Topic 4 PBL Questions: PBL 1 Can you please explain how you calculated the value of the land? AASB140 if investment The land figure of $1,800,000 comprises of two separate blocks of land located on the Gold Coast and Sunshine Coast. These vacant plots were purchased with the intention of building a new nightclub in each location. The first lot located in Burleigh Heads was purchased for $1,000,000 on the 1st of March 2019. The second lot located in Caloundra was purchased the same date for $800,000. Is the land recorded on the balance sheet the site at which infinity bar is located? No, the land is strictly for investment purposes and is not the location at which the Infinity Bar is located. Does the value of the land include the any structures and/or capital improvements? The land includes no structures or capital improvements and is entirely vacant. Has the land been valued since its purchase? The land was independently valued at 30 June 2021 and the results were as follows: Burleigh Heads property has decreased in value to $940,000 Caloundra property has increased in value to $940,000 The company would also wishes to record the Caloundra land at market value and the Burleigh land at cost price. Did the company have any carried forward tax losses or unrealised gains? There were no carried forward tax loses or unrealised gains for the 2021 financial year. Can you please explain how you calculated the value of the goodwill? On the 19th May 2020 an existing bar and nightclub was purchased by the company for $1,600,000 and featured intangible assets of $1,200,000 and $400,000 in goodwill. Was the goodwill purchased goodwill or internally generated goodwill? The goodwill was purchased goodwill as recorded in the nightclub purchase transaction. Did the purchased goodwill reflect the actual benefits derived from the purchase price? No, the nightclub has struggled significantly due to the Covid-19 pandemic including lockdowns and overall loss of foot traffic and customers. What are you forecasted cash flows for the upcoming period and subsequent discount rate? The company has calculated a recoverable amount based on an already discounted figure of $1,300,000 with a discount rate of 2.5%. What would you consider to be the fair value of the business currently? The business currently has a fair value less cost of sale of $1,100,000. Depreciation of tangible assets bought by the business.

Topic 4 PBL Questions: PBL 1 Can you please explain how you calculated the value of the land? AASB140 if investment The land figure of $1,800,000 comprises of two separate blocks of land located on the Gold Coast and Sunshine Coast. These vacant plots were purchased with the intention of building a new nightclub in each location. The first lot located in Burleigh Heads was purchased for $1,000,000 on the 1st of March 2019. The second lot located in Caloundra was purchased the same date for $800,000. Is the land recorded on the balance sheet the site at which infinity bar is located? No, the land is strictly for investment purposes and is not the location at which the Infinity Bar is located. Does the value of the land include the any structures and/or capital improvements? The land includes no structures or capital improvements and is entirely vacant. Has the land been valued since its purchase? The land was independently valued at 30 June 2021 and the results were as follows: Burleigh Heads property has decreased in value to $940,000 Caloundra property has increased in value to $940,000 The company would also wishes to record the Caloundra land at market value and the Burleigh land at cost price. Did the company have any carried forward tax losses or unrealised gains? There were no carried forward tax loses or unrealised gains for the 2021 financial year. Can you please explain how you calculated the value of the goodwill? On the 19th May 2020 an existing bar and nightclub was purchased by the company for $1,600,000 and featured intangible assets of $1,200,000 and $400,000 in goodwill. Was the goodwill purchased goodwill or internally generated goodwill? The goodwill was purchased goodwill as recorded in the nightclub purchase transaction. Did the purchased goodwill reflect the actual benefits derived from the purchase price? No, the nightclub has struggled significantly due to the Covid-19 pandemic including lockdowns and overall loss of foot traffic and customers. What are you forecasted cash flows for the upcoming period and subsequent discount rate? The company has calculated a recoverable amount based on an already discounted figure of $1,300,000 with a discount rate of 2.5%. What would you consider to be the fair value of the business currently? The business currently has a fair value less cost of sale of $1,100,000. Depreciation of tangible assets bought by the business.

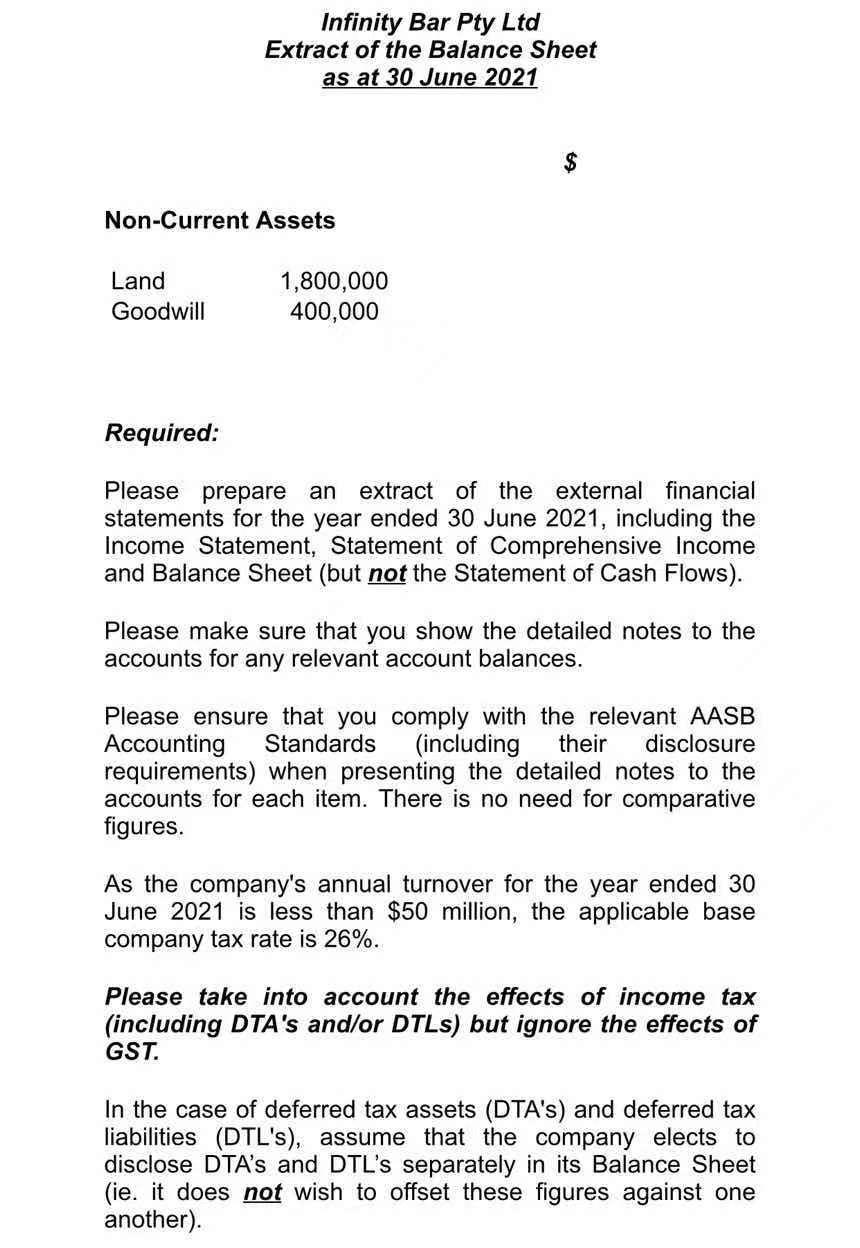

PBL 1 (Group Discussion and Group Written Submission - 8%) - AOL KS1.1: You have been presented with an extract of the draft external financial statements (and in particular, the Balance Sheet) of Infinity Bar Pty Ltd as at 30 June 2021. The company owns and operates a licensed bar in Brisbane's CBD. The bar serves a range of alcoholic and non-alcoholic beverages as well as providing patrons with a range of food options from its menu. Infinity Bar Pty Ltd is a small proprietary company, but is considered a reporting entity. The company is a family- owned business that was established in August 2016. It is in the process of preparing its annual financial statements for the year ended 30 June 2021. The company's CFO, Corey Hart has drafted the external financial statements for the year ended 30 June 2021. However, before presenting them to the board of directors for sign off, Corey approaches you seeking advice as to how two figures appearing in the company's draft balance sheet shown below should be accounted for. Corey states that whilst he has drafted the external financial statements, he considers himself primarily to be a management accountant and readily admits that he does not have detailed knowledge of AASB Accounting Standards. Accordingly, Corey has requested that your group review the draft figures shown below and advise what changes (if any) are required when preparing the final version of the company's 2021 external financial statements. Infinity Bar Pty Ltd Extract of the Balance Sheet as at 30 June 2021 $ Non-Current Assets Land Goodwill 1,800,000 400,000 Required: Please prepare an extract of the external financial statements for the year ended 30 June 2021, including the Income Statement, Statement of Comprehensive Income and Balance Sheet (but not the Statement of Cash Flows). Please make sure that you show the detailed notes to the accounts for any relevant account balances. Please ensure that you comply with the relevant AASB Accounting Standards (including their disclosure requirements) when presenting the detailed notes to the accounts for each item. There is no need for comparative figures. As the company's annual turnover for the year ended 30 June 2021 is less than $50 million, the applicable base company tax rate is 26%. Please take into account the effects of income tax (including DTA's and/or DTLs) but ignore the effects of GST. In the case of deferred tax assets (DTA's) and deferred tax liabilities (DTL's), assume that the company elects to disclose DTA's and DTL's separately in its Balance Sheet (ie. it does not wish to offset these figures against one another). Note: There may be other accounts impacted or "triggered by changes to the draft figures in the financial statements. If this is the case, then please include the relevant accounts in your extract of the external financial statements for Infinity Bar Pty Ltd. as For example, if a revenue or expense account arises a result of any amendments/adjustments you make, then please include this account and any supporting note required in the accounts. However, there is no need to prepare Note 1: Statement of Significant Accounting Policies for Infinity Bar Pty Ltd. PBL 1 (Group Discussion and Group Written Submission - 8%) - AOL KS1.1: You have been presented with an extract of the draft external financial statements (and in particular, the Balance Sheet) of Infinity Bar Pty Ltd as at 30 June 2021. The company owns and operates a licensed bar in Brisbane's CBD. The bar serves a range of alcoholic and non-alcoholic beverages as well as providing patrons with a range of food options from its menu. Infinity Bar Pty Ltd is a small proprietary company, but is considered a reporting entity. The company is a family- owned business that was established in August 2016. It is in the process of preparing its annual financial statements for the year ended 30 June 2021. The company's CFO, Corey Hart has drafted the external financial statements for the year ended 30 June 2021. However, before presenting them to the board of directors for sign off, Corey approaches you seeking advice as to how two figures appearing in the company's draft balance sheet shown below should be accounted for. Corey states that whilst he has drafted the external financial statements, he considers himself primarily to be a management accountant and readily admits that he does not have detailed knowledge of AASB Accounting Standards. Accordingly, Corey has requested that your group review the draft figures shown below and advise what changes (if any) are required when preparing the final version of the company's 2021 external financial statements. Infinity Bar Pty Ltd Extract of the Balance Sheet as at 30 June 2021 $ Non-Current Assets Land Goodwill 1,800,000 400,000 Required: Please prepare an extract of the external financial statements for the year ended 30 June 2021, including the Income Statement, Statement of Comprehensive Income and Balance Sheet (but not the Statement of Cash Flows). Please make sure that you show the detailed notes to the accounts for any relevant account balances. Please ensure that you comply with the relevant AASB Accounting Standards (including their disclosure requirements) when presenting the detailed notes to the accounts for each item. There is no need for comparative figures. As the company's annual turnover for the year ended 30 June 2021 is less than $50 million, the applicable base company tax rate is 26%. Please take into account the effects of income tax (including DTA's and/or DTLs) but ignore the effects of GST. In the case of deferred tax assets (DTA's) and deferred tax liabilities (DTL's), assume that the company elects to disclose DTA's and DTL's separately in its Balance Sheet (ie. it does not wish to offset these figures against one another). Note: There may be other accounts impacted or "triggered by changes to the draft figures in the financial statements. If this is the case, then please include the relevant accounts in your extract of the external financial statements for Infinity Bar Pty Ltd. as For example, if a revenue or expense account arises a result of any amendments/adjustments you make, then please include this account and any supporting note required in the accounts. However, there is no need to prepare Note 1: Statement of Significant Accounting Policies for Infinity Bar Pty Ltd

Topic 4 PBL Questions: PBL 1 Can you please explain how you calculated the value of the land? AASB140 if investment The land figure of $1,800,000 comprises of two separate blocks of land located on the Gold Coast and Sunshine Coast. These vacant plots were purchased with the intention of building a new nightclub in each location. The first lot located in Burleigh Heads was purchased for $1,000,000 on the 1st of March 2019. The second lot located in Caloundra was purchased the same date for $800,000. Is the land recorded on the balance sheet the site at which infinity bar is located? No, the land is strictly for investment purposes and is not the location at which the Infinity Bar is located. Does the value of the land include the any structures and/or capital improvements? The land includes no structures or capital improvements and is entirely vacant. Has the land been valued since its purchase? The land was independently valued at 30 June 2021 and the results were as follows: Burleigh Heads property has decreased in value to $940,000 Caloundra property has increased in value to $940,000 The company would also wishes to record the Caloundra land at market value and the Burleigh land at cost price. Did the company have any carried forward tax losses or unrealised gains? There were no carried forward tax loses or unrealised gains for the 2021 financial year. Can you please explain how you calculated the value of the goodwill? On the 19th May 2020 an existing bar and nightclub was purchased by the company for $1,600,000 and featured intangible assets of $1,200,000 and $400,000 in goodwill. Was the goodwill purchased goodwill or internally generated goodwill? The goodwill was purchased goodwill as recorded in the nightclub purchase transaction. Did the purchased goodwill reflect the actual benefits derived from the purchase price? No, the nightclub has struggled significantly due to the Covid-19 pandemic including lockdowns and overall loss of foot traffic and customers. What are you forecasted cash flows for the upcoming period and subsequent discount rate? The company has calculated a recoverable amount based on an already discounted figure of $1,300,000 with a discount rate of 2.5%. What would you consider to be the fair value of the business currently? The business currently has a fair value less cost of sale of $1,100,000. Depreciation of tangible assets bought by the business.

Topic 4 PBL Questions: PBL 1 Can you please explain how you calculated the value of the land? AASB140 if investment The land figure of $1,800,000 comprises of two separate blocks of land located on the Gold Coast and Sunshine Coast. These vacant plots were purchased with the intention of building a new nightclub in each location. The first lot located in Burleigh Heads was purchased for $1,000,000 on the 1st of March 2019. The second lot located in Caloundra was purchased the same date for $800,000. Is the land recorded on the balance sheet the site at which infinity bar is located? No, the land is strictly for investment purposes and is not the location at which the Infinity Bar is located. Does the value of the land include the any structures and/or capital improvements? The land includes no structures or capital improvements and is entirely vacant. Has the land been valued since its purchase? The land was independently valued at 30 June 2021 and the results were as follows: Burleigh Heads property has decreased in value to $940,000 Caloundra property has increased in value to $940,000 The company would also wishes to record the Caloundra land at market value and the Burleigh land at cost price. Did the company have any carried forward tax losses or unrealised gains? There were no carried forward tax loses or unrealised gains for the 2021 financial year. Can you please explain how you calculated the value of the goodwill? On the 19th May 2020 an existing bar and nightclub was purchased by the company for $1,600,000 and featured intangible assets of $1,200,000 and $400,000 in goodwill. Was the goodwill purchased goodwill or internally generated goodwill? The goodwill was purchased goodwill as recorded in the nightclub purchase transaction. Did the purchased goodwill reflect the actual benefits derived from the purchase price? No, the nightclub has struggled significantly due to the Covid-19 pandemic including lockdowns and overall loss of foot traffic and customers. What are you forecasted cash flows for the upcoming period and subsequent discount rate? The company has calculated a recoverable amount based on an already discounted figure of $1,300,000 with a discount rate of 2.5%. What would you consider to be the fair value of the business currently? The business currently has a fair value less cost of sale of $1,100,000. Depreciation of tangible assets bought by the business.