Answered step by step

Verified Expert Solution

Question

1 Approved Answer

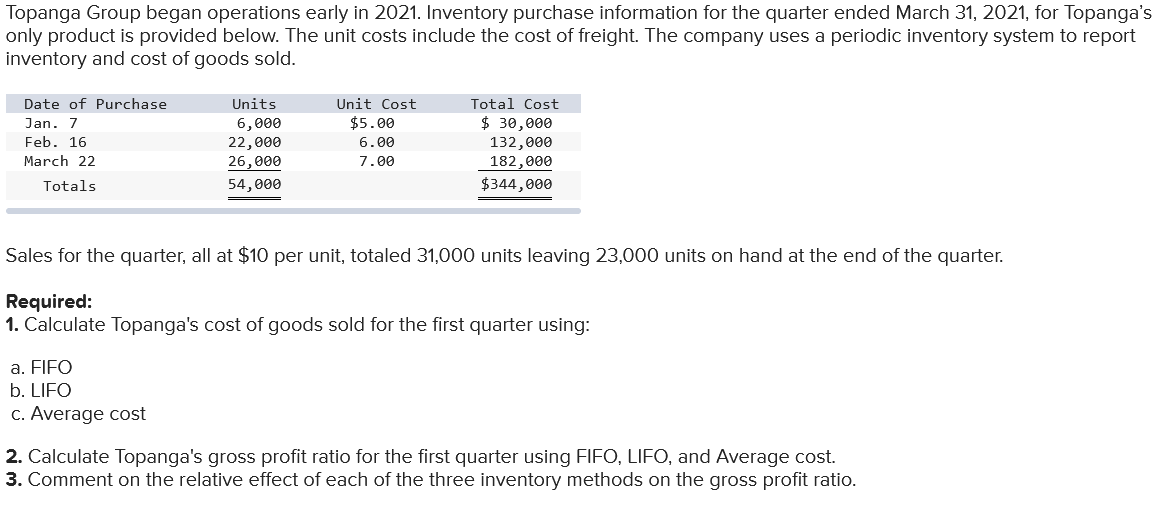

Topanga Group began operations early in 2021. Inventory purchase information for the quarter ended March 31, 2021, for Topanga's only product is provided below. The

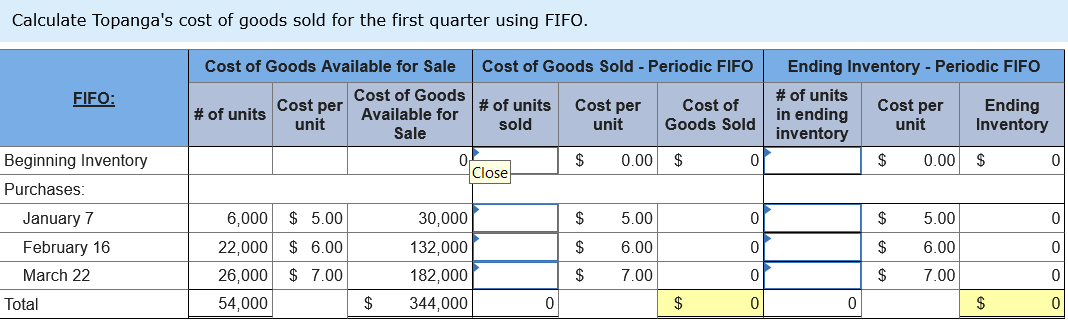

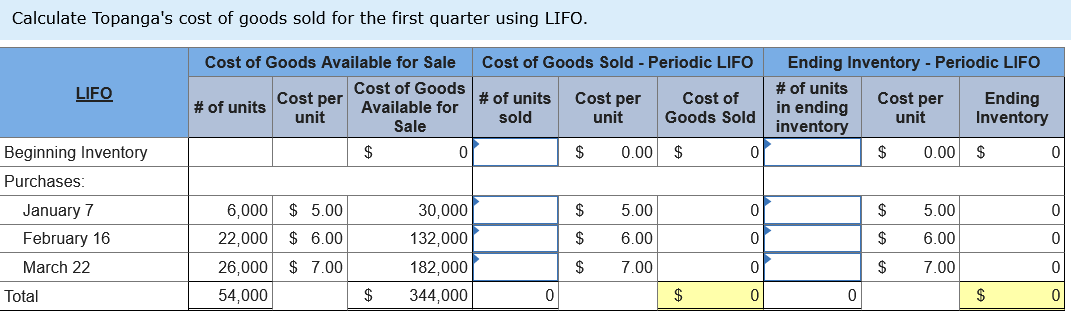

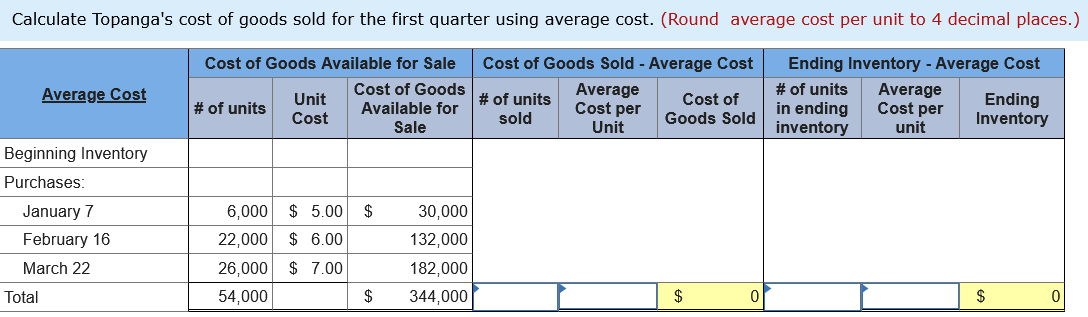

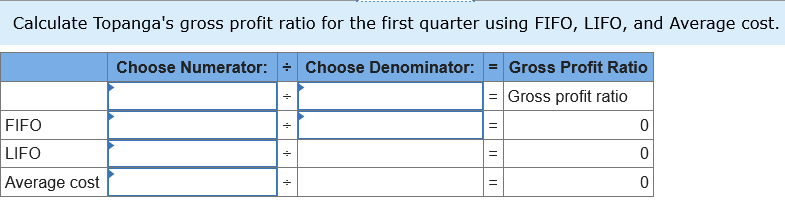

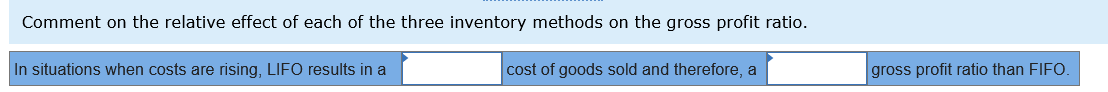

Topanga Group began operations early in 2021. Inventory purchase information for the quarter ended March 31, 2021, for Topanga's only product is provided below. The unit costs include the cost of freight. The company uses a periodic inventory system to report inventory and cost of goods sold. Sales for the quarter, all at $10 per unit, totaled 31,000 units leaving 23,000 units on hand at the end of the quarter. Required: 1. Calculate Topanga's cost of goods sold for the first quarter using: a. FIFO b. LIFO c. Average cost 2. Calculate Topanga's gross profit ratio for the first quarter using FIFO, LIFO, and Average cost. 3. Comment on the relative effect of each of the three inventory methods on the gross profit ratio. Calculate Topanga's cost of goods sold for the first quarter using FIFO. Calculate Topanga's cost of goods sold for the first quarter using LIFO. Calculate Topanga's cost of goods sold for the first quarter using average cost. (Round average cost per unit to 4 decimal places.) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Average Cost } & \multicolumn{4}{|c|}{ Cost of Goods Available for Sale } & \multicolumn{3}{|c|}{ Cost of Goods Sold - Average Cost } & \multicolumn{3}{|c|}{ Ending Inventory - Average Cost } \\ \hline & # of units & \begin{tabular}{l} Unit \\ Cost \end{tabular} & & \begin{tabular}{l} of Goods \\ ilable for \\ Sale \end{tabular} & \begin{tabular}{c} \# of units \\ sold \end{tabular} & \begin{tabular}{c} Average \\ Cost per \\ Unit \end{tabular} & \begin{tabular}{c} Cost of \\ Goods Sold \end{tabular} & \begin{tabular}{l} \# of units \\ in ending \\ inventory \end{tabular} & \begin{tabular}{c} Average \\ Cost per \\ unit \end{tabular} & \begin{tabular}{c} Ending \\ Inventory \end{tabular} \\ \hline \multicolumn{11}{|l|}{ Beginning Inventory } \\ \hline \multicolumn{11}{|l|}{ Purchases: } \\ \hline January 7 & 6,000 & $5.00 & $ & 30,000 & & & & & & \\ \hline February 16 & 22,000 & $6.00 & & 132,000 & & & & & & \\ \hline March 22 & 26,000 & $7.00 & & 182,000 & & & & & & \\ \hline Total & 54,000 & & $ & 344,000 & & & $ & & & $ \\ \hline \end{tabular} Calculate Topanga's gross profit ratio for the first quarter using FIFO, LIFO, and Average cost. Comment on the relative effect of each of the three inventory methods on the gross profit ratio. In situations when costs are rising, LIFO results in a cost of goods sold and therefore, a gross profit ratio than FIFO

Topanga Group began operations early in 2021. Inventory purchase information for the quarter ended March 31, 2021, for Topanga's only product is provided below. The unit costs include the cost of freight. The company uses a periodic inventory system to report inventory and cost of goods sold. Sales for the quarter, all at $10 per unit, totaled 31,000 units leaving 23,000 units on hand at the end of the quarter. Required: 1. Calculate Topanga's cost of goods sold for the first quarter using: a. FIFO b. LIFO c. Average cost 2. Calculate Topanga's gross profit ratio for the first quarter using FIFO, LIFO, and Average cost. 3. Comment on the relative effect of each of the three inventory methods on the gross profit ratio. Calculate Topanga's cost of goods sold for the first quarter using FIFO. Calculate Topanga's cost of goods sold for the first quarter using LIFO. Calculate Topanga's cost of goods sold for the first quarter using average cost. (Round average cost per unit to 4 decimal places.) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Average Cost } & \multicolumn{4}{|c|}{ Cost of Goods Available for Sale } & \multicolumn{3}{|c|}{ Cost of Goods Sold - Average Cost } & \multicolumn{3}{|c|}{ Ending Inventory - Average Cost } \\ \hline & # of units & \begin{tabular}{l} Unit \\ Cost \end{tabular} & & \begin{tabular}{l} of Goods \\ ilable for \\ Sale \end{tabular} & \begin{tabular}{c} \# of units \\ sold \end{tabular} & \begin{tabular}{c} Average \\ Cost per \\ Unit \end{tabular} & \begin{tabular}{c} Cost of \\ Goods Sold \end{tabular} & \begin{tabular}{l} \# of units \\ in ending \\ inventory \end{tabular} & \begin{tabular}{c} Average \\ Cost per \\ unit \end{tabular} & \begin{tabular}{c} Ending \\ Inventory \end{tabular} \\ \hline \multicolumn{11}{|l|}{ Beginning Inventory } \\ \hline \multicolumn{11}{|l|}{ Purchases: } \\ \hline January 7 & 6,000 & $5.00 & $ & 30,000 & & & & & & \\ \hline February 16 & 22,000 & $6.00 & & 132,000 & & & & & & \\ \hline March 22 & 26,000 & $7.00 & & 182,000 & & & & & & \\ \hline Total & 54,000 & & $ & 344,000 & & & $ & & & $ \\ \hline \end{tabular} Calculate Topanga's gross profit ratio for the first quarter using FIFO, LIFO, and Average cost. Comment on the relative effect of each of the three inventory methods on the gross profit ratio. In situations when costs are rising, LIFO results in a cost of goods sold and therefore, a gross profit ratio than FIFO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started