Question: Topic: Bond Returns 11) For each of the below, indicate True or False. No explanation is required. a) Given: At t = 0 you bought

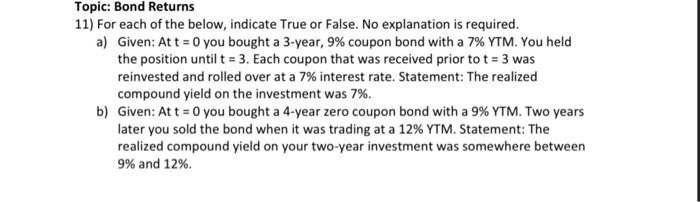

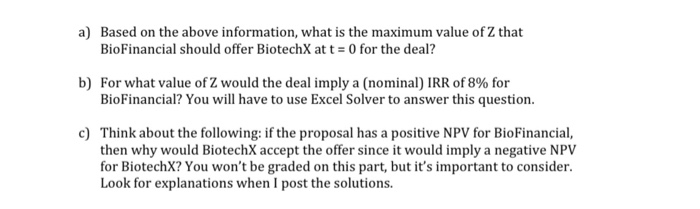

Topic: Bond Returns 11) For each of the below, indicate True or False. No explanation is required. a) Given: At t = 0 you bought a 3-year, 9% coupon bond with a 7% YTM. You held the position until t = 3. Each coupon that was received prior to t = 3 was reinvested and rolled over at a 7% interest rate. Statement: The realized compound yield on the investment was 7%. b) Given: At t = 0 you bought a 4-year zero coupon bond with a 9% YTM. Two years later you sold the bond when it was trading at a 12% YTM. Statement: The realized compound yield on your two-year investment was somewhere between 9% and 12%. a) Based on the above information, what is the maximum value of Z that BioFinancial should offer BiotechX at t = 0 for the deal? b) For what value of Z would the deal imply a (nominal) IRR of 8% for BioFinancial? You will have to use Excel Solver to answer this question. c) Think about the following: if the proposal has a positive NPV for BioFinancial, then why would BiotechX accept the offer since it would imply a negative NPV for BiotechX? You won't be graded on this part, but it's important to consider. Look for explanations when I post the solutions. Topic: Bond Returns 11) For each of the below, indicate True or False. No explanation is required. a) Given: At t = 0 you bought a 3-year, 9% coupon bond with a 7% YTM. You held the position until t = 3. Each coupon that was received prior to t = 3 was reinvested and rolled over at a 7% interest rate. Statement: The realized compound yield on the investment was 7%. b) Given: At t = 0 you bought a 4-year zero coupon bond with a 9% YTM. Two years later you sold the bond when it was trading at a 12% YTM. Statement: The realized compound yield on your two-year investment was somewhere between 9% and 12%. a) Based on the above information, what is the maximum value of Z that BioFinancial should offer BiotechX at t = 0 for the deal? b) For what value of Z would the deal imply a (nominal) IRR of 8% for BioFinancial? You will have to use Excel Solver to answer this question. c) Think about the following: if the proposal has a positive NPV for BioFinancial, then why would BiotechX accept the offer since it would imply a negative NPV for BiotechX? You won't be graded on this part, but it's important to consider. Look for explanations when I post the solutions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts