOR_= Home Insert Page Layout Formulas Data Review View Times New... 11 A- A+ Wrap Text General Paste B IV. Merge & Center $. Office Update To keep up to date with security updates, fixes, and improvements, choose Check for Updates GS x fx B C D E F Pred Stock Stock Par Value Divides Per Share Cum price per she Common Stock Cum ma prica per she Last Dividend paid Dividend Growth Rae Risk free Stock Cost of Pod Stock Coat of Equity CAPM Method Cost of Equity DOM Mehed Cost of Equity Al Mwa Mae Weighs Wrighted Aveare Cost of Capit 1 2 Periods left until Maturity 3 Coupon Rate 4 Seal Payment 5 Cur Price 6 Face Value 7 8 9 Tax Rate 10 Cost of DD 11 12 13 Total Boda 14 Total Preford Stock 15 Total Common Stock 16 Tool Fire Value 17 18 19 20 21 22 23 24 25 26 27 28 29 WACC Scenario 1 Scenario 2 + Ready MacBOOK