Question

Top Pedigree Corporation was formed by three shareholders on January 1, 2016. After a difficult first year, the company believes they need to obtain a

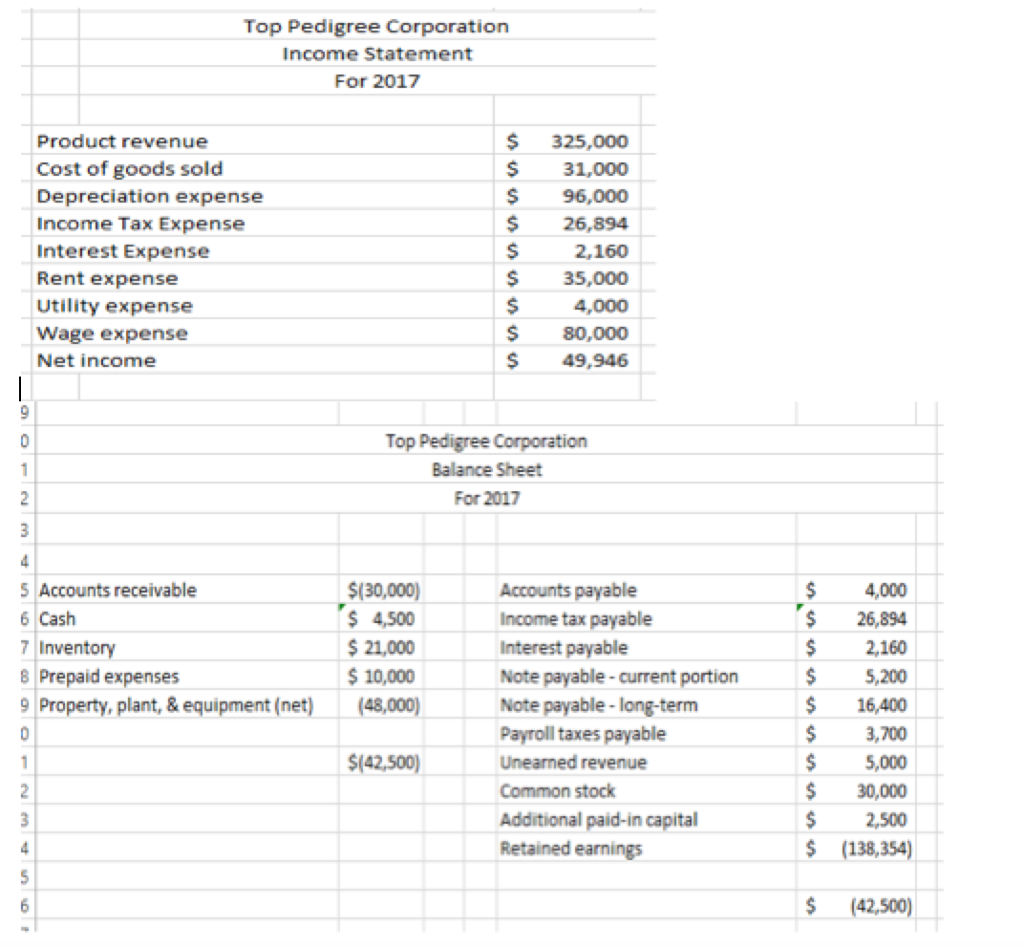

Top Pedigree Corporation was formed by three shareholders on January 1, 2016. After a difficult first year, the company believes they need to obtain a line of credit to expand the business. The bank has requested financial statements for the eight months ended August 31, 2017 in order to determine eligibility for the line of credit. Although none of the shareholders have any accounting experience, one of them has taken on the role of bookkeeper and has prepared the following financial statements for year-to-date operations through August 31, 2017. You been hired to review the financial statements. During your review, you have discovered that in addition to multiple presentation issues, there are some adjustments that must be made to the financial statements. Property, plant, & equipment is comprised of a group of assets that were purchased on January 1, 2016 for $60,000 and have a combined monthly depreciation expense of $1,000. On August 27, 2017, a check for $40,000 was deposited. The shareholder/bookkeeper applied this amount to accounts receivable. The services for this check were not performed as of August 27 and had not yet been issued to the customer. Prepaid expenses are comprised of rent paid to the landlord at July 1, 2017 for the quarter ending September 30, 2017. The total amount paid for the three months was $15,000. On January 1, 2016, the company borrowed $28,800 at a 10% annual rate. The loan is to be paid back to the bank annually on December 31st in four equal installments. The first installment was paid on December 31, 2016. Interest on the balance owed is also paid annually on December 31st. The interest for the year is expensed evenly throughout the year. (Hint: there are two adjustments to be made) Income tax expense must be calculated based on the adjustments. The income tax rate is 35%. Requirements: (1) Prepare a trial balance spreadsheet. Reference each adjustments with the letter used above. You must use exhibit 4.5 in the text as a reference point for your trial balance spreadsheet. (2) Prepare a properly formatted income statement and balance sheet based on the adjusted balances from your trial balance spreadsheet. (3) Calculate the net profit margin and current ratio for the revised financial statements. (4) Prepare a memo to the shareholders explaining the errors you discovered during your review and why you made the entry you did to correct each error. Keep in mind that none of the three shareholders have any accounting experience and, therefore, have no understanding of GAAP. Also, include a brief description explaining the results of your ratio analysis from requirement (3).

Top Pedigree Corporation was formed by three shareholders on January 1, 2016. After a difficult first year, the company believes they need to obtain a line of credit to expand the business. The bank has requested financial statements for the eight months ended August 31, 2017 in order to determine eligibility for the line of credit. Although none of the shareholders have any accounting experience, one of them has taken on the role of bookkeeper and has prepared the following financial statements for year-to-date operations through August 31, 2017. You been hired to review the financial statements. During your review, you have discovered that in addition to multiple presentation issues, there are some adjustments that must be made to the financial statements. Property, plant, & equipment is comprised of a group of assets that were purchased on January 1, 2016 for $60,000 and have a combined monthly depreciation expense of $1,000. On August 27, 2017, a check for $40,000 was deposited. The shareholder/bookkeeper applied this amount to accounts receivable. The services for this check were not performed as of August 27 and had not yet been issued to the customer. Prepaid expenses are comprised of rent paid to the landlord at July 1, 2017 for the quarter ending September 30, 2017. The total amount paid for the three months was $15,000. On January 1, 2016, the company borrowed $28,800 at a 10% annual rate. The loan is to be paid back to the bank annually on December 31st in four equal installments. The first installment was paid on December 31, 2016. Interest on the balance owed is also paid annually on December 31st. The interest for the year is expensed evenly throughout the year. (Hint: there are two adjustments to be made) Income tax expense must be calculated based on the adjustments. The income tax rate is 35%. Requirements: (1) Prepare a trial balance spreadsheet. Reference each adjustments with the letter used above. You must use exhibit 4.5 in the text as a reference point for your trial balance spreadsheet. (2) Prepare a properly formatted income statement and balance sheet based on the adjusted balances from your trial balance spreadsheet. (3) Calculate the net profit margin and current ratio for the revised financial statements. (4) Prepare a memo to the shareholders explaining the errors you discovered during your review and why you made the entry you did to correct each error. Keep in mind that none of the three shareholders have any accounting experience and, therefore, have no understanding of GAAP. Also, include a brief description explaining the results of your ratio analysis from requirement (3).

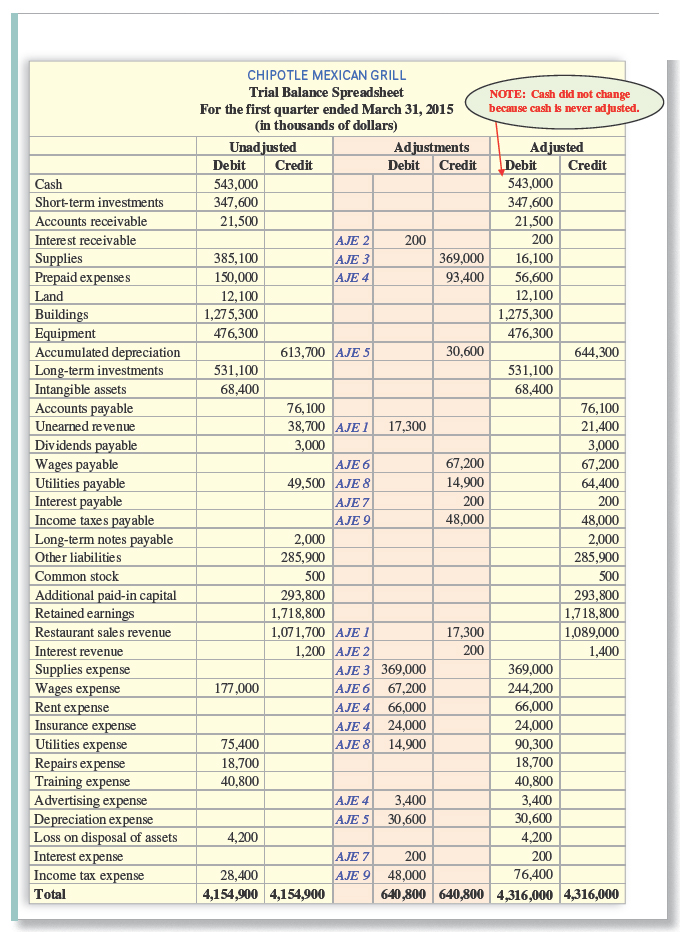

CHIPOTLE MEXICAN GRILL Trial Balance Spreadsheet For the first quarter ended March 31, 2015 (in thousands of dollars) NOTE: Cash did not change because cash ls never ajusted. Unadjusted DebitCredit Adjustments Debit CreditDebit Credit Adjusted Short-term investments Accounts receivable Intere st receivable 543,000 347,600 21,500 543,000 347,600 21,500 200 369,000 16,100 93,400 56,600 12,100 1,275,300 476,300 AJE 2200 385,100 150,000 JE 3 d expenses Buildings 1,275,300 476,300 uipment Accumulated depreciation 613,700 AJE 5 644,300 Long-term investments 531,100 531,100 68,400 Intangible assets Accounts payable Unearned revenue Dividends payable 76,100 38,700 AJE1 17,300 76,100 21,400 67,200 14,900 3 67,200 64,400 AJE 6 49,500 AJE & AJE 7 AJE 9 Utilities payable 200 48 48,000 Income taxes payable Long-term notes payable Other liabilities Common stock Additional paid-in capital 2,000 285,900 285,900 Retained earnings Restaurant sales revenue Interest revenue 293,800 1,718,800 293,800 1,718,800 1,089,000 1,071,700 AJE I 1,200 AJE 2 17,300 200 369000-1400 244,200 Supplies expense AJE 3 369,000 wages expense Rent expense Insurance expense 177,000 AJE 6 67 .200 AJE466,000 AJE 4 24,000 AJE 8 14,900 Utilities expense Repairs expense Training expense Advertising expense Depreci 75,400 18,700 40,800 18,700 40,800 AJE 4 3,400 AJE 51 30.600 iation expense 30,600 Loss on disposal of assets Interest expense Income tax expense Total 4,00 AJE 7200 AJE 9 48,000 28,400 4,154,900 4,154,900 640,800 640,800 4,316,000 4316,000 CHIPOTLE MEXICAN GRILL Trial Balance Spreadsheet For the first quarter ended March 31, 2015 (in thousands of dollars) NOTE: Cash did not change because cash ls never ajusted. Unadjusted DebitCredit Adjustments Debit CreditDebit Credit Adjusted Short-term investments Accounts receivable Intere st receivable 543,000 347,600 21,500 543,000 347,600 21,500 200 369,000 16,100 93,400 56,600 12,100 1,275,300 476,300 AJE 2200 385,100 150,000 JE 3 d expenses Buildings 1,275,300 476,300 uipment Accumulated depreciation 613,700 AJE 5 644,300 Long-term investments 531,100 531,100 68,400 Intangible assets Accounts payable Unearned revenue Dividends payable 76,100 38,700 AJE1 17,300 76,100 21,400 67,200 14,900 3 67,200 64,400 AJE 6 49,500 AJE & AJE 7 AJE 9 Utilities payable 200 48 48,000 Income taxes payable Long-term notes payable Other liabilities Common stock Additional paid-in capital 2,000 285,900 285,900 Retained earnings Restaurant sales revenue Interest revenue 293,800 1,718,800 293,800 1,718,800 1,089,000 1,071,700 AJE I 1,200 AJE 2 17,300 200 369000-1400 244,200 Supplies expense AJE 3 369,000 wages expense Rent expense Insurance expense 177,000 AJE 6 67 .200 AJE466,000 AJE 4 24,000 AJE 8 14,900 Utilities expense Repairs expense Training expense Advertising expense Depreci 75,400 18,700 40,800 18,700 40,800 AJE 4 3,400 AJE 51 30.600 iation expense 30,600 Loss on disposal of assets Interest expense Income tax expense Total 4,00 AJE 7200 AJE 9 48,000 28,400 4,154,900 4,154,900 640,800 640,800 4,316,000 4316,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started