Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Topic From Chapter 9: Dividend-Paying vs. Non-Dividend-Paying Stocks. Introduction: Ralph Nader is many things. Lawyer, author, consumer advocate, and a four-time candidate for President of

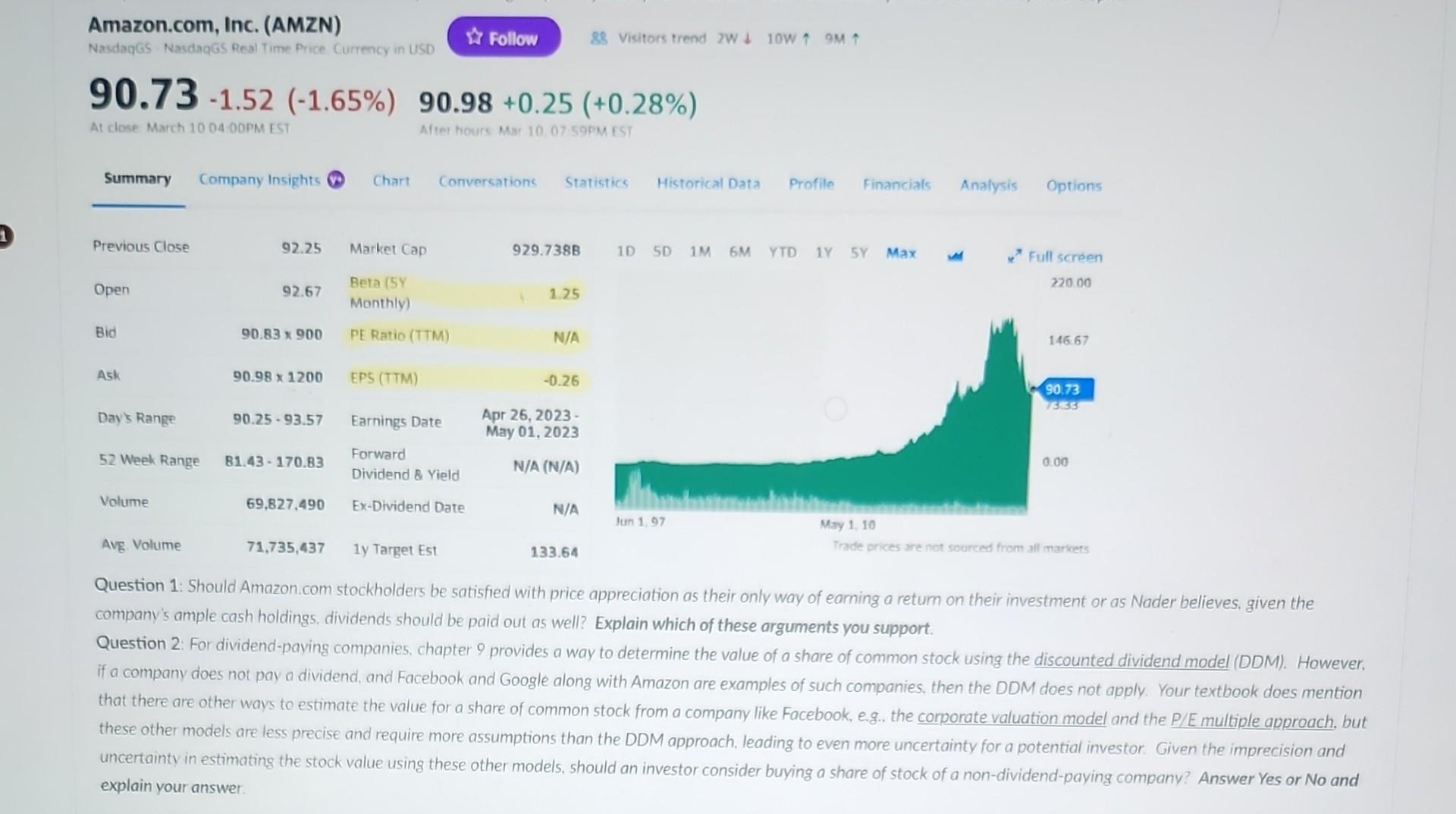

Topic From Chapter 9: Dividend-Paying vs. Non-Dividend-Paying Stocks. Introduction: Ralph Nader is many things. Lawyer, author, consumer advocate, and a four-time candidate for President of the U.S. Nader is also a stockholder and owns stock in Amazon.com, a company that has never paid a cash dividend. Nader believes that Amazon, given its stockpile of cash (Amazon's year-end cash balance in 2022 was $53.9 billion), should be paying its stockholders a yearly dividend. In a 2018 interview with After the Bell co-anchor David Asman, Nader claims that most stockholders want a regular dividend because it provides a "fundamental basis of stability." At the time of the interview, Amazon had a price-earnings ratio or P/E ratio of 300 , a number that Nader finds alarmingly high and to him, an indicator that the price of Amazon stock was over-valued. Note: For the period of 1920 to 1990 , the P/E ratio of the S\&P 500 index was in the range of 10 to 20. Despite the tremendous growth in the price of Amazon stock, Nader points out that these are "paper profits" and these price gains could be quickly wiped out. To learn more, view the Youtube video conducted on the Fox Business Network (3:33 minutes): Ralph Nader and Amazon Amazon.com price appreciation: Below is a March 10, 2023 screenshot taken from Yahoo! Finance providing a financial summary of Amazon.com. If you had purchased been $90.73. yhare of Amazon.com on March 1, 2013, the closing price would have been $13.32. Assuming you sold your share of Amazon 10 years later, the price would have been $90.73, yielding an annual return of 21.2% for your investment, none of which was from dividend income. Both the beta estimate (discussed in chapter 8 ) and P/E ratio (discussed in chapters 4 and 9) for Amazon.com have been highlighted. Also note: Amazon ended 2022 with a net loss resulting in a negative EPS as shown below and a current P/E ratio that cannot be determined. In Mderch of 2022, Amazon was trading at almost $3,000 per share but the company declared a 20 -for-1 stock split (to be discussed in chapter 15) that took affect in June of that year Amazon.com, Inc. (AMZN) NasdagGS - NasdaqGS Real Time Price Currency in USD &8 Visitors trend 2W10W9M 90.731.52(1.65%)90.98+0.25(+0.28%) 90.731.52(1.65%)90.98+0.25(+0.28%) At close March 100400OPM EST After hours Mar 10.0759smest Summary Company Insights ( Chart C Statistics P Profile Financials Analysis Options Question 1: Should Amazon.com stockholders be satisfied with price appreciation as their only way of earning a return on their investment or as Nader believes. given the company's ample cash holdings, dividends should be paid out as well? Explain which of these arguments you support. Question 2: For dividend-paving companies, chapter 9 provides a way to determine the value of a share of common stock using the discounted dividend model (DDM). However. if a company does not pay a dividend, and Facebook and Google along with Amazon are examples of such companies, then the DDM does not apply. Your textbook does mention that there are other ways to estimate the value for a share of common stock from a company like Facebook, e.g.. the corporate valuation model and the P/E multiple approach. but these other models are less precise and require more assumptions than the DDM approach, leading to even more uncertainty for a potential investor. Given the imprecision and uncertainty in estimating the stock value using these other models, should an investor consider buying a share of stock of a non-dividend-paying company? Answer Yes or No and explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started