Answered step by step

Verified Expert Solution

Question

1 Approved Answer

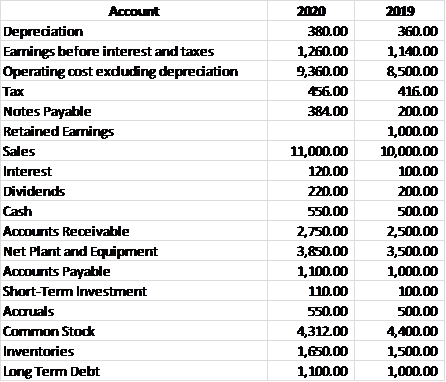

TOPIC: Financial Statements and Financial Statement Analysis Directions : Using Rhodes Corporations financial data (shown above), provide the items required. Requirements; Construct the; 2019 and

TOPIC: Financial Statements and Financial Statement Analysis

Directions:

- Using Rhodes Corporations financial data (shown above), provide the items required.

Requirements;

- Construct the;

- 2019 and 2020 Balance sheet (10 marks complete statement 1 mark deduction for every incorrect item)

- 2019 and 2020 Income Statement (10 marks complete statement 1 mark deduction for every incorrect item)

- 2020 Statement of Cash flow (15 marks complete statement 1 mark deduction for every incorrect item)

- Compute the;

- What is the net operating profit after taxes (NOPAT) for 2020? (1 marks correct answer + 2 marks correct process)

- What are the amounts of net operating working capital for both years? (1 marks correct answer + 2 marks correct process) per year

- What are the amounts of total net operating capital for both years? (1 marks correct answer + 2 marks correct process) per year

- What is the free cash flow for 2020? 1 marks correct answer + 2 marks correct process)

- What is the ROIC for 2020? 1 marks correct answer + 2 marks correct process)

- How much of the FCF did Rhodes use? (Hint: Remember that a net use can be negative.) 1 marks correct answer + 2 marks correct process)

- Compute for the following Financial Ratio; (1 marks correct answer + 2 marks correct process)

- Current Ratio

- Quick Ratio

- Average Collection Period (365 days)

- Debt Ratio

- Net Profit Margin

- Return on Total Asset

- Return on Equity

Account 2020 2019 380.00 360.00 Depreciation Earnings before interest and taxes Operating cost exduding depredation 1,140.00 8,500.00 1,260.00 9,360.00 46.00 384.00 Tax 416.00 200.00 Notes Payable Retained Earnings Sales 1,000.00 10,000.00 11,000.00 Interest 120.00 100.00 Dividers 220.00 200.00 Cash 550.00 500.00 Accounts Receivable Net Plant and Equipment Accounts Payable Short-Term Investment 2,750.00 3,850.00 1,100.00 110.00 2,500.00 3,500.00 1,000.00 100.00 Acouals 550.00 500.00 Common Stock Inwentories 4,312.00 1,650.00 1,100.00 4,400.00 1,500.00 1,000.00 Long Term Debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started