Question

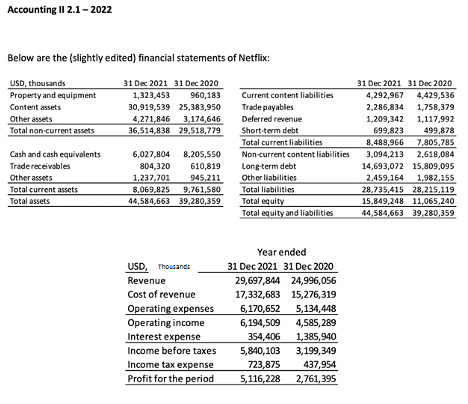

Topic: Creating an Accounting Adjustment Table for an Accelerated Amortized asset. Context: Of total content assets of USD 30,919,539 (see balance sheet), an amount of

Topic: Creating an Accounting "Adjustment Table" for an Accelerated Amortized asset.

Context:

Of total content assets of USD 30,919,539 (see balance sheet), an amount of USD 10,242,575 relates to in-production content, which is not yet amortized.

The remainder of USD 20,675,964 will be amortized over the next few years, of which about 42%, or mUSD 8,744, in 2022.

-Content Assets Not Amortized = 10,242,575

-Content Assets Amortized over Next few years = 20,675,964

-Content Assets Amortized in 2022 = 8,683,904.88 (42% of 20,675,964)

Question:

What would be the effect of accelerating amortization of Netflixs content assets, specifically of increasing amortization of the carrying amount from 42% to, say, 60%?

*Show the adjustments you would make to the firms financial statements in the form of an adjustment table. (Include any tax effects under other assets.)

-Original: Content Assets Amortized in 2022 = 8,683,904.88 (42% of 20,675,964)

-Accelerated: Content Assets Amortized in 2022 = 12,405,578.4 (60% of 20,675,964)

Accounting II 2.1-2022 Below are the (slightly edited) financial statements of Netflix: Accounting II 2.1-2022 Below are the (slightly edited) financial statements of NetflixStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started