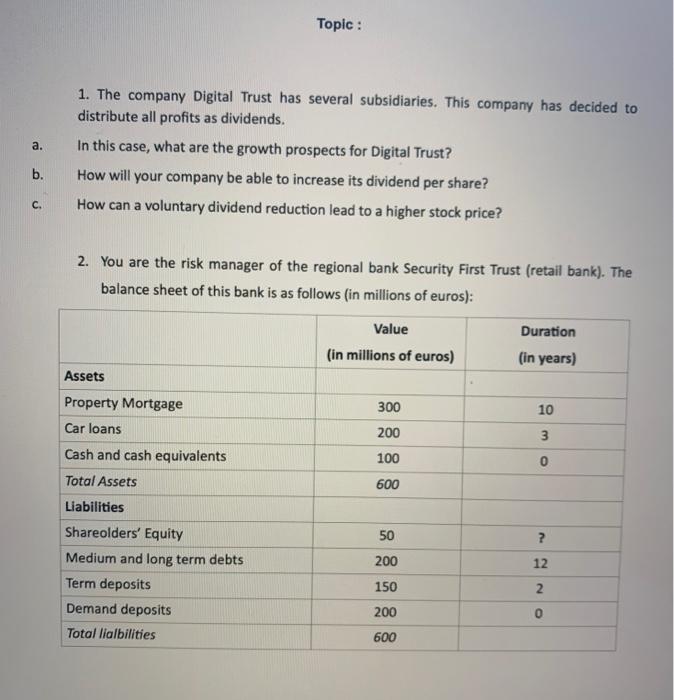

Topic: a. 1. The company Digital Trust has several subsidiaries. This company has decided to distribute all profits as dividends. In this case, what are the growth prospects for Digital Trust? How will your company be able to increase its dividend per share? How can a voluntary dividend reduction lead to a higher stock price? b. c. 2. You are the risk manager of the regional bank Security First Trust (retail bank). The balance sheet of this bank is as follows (in millions of euros): Value Duration (in millions of euros) (in years) Assets Property Mortgage 300 10 Car loans 200 3 Cash and cash equivalents 100 0 Total Assets 600 50 ? ? 200 12 Liabilities Shareolders' Equity Medium and long term debts Term deposits Demand deposits Total lialbilities 2 150 200 0 600 a. What is the duration of this bank's equity? b. If interest rates are currently 5%, but were to drop to 4%, what would be the change in the value of equity that this bank would experience? c. If due to a new government consumer support program, this bank experienced a wave of prepayments on auto loans, reducing the size of its auto loan portfolio from 200 million to 100 million and increasing cash on hand to 200 million. What would be the duration of this bank's equity as a result of these prepayments? d. Why is the duration of the liabilities of an investment bank higher than that of a retail bank? 3. If your company needs to borrow 8,000,000 euros in 6 months that you can pay back in 3 months. In order to hedge against an increase in interest rates in 6 months, you purchase an FRA (6 x 9) with a bank at an FRA rate of 2%, with a principal of 8,000,000 euros. a. If in 6 months the interest rate rose to 2.5%, who would pay compensation? b. What would be the value of this compensation? c. If you had instead used a swap contract to hedge against an interest rate risk, what would have been the effect of an increase in interest rates on the value of the swap for the party that 1/receives the fixed rate: 2/pays the fixed rate. 4. Norah SA has just paid an annual dividend of 1.99. Analysts expect the company's profits to increase by 6% per year for the next four years. Beyond that, Norah SA's profits are expected to grow at the industry average rate of 4.6% per year. a. If Norah AG's cost of equity is 8.2% per year and its dividend payout ratio remains constant, what price should Norah AG's shares sell for using the dividend discount model? b. If, while maintaining a constant total payout ratio, the CFO finally decided to pay out 50% of the profits in dividends and use the remaining 50% to buy back shares, what would be the price of Norah SA stock? c. What is the most appropriate/direct discount rate to use to determine the price of this company's stock? 5. If your company pays no dividends but spent 4 million euros on share buybacks last year. If your company's cost of equity is 8%, and the amount spent on buybacks is expected to grow by 5% next year. If your company has 8 million shares outstanding, what is the price per share of your company? 6. Your company, which is mainly located in Paris, is considering relocating part of its offices to the provinces and, as far as possible, maintaining part of the employees' activity by telecommuting for at least 5 years. This decision should reduce operating costs by 200,000 euros per year. a. If investors were not expecting this news, what would be the most likely effect on your company's stock price at the time of the announcement, given that your company has 50,000 shares outstanding, no debt and a cost of equity of 10%? b. What is the most appropriate discount rate when valuing a company using the discounted cash flow method ? 7. Six months ago you purchased a dollar call option because you knew you would need dollars in August. The strike price of the option is 1/$. If at expiration the spot exchange rate is 0.9/$, what do you do with the option? At what rate will you buy dollars? 8. Explain in two-three sentences why and when cash flows are discounted using either return on equity or WACC? 9. Digital Trust is a company with several overseas subsidiaries. The main customers of this company are in Russia. The Russo-Ukrainian crisis has disrupted its commercial and financial approach and the company is exposed to multiple risks. Which ones and why?)