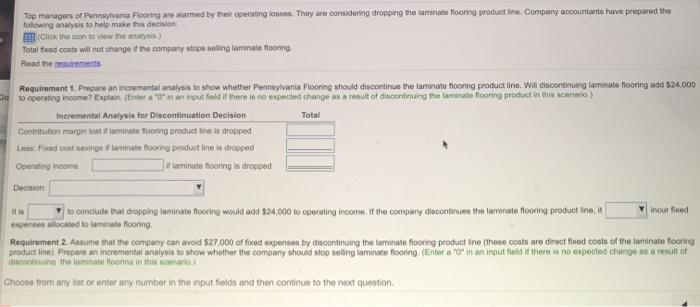

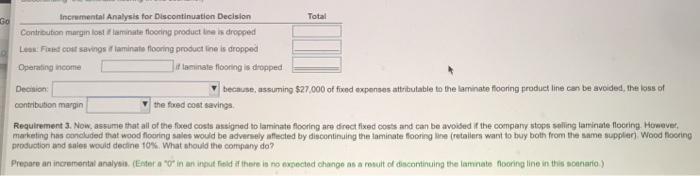

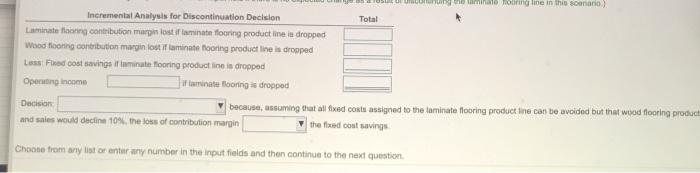

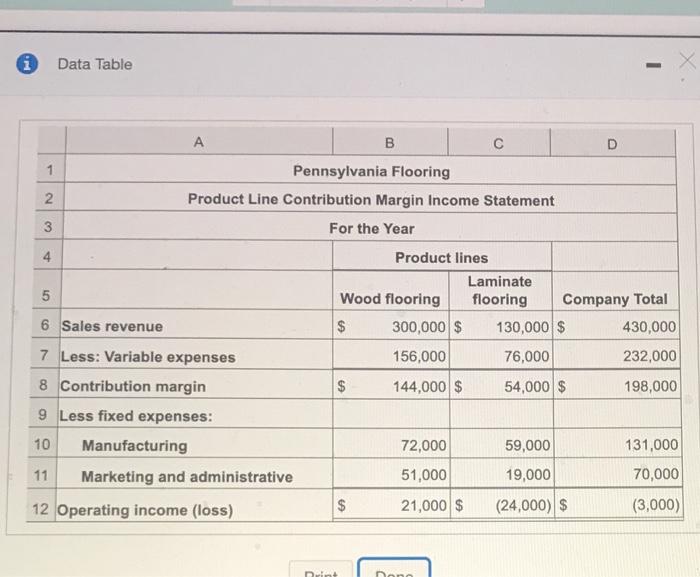

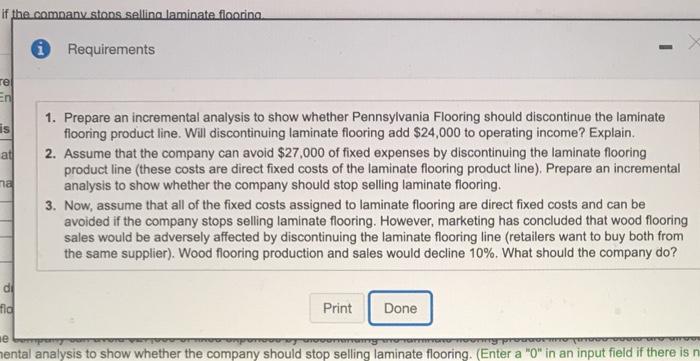

Top manager of Pennsylvania Flooring are alarmed by the operating losses. They are considering dropping the laminate flooring product line Company accountants have prepared the following analysis to help make this decision Click the icon to view the analysis) Total feed costs will not change if the company tooling taminate floong Read the requirements Requirement 1. Prepare an incremental analysis to show whether Pennsylvania Flooring should discontinue the laminate flooring product line. Will discontinuingaminate flooring odd 524.000 Go to operating income? Explain (train an input field if there is no expected change as a result of discontinuing the laminate flooring product in this sero) Incremental Analysis for Discontinuation Decision Total Contribution margin fotitiaminate fooing product line in dropped Les and cost savings laminate flooring product line is cropped Operating income it tuminato flooring in dropped Decision se conclude that dropping Laminate fooring would add $24,000 to operating income. If the company discontinues the laminate flooring product inen inou fixed expenses located to laminate flooring, Requirement 2. Asume that the company can avoid $27.000 of fixed expenses by discontinuing the laminate flooring product in these costs are direct fixed costs of the Laminate flooring product line. Prepare an incremental analysis to show whether the company should stop seling laminate flooring (Enter a "C" in an input field if there is no expected change as a result of discontinuing the laminate flooring in this son Choose from any intor enterary number in the input fields and then continue to the next question GO Total Incremental Analysis for Discontinuation Decision Contribution margin fost laminate flooring product is dropped La Fed coal savings r laminate flooring product line is dropped Operating income Dit laminate flooring is dropped Decion: because, assuming $27.000 of fixed expenses attributable to the laminate flooring product line can be avoided, the loss of contribution margin the food cost savings Requirements. Now, assume that all of the fixed costs assigned to laminate flooring are direct fixed costs and can be avoided if the company stops selling laminate flooring. However, marketing has concluded that wood flooring sales would be adversely affected by discontinuing the laminate flooring line (retailers want to buy both from the same supplier Wood flooring production and sales would decline 10%. What should the company do? Prepare an incrementat aralysin. (Estero 0 in an input froid if there in no expected change as a conuit of ducontinuing the laminate Mooring tino in this sortaria) hamile on line in this scenario) Incremental Analysis for Discontinuation Decision Total Laminate flooring contribution margin ostaminate flooring product line is dropped Wood Flooring contribution margin fost laminate flooring product line is dropped Lass Fed cost savings are flooring product line is dropped Operating income Tur taminate flooring is dropped Decision because, assuming that all fixed costs assigned to the laminate flooring product line can be avoided but that wood flooring product and sales would decline 10%. the loss of contribution margin the fed cost savings Choose from any list or enter any number in the input fields and then continue to the next question Data Table - x A B D 2 3 4 5 1 Pennsylvania Flooring 2 Product Line Contribution Margin Income Statement 3 For the Year Product lines Laminate 5 Wood flooring flooring Company Total 6 Sales revenue $ 300,000 $ 130,000 $ 430,000 7 Less: Variable expenses 156,000 76,000 232,000 8 Contribution margin $ 144,000 $ 54,000 $ 198,000 9 Less fixed expenses: 10 Manufacturing 72,000 59,000 131,000 11 Marketing and administrative 51,000 19,000 70,000 12 Operating income (loss) $ 21,000 $ (24,000) $ (3,000) $ neint Don if the company stops selling laminate floorina i Requirements Te en is at ma 1. Prepare an incremental analysis to show whether Pennsylvania Flooring should discontinue the laminate flooring product line. Will discontinuing laminate flooring add $24,000 to operating income? Explain. 2. Assume that the company can avoid $27,000 of fixed expenses by discontinuing the laminate flooring product line (these costs are direct fixed costs of the laminate flooring product line), Prepare an incremental analysis to show whether the company should stop seling laminate flooring. 3. Now, assume that all of the fixed costs assigned to laminate flooring are direct fixed costs and can be avoided if the company stops selling laminate flooring. However, marketing has concluded that wood flooring sales would be adversely affected by discontinuing the laminate flooring line (retailers want to buy both from the same supplier). Wood flooring production and sales would decline 10%. What should the company do? d! tid Print Done de hental analysis to show whether the company should stop selling laminate flooring (Enter a "0" in an input field if there is n