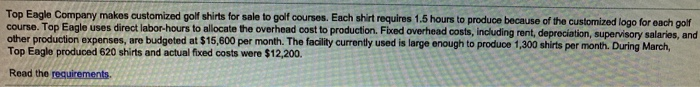

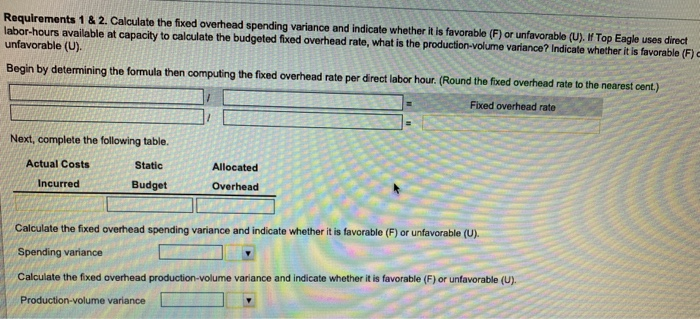

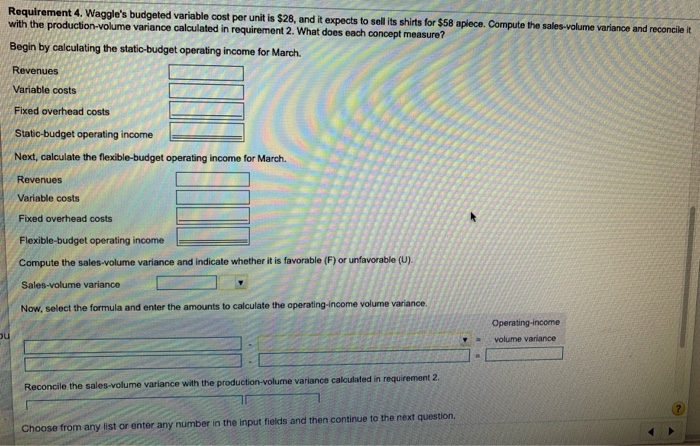

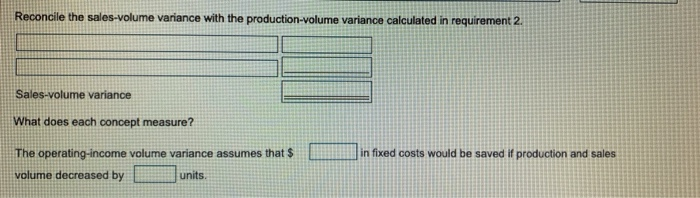

Top Eagle Company makes customized golf shirts for sale to golf courses. Each shirt requires 1.5 hours to produce because of the customized logo for each golf course. Top Eagle uses direct labor-hours to allocate the overhead cost to production. Fixed overhead costs, including rent, depreciation, supervisory salaries, and other production expenses, are budgeted at $15,600 per month. The facility currently used is large enough to produce 1,300 shirts per month. During March, Top Eagle produced 620 shirts and actual fixed costs were $12,200 Read the requirements. Requirements 1&2. Calculate the fixed overhead spending variance and indicate whether it is favorable (F) or unfavorable (U). Top Eagle uses direct labor-hours available at capacity to calculate the budgeted fixed overhead rate, what is the production-volume variance? Indicate whether it is favorable (F) unfavorable (U). Begin by determining the formula then computing the fixed overhead rate per direct labor hour. (Round the fixed overhead rate to the nearest cont.) Fixed overhead rate / // // / Next, complete the following table. Actual Costs Static Incurred Budget Allocated Overhead Calculate the fixed overhead spending variance and indicate whether it is favorable (F) or unfavorable (U). Spending variance Calculate the fixed overhead production-volume variance and indicate whether it is favorable (F) or unfavorable (U). Production-volume variance Reconcile the sales volume variance with the production-volume variance calculated in requirement 2. Sales-volume variance What does each concept measure? in fixed costs would be saved if production and sales The operating-income volume variance assumes that $ volume decreased by units Top Eagle Company makes customized golf shirts for sale to golf courses. Each shirt requires 1.5 hours to produce because of the customized logo for each golf course. Top Eagle uses direct labor-hours to allocate the overhead cost to production. Fixed overhead costs, including rent, depreciation, supervisory salaries, and other production expenses, are budgeted at $15,600 per month. The facility currently used is large enough to produce 1,300 shirts per month. During March, Top Eagle produced 620 shirts and actual fixed costs were $12,200 Read the requirements. Requirements 1&2. Calculate the fixed overhead spending variance and indicate whether it is favorable (F) or unfavorable (U). Top Eagle uses direct labor-hours available at capacity to calculate the budgeted fixed overhead rate, what is the production-volume variance? Indicate whether it is favorable (F) unfavorable (U). Begin by determining the formula then computing the fixed overhead rate per direct labor hour. (Round the fixed overhead rate to the nearest cont.) Fixed overhead rate / // // / Next, complete the following table. Actual Costs Static Incurred Budget Allocated Overhead Calculate the fixed overhead spending variance and indicate whether it is favorable (F) or unfavorable (U). Spending variance Calculate the fixed overhead production-volume variance and indicate whether it is favorable (F) or unfavorable (U). Production-volume variance Reconcile the sales volume variance with the production-volume variance calculated in requirement 2. Sales-volume variance What does each concept measure? in fixed costs would be saved if production and sales The operating-income volume variance assumes that $ volume decreased by units