Answered step by step

Verified Expert Solution

Question

1 Approved Answer

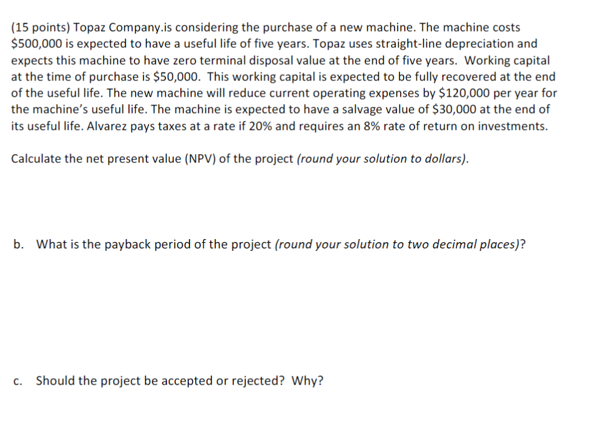

Topaz company is consdierng the pruchase of a new machine the machine costs $ 5 0 0 , 0 0 0 is expected to have

Topaz company is consdierng the pruchase of a new machine the machine costs $ is expected to have a useful life of years points Topaz

Company.is considering the purchase of a new machine. The machine costs

$ is expected to have a useful life of five years. Topaz uses straightline depreciation and

expects this machine to have zero terminal disposal value at the end of five years. Working capital

at the time of purchase is $ This working capital is expected to be fully recovered at the end

of the useful life. The new machine will reduce current operating expenses by $ per year for

the machine's useful life. The machine is expected to have a salvage value of $ at the end of

its useful life. Alvarez pays taxes at a rate if and requires an rate of return on investments.

Calculate the net present value NPV of the project round your solution to dollars

b What is the payback period of the project round your solution to two decimal places

c Should the project be accepted or rejected? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started