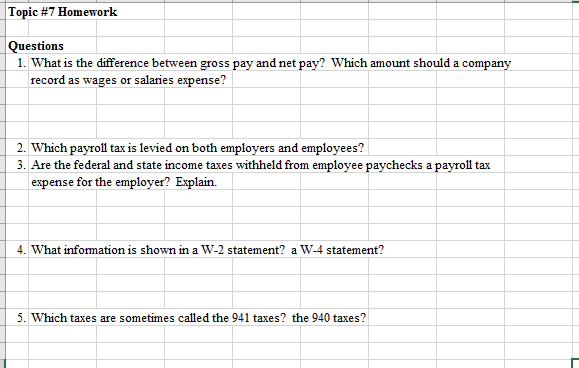

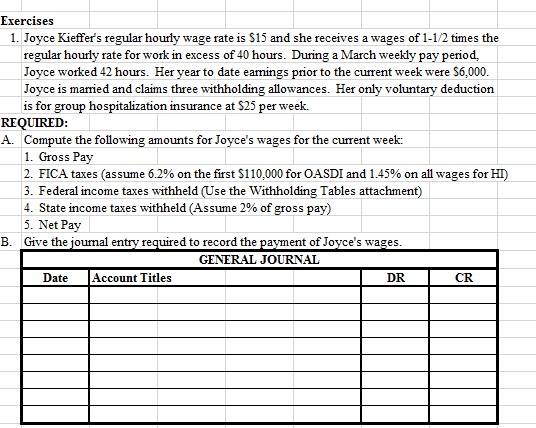

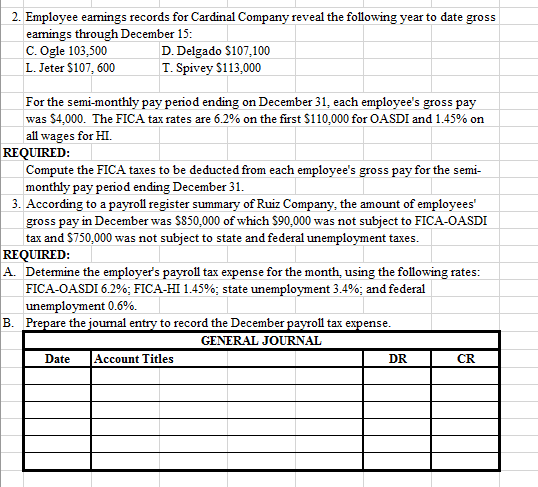

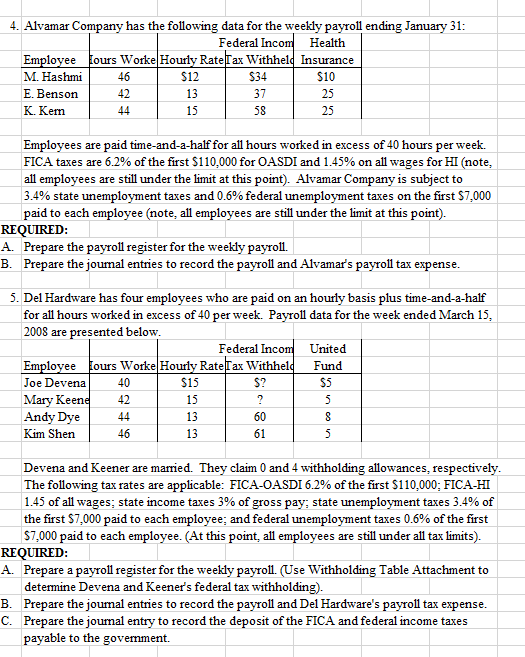

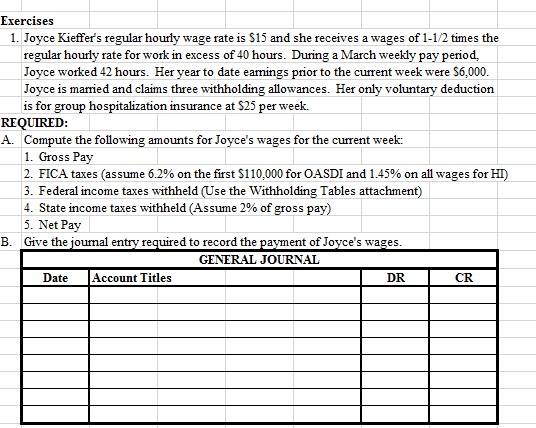

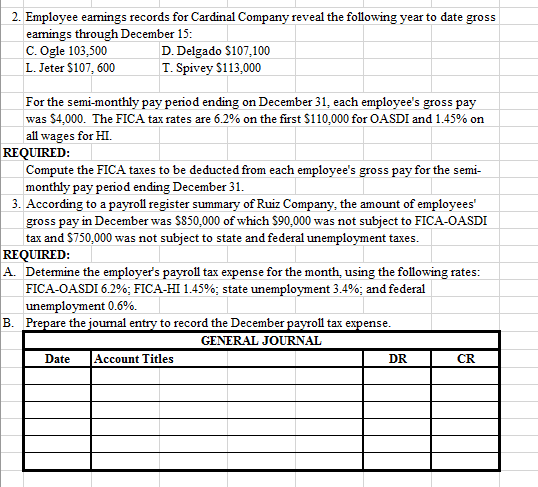

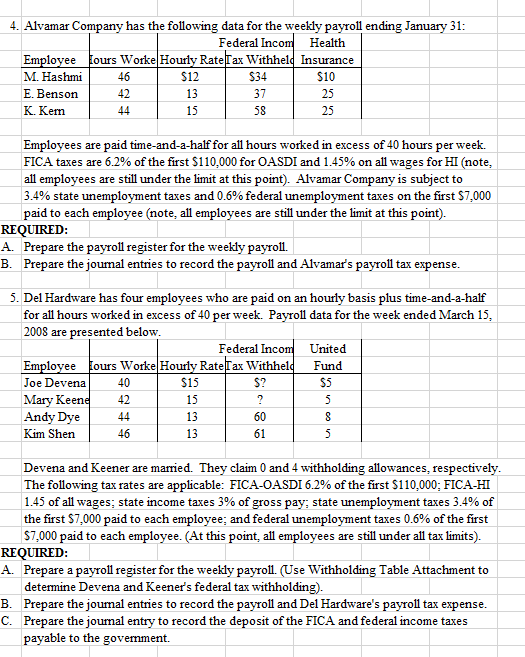

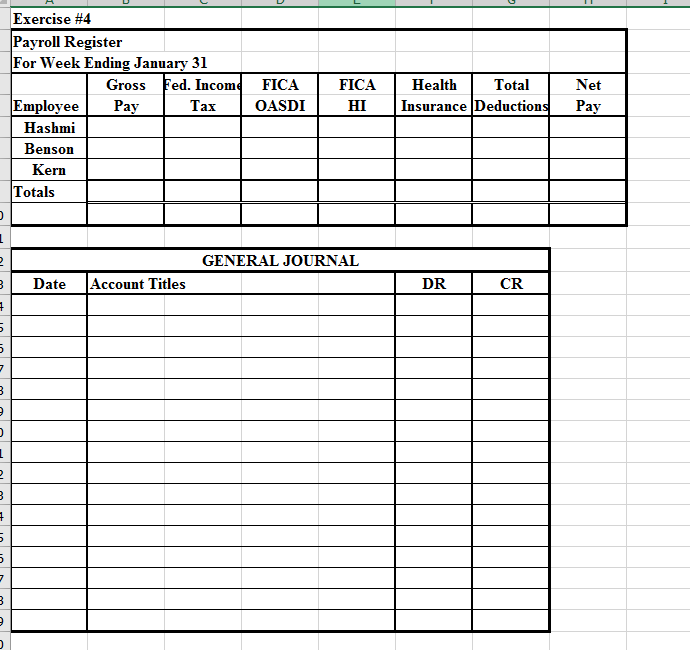

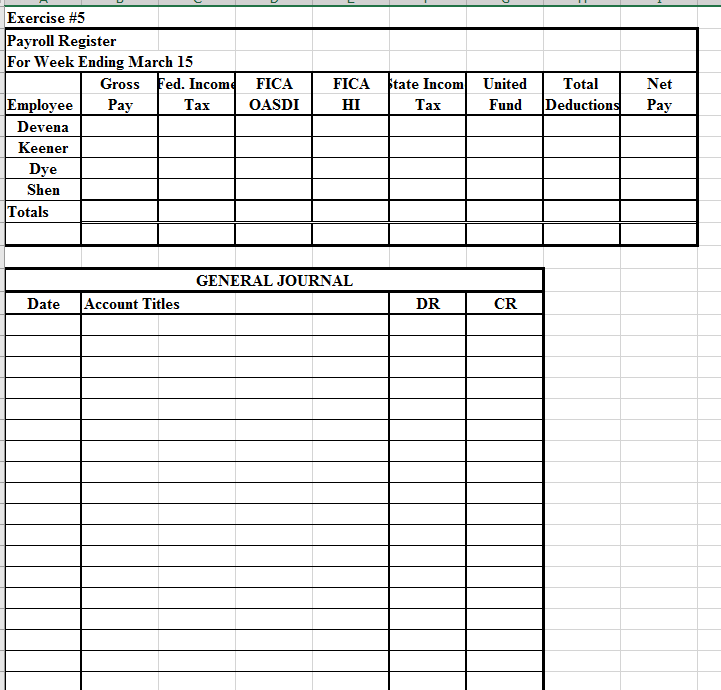

Topic #7 Homework Questions 1. What is the difference between gross pay and net pay? Which amount should a company record as wages or salaries expense? 2. Which payroll tax is levied on both employers and employees? 3. Are the federal and state income taxes withheld from employee paychecks a payroll tax expense for the employer? Explain 4 What infommation is shown in a W-2 statement? a W-4 statement? 5. Which taxes are sometimes called the 941 taxes? the 940 taxes? Exercises 1. Joyce Kieffer's regular hourly wage rate is $15 and she receives a wages of 1-1/2 times the regular hourly rate for work in excess of 40 hours. During a March weekly pay period |Joyce worked 42 hours. Her year to date earnings prior to the current week were $6,000 Joyce is married and claims three withholding allowances. Her only voluntary deuction |is for group hospitalization insurance at $25 per week REQUIRED: A. Compute the following amounts for Joyce's wages for the current week: 1. Gross Pay 2. FICA taxes (assume 6.2% on the first $110,000 for OASDI and 1.45% on all wages for HI) |3. Federal income taxes withheld (Use the Withholding Tables attachment) 4. State income taxes withheld (Assume 2% of gross pay) 5. Net Pay B. Give the joumal entry required to record the payment of Joyce's wages GENERAL JOURNAL Account Titles Date DR CR 2. Employee earmings records for Cardinal Company reveal the following year to date gross earmings through December 15: C. Ogle 103,500 L. Jeter $107, 600 D. Delgado $107,100 T. Spivey $113,000 For the semi-monthly pay period ending on December 31, each employee's gross pay was $4,000. The FICA tax rates are 6.2% on the first $110,000 for OASDI and 1.45% on all wages for HI. REQUIRED: Compute the FICA taxes to be deducted from each employee's gross pay for the semi monthly pay period ending December 31. 3. According to a payroll register summary of Ruiz Company, the amount of employees' gross pay in December was $850,000 of which $90,000 was not subject to FICA-OASDI tax and $750,000 was not subject to state and federal unemployment taxes REQUIRED: A Determine the employer's payroll tax expense for the month, using the following rates: FICA-OASDI 6.2%; FICA-HI 1.45%; state unemployment 3.4%; and federal unemployment 0.6% Prepare the joumal entry to record the December payroll tax expense. B. GENERAL JOURNAL Account Titles Date DR CR 4 Alvamar Company has the following data for the weekly payroll ending January 31: Federal Incom Health ours Worke Hourly RateTax Withhel Insurance Employee S12 M. Hashmi 46 S34 $10 E. Benson 42 13 37 25 K. Kem 44 15 58 25 week Employees are paid time-and-a-half for all hours worked in excess of 40 hours FICA taxes are 6.2% of the first $110,000 for OASDI and 1.45% on all wages for HI (note | all employees are still under the limit at this point). Alvamar Company is subject to | 3.4% state unemployment taxes and 0.6% federal unemployment taxes on the frst $7,000 per paid to each employee (note, all employees are still under the limit at this point). REQUIRED: A. Prepare the payroll register for the weekly payroll B. Prepare the joumal entries to record the payroll and Alvamar's payroll tax expense. 5. Del Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 per week. Payroll data for the week ended March 15 2008 are presented below Federal Incom ours Worke Hourly Rate Tax Withhel United Fund Employee $15 Joe Devena 40 $? S5 | Mary Keene Andy Dye 42 15 5 44 13 60 Kim Shen 46 13 61 5 Devena and Keener are married. They claim 0 and 4 withholding allowances, respectively The following tax rates are applicable: FICA-OASDI 6.2% of the first $110,000; FICA-HI 1.45 of all wages; state income taxes 3% of gross pay, state unemployment taxes 3.4% of the first $7,000 paid to each employee; and federal unemployment taxes 0.6% of the first $7,000 paid to each employee. (At this point, all employees are still under all tax limits) REQUIRED A. Prepare a payroll register for the weekly payroll. (Use Withholding Table Attachment to determine Devena and Keener's federal tax withholding) B. Prepare the joumal entries to record the payroll and Del Hardware's payroll tax expense C. Prepare the joumal entry to record the deposit of the FICA and federal income taxes payable to the govemment Exercise #4 Payroll Register For Week Ending January 31 Gross Fed. Income Pay Total Net FICA FICA Health Employee Insurance Deductions x OASDI HI Pay Hashmi Benson Kern Totals GENERAL JOURNAL Account Titles DR Date CR Exercise #5 Payroll Register For Week Ending March 15 Fed. Income State Incom Net Gross FICA FICA United Total Employee Deductions HI ay OASDI Fund ay Devena Keener Dye Shen Totals GENERAL JOURNAL Account Titles DR CR Date