Topic 6(ii) Week 9 tutorial 1 Tutorial Topic Review Question Billy Bones Gym Ltd (see following pages). Please note that is a past question, and therefore excellent practice.

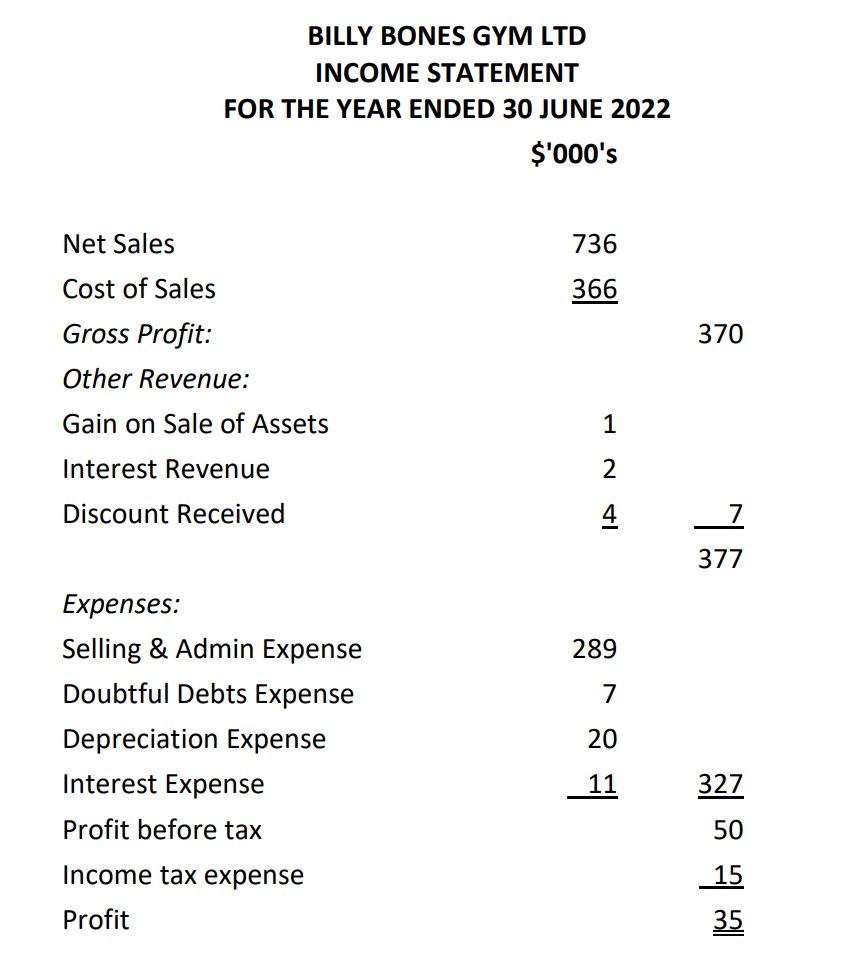

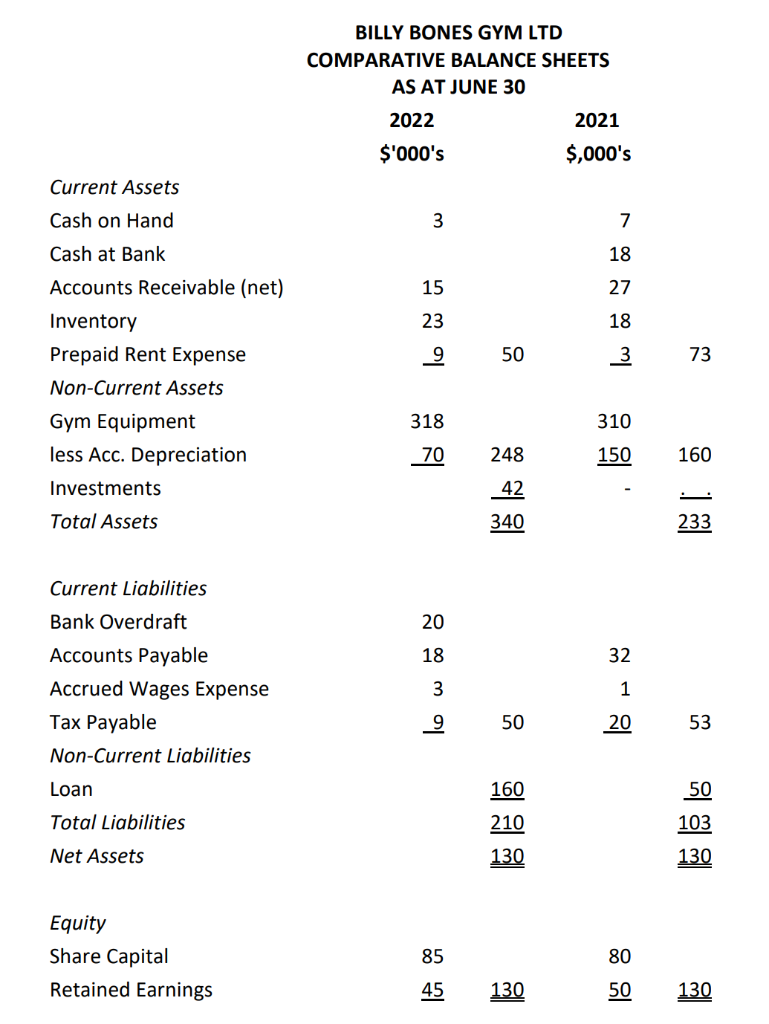

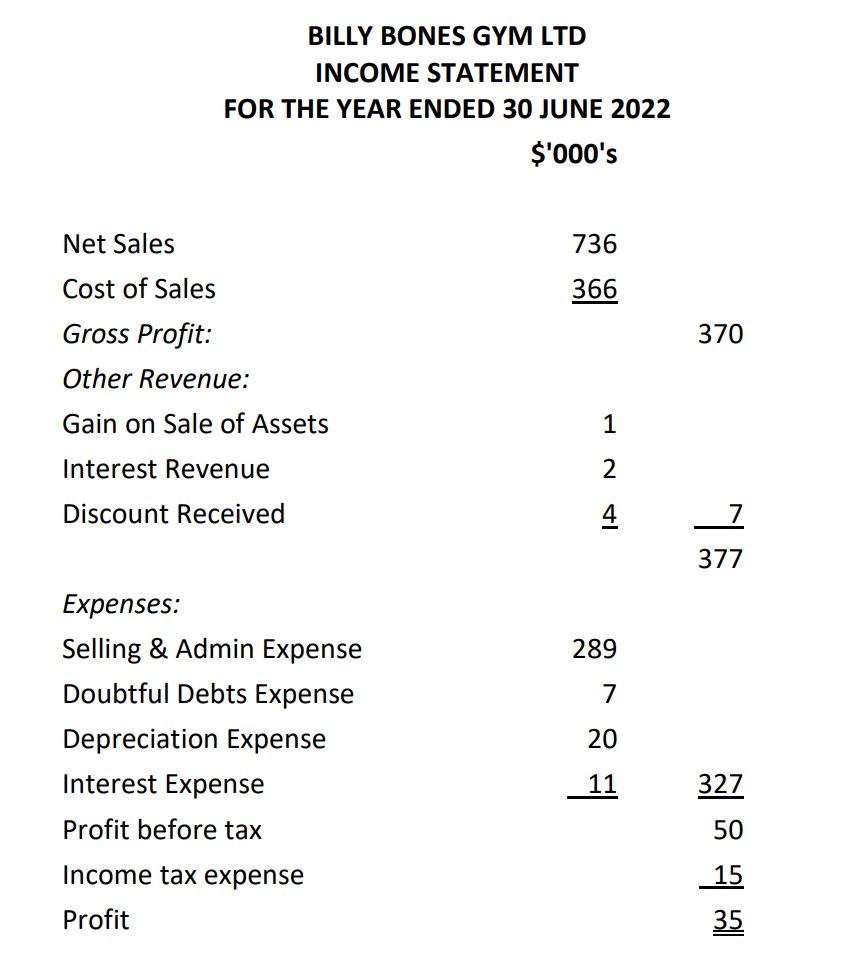

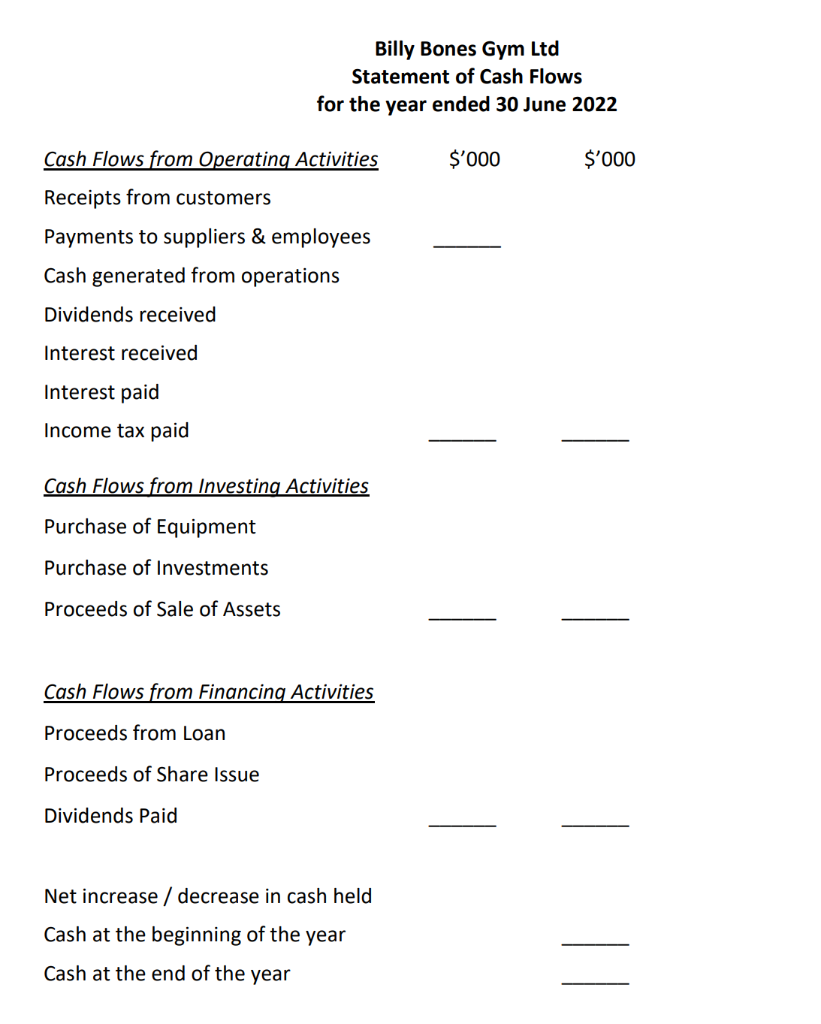

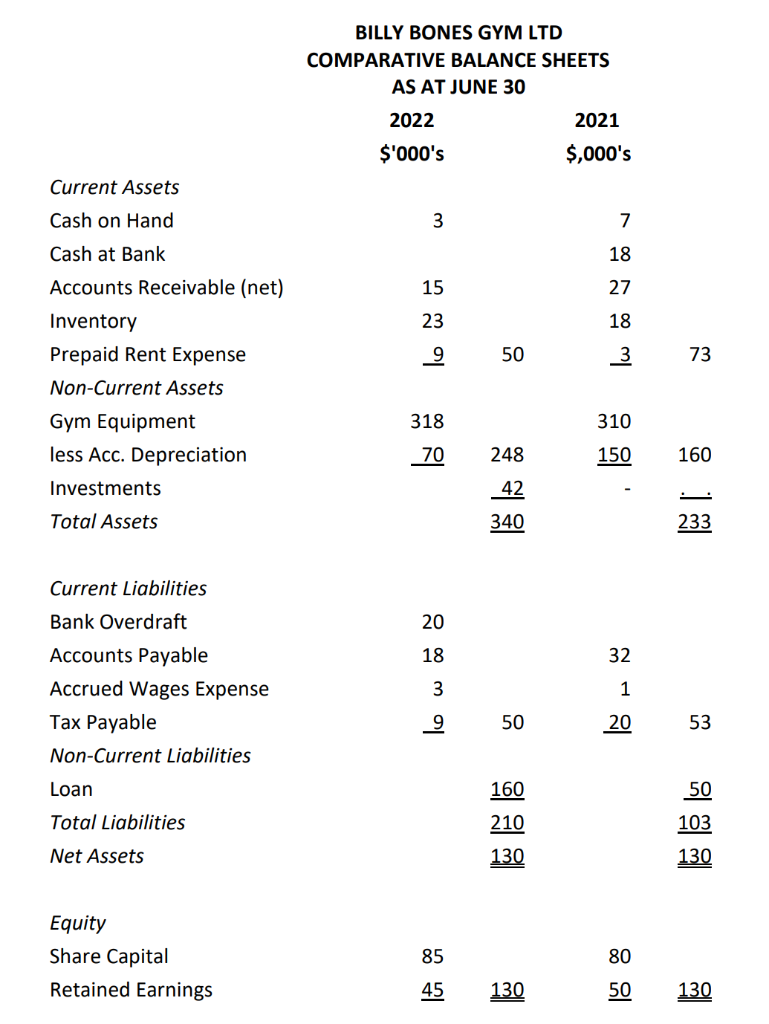

You are provided the following financial information for Billy Bones Gym:

continued -->

continued -->

Additional Information: Gymnasium Equipment with a historic cost of $110, 000 was sold for $11,000 cash making the company a profit of $1000.

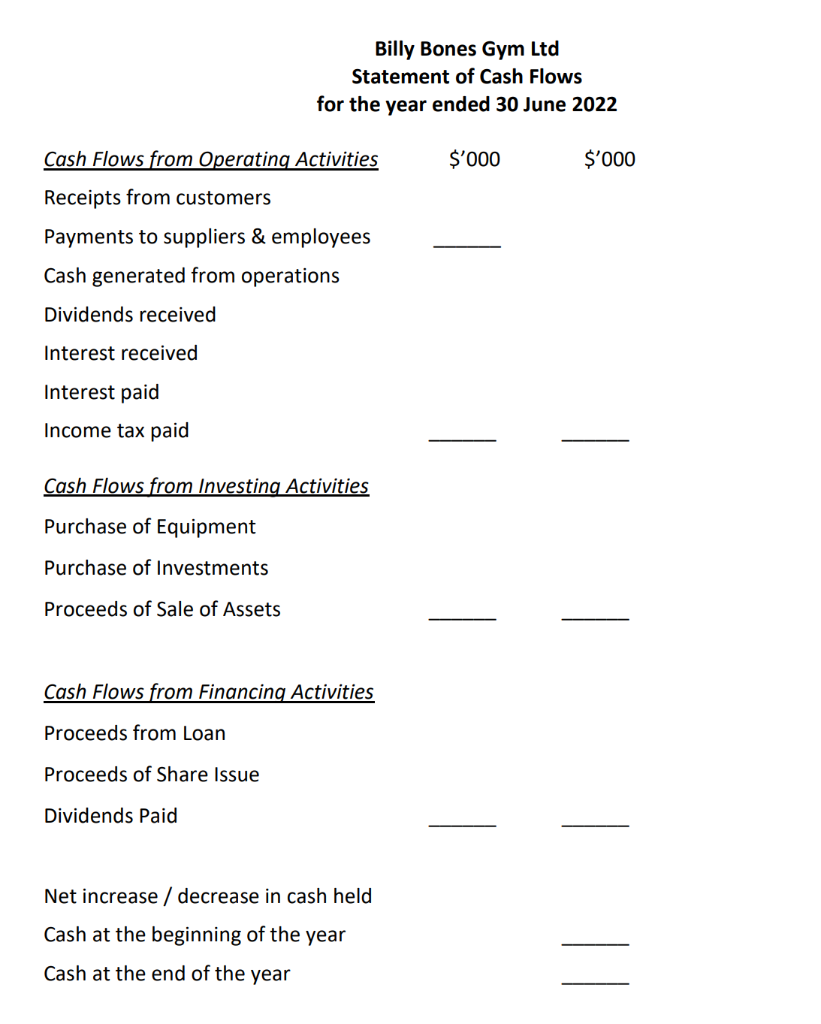

REQUIRED: Answer part a. of this question in the proper format provided on the next page. you must show all working

a. Using the proper format provided prepare a cash flow statement in the format required by applicable accounting standard. Show all calculations.

b. Comment on the fact that cash flow for the period was negative despite making a profit. Highlight any items that may have contributed to this result

BILLY BONES GYM LTD COMPARATIVE BALANCE SHEETS AS AT JUNE 30 2022$000s2021$,000s Current Assets CashonHandCashatBankAccountsReceivable(net)InventoryPrepaidRentExpenseNon-CurrentAssetsGymEquipmentlessAcc.DepreciationInvestmentsTotalAssets3152393187050248423407182718331015073160340 Current Liabilities Bank Overdraft 20 Accounts Payable 1832 Accrued Wages Expense Tax Payable \begin{tabular}{rrr} 3 & & 1 \\ 9 & 50 & 20 \\ \hline \end{tabular} 53 Non-Current Liabilities Loan Total Liabilities Net Assets 160 130 10350 130 Equity Share Capital 8580 Retained Earnings 45130 50130 BILLY BONES GYM LTD INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE 2022 \$'000's Net Sales 736 Cost of Sales 366 Gross Profit: 370 Other Revenue: Gain on Sale of Assets 1 Interest Revenue Discount Received 43777 Expenses: Selling \& Admin Expense 289 Doubtful Debts Expense 7 Depreciation Expense 20 Interest Expense Profit before tax 50327 Income tax expense Profit 3515 Billy Bones Gym Ltd Statement of Cash Flows for the year ended 30 June 2022 Cash Flows from Operating Activities $000$000 Receipts from customers Payments to suppliers \& employees Cash generated from operations Dividends received Interest received Interest paid Income tax paid Cash Flows from Investing Activities Purchase of Equipment Purchase of Investments Proceeds of Sale of Assets Cash Flows from Financing Activities Proceeds from Loan Proceeds of Share Issue Dividends Paid Net increase / decrease in cash held Cash at the beginning of the year Cash at the end of the year BILLY BONES GYM LTD COMPARATIVE BALANCE SHEETS AS AT JUNE 30 2022$000s2021$,000s Current Assets CashonHandCashatBankAccountsReceivable(net)InventoryPrepaidRentExpenseNon-CurrentAssetsGymEquipmentlessAcc.DepreciationInvestmentsTotalAssets3152393187050248423407182718331015073160340 Current Liabilities Bank Overdraft 20 Accounts Payable 1832 Accrued Wages Expense Tax Payable \begin{tabular}{rrr} 3 & & 1 \\ 9 & 50 & 20 \\ \hline \end{tabular} 53 Non-Current Liabilities Loan Total Liabilities Net Assets 160 130 10350 130 Equity Share Capital 8580 Retained Earnings 45130 50130 BILLY BONES GYM LTD INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE 2022 \$'000's Net Sales 736 Cost of Sales 366 Gross Profit: 370 Other Revenue: Gain on Sale of Assets 1 Interest Revenue Discount Received 43777 Expenses: Selling \& Admin Expense 289 Doubtful Debts Expense 7 Depreciation Expense 20 Interest Expense Profit before tax 50327 Income tax expense Profit 3515 Billy Bones Gym Ltd Statement of Cash Flows for the year ended 30 June 2022 Cash Flows from Operating Activities $000$000 Receipts from customers Payments to suppliers \& employees Cash generated from operations Dividends received Interest received Interest paid Income tax paid Cash Flows from Investing Activities Purchase of Equipment Purchase of Investments Proceeds of Sale of Assets Cash Flows from Financing Activities Proceeds from Loan Proceeds of Share Issue Dividends Paid Net increase / decrease in cash held Cash at the beginning of the year Cash at the end of the year

continued -->

continued -->