Answered step by step

Verified Expert Solution

Question

1 Approved Answer

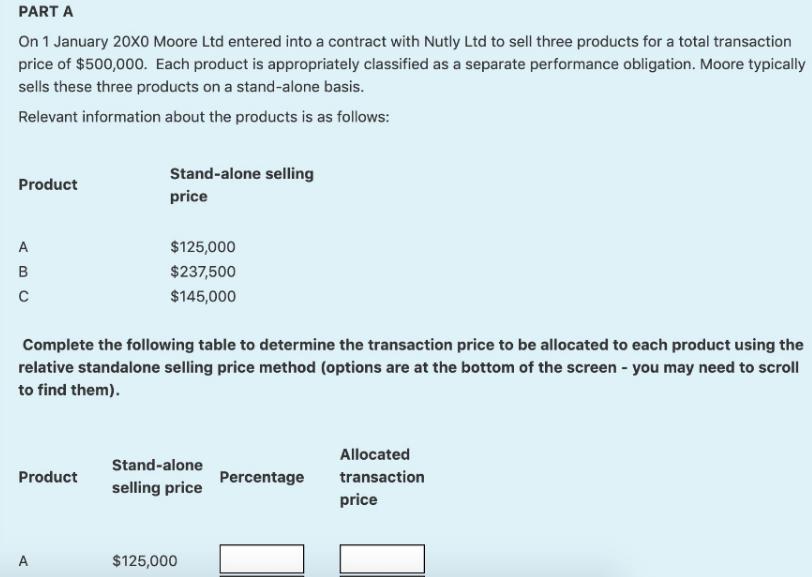

PART A On 1 January 20X0O Moore Ltd entered into a contract with Nutly Ltd to sell three products for a total transaction price

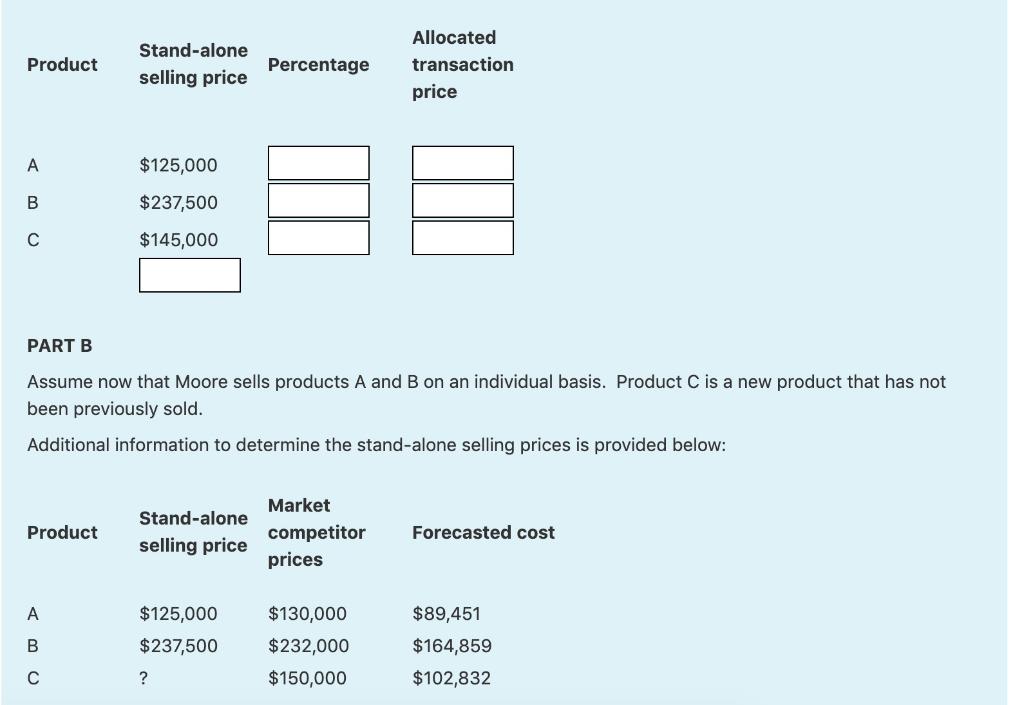

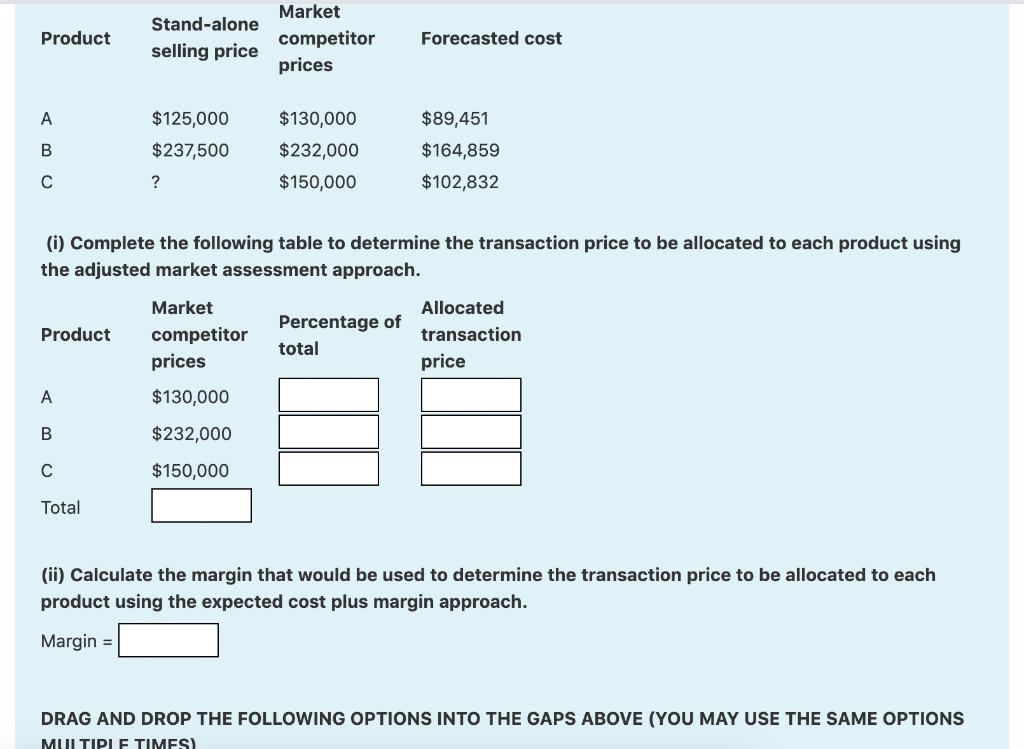

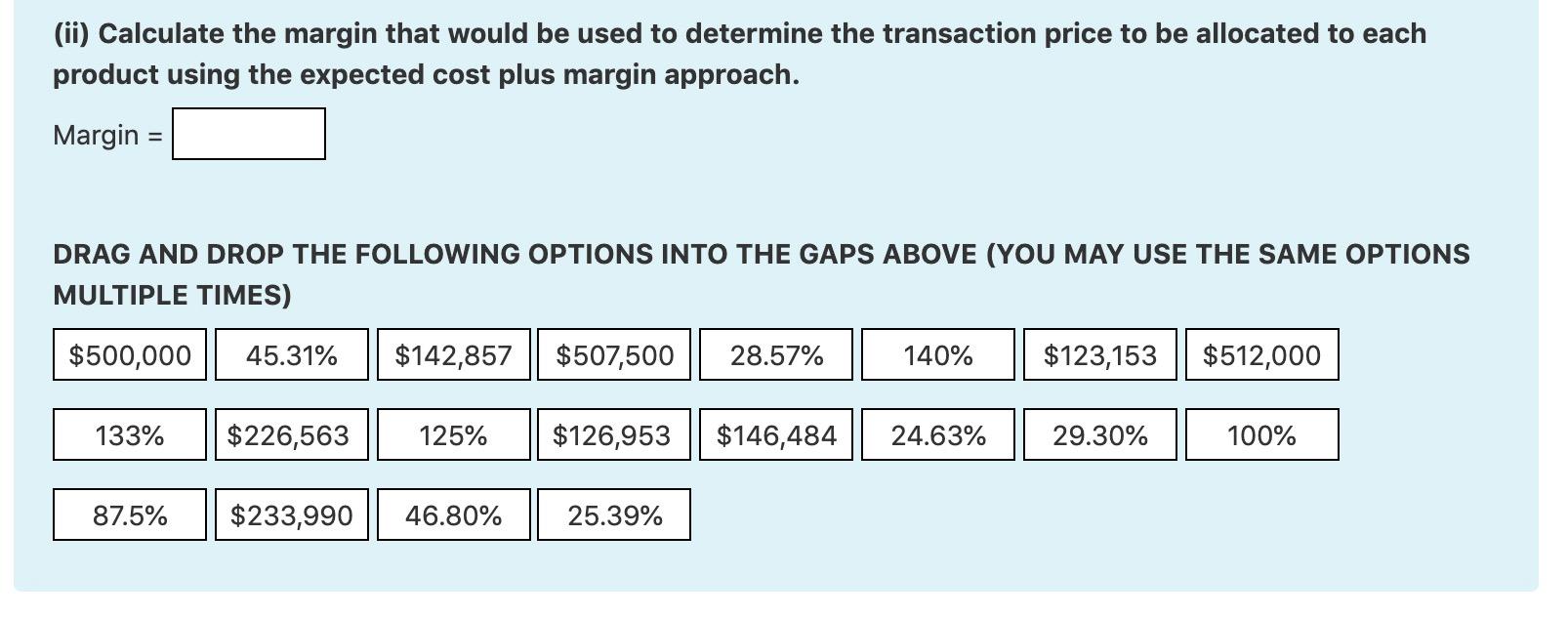

PART A On 1 January 20X0O Moore Ltd entered into a contract with Nutly Ltd to sell three products for a total transaction price of $500,000. Each product is appropriately classified as a separate performance obligation. Moore typically sells these three products on a stand-alone basis. Relevant information about the products is as follows: Stand-alone selling Product price $125,000 $237,500 $145,000 Complete the following table to determine the transaction price to be allocated to each product using the relative standalone selling price method (options are at the bottom of the screen - you may need to scroll to find them). Allocated Stand-alone Product Percentage transaction selling price price A $125,000 AB Allocated Stand-alone Product Percentage transaction selling price price A $125,000 $237,500 $145,000 PART B Assume now that Moore sells products A and B on an individual basis. Product C is a new product that has not been previously sold. Additional information to determine the stand-alone selling prices is provided below: Market Stand-alone Product competitor Forecasted cost selling price prices A $125,000 $130,000 $89,451 $237,500 $232,000 $164,859 C $150,000 $102,832 Market Stand-alone Product competitor Forecasted cost selling price prices A $125,000 $130,000 $89,451 $237,500 $232,000 $164,859 ? $150,000 $102,832 (i) Complete the following table to determine the transaction price to be allocated to each product using the adjusted market assessment approach. Market Allocated Percentage of Product competitor transaction total prices price A $130,000 B $232,000 $150,000 Total (ii) Calculate the margin that would be used to determine the transaction price to be allocated to each product using the expected cost plus margin approach. Margin = DRAG AND DROP THE FOLLOWING OPTIONS INTO THE GAPS ABOVE (YOU MAY USE THE SAME OPTIONS MULTIPLE TIMES) (ii) Calculate the margin that would be used to determine the transaction price to be allocated to each product using the expected cost plus margin approach. Margin %3D DRAG AND DROP THE FOLLOWING OPTIONS INTO THE GAPS ABOVE (YOU MAY USE THE SAME OPTIONS MULTIPLE TIMES) $500,000 45.31% $142,857 $507,500 28.57% 140% $123,153 $512,000 133% $226,563 125% $126,953 $146,484 24.63% 29.30% 100% 87.5% $233,990 46.80% 25.39%

Step by Step Solution

★★★★★

3.40 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started