Question

TOPIC: INCREMENTAL ANALYSIS: Keep or Replace equipment (Relevant cost) I have to present the following question in a presentation. Can you please explain each step

TOPIC: INCREMENTAL ANALYSIS: Keep or Replace equipment (Relevant cost)

I have to present the following question in a presentation. Can you please explain each step in detail of the question.

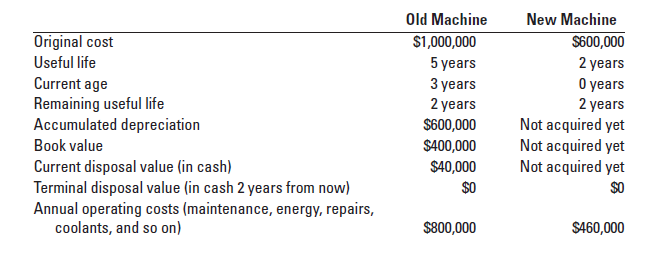

QUESTION: Toledo Company, a manufacturer of aircraft components, is considering replacing a metal-cutting machine with a newer model. The new machine is more efficient than the old machine, but it has a shorter life. Revenues from aircraft parts ($1.1 million per year) will be unaffected by the replacement decision. Here are the data the management accountant prepares for the existing (old) machine and the replacement (new) machine:

Toledo Corporation uses straight-line depreciation. To focus on relevance, we ignore the time value of money and income taxes.2 Should Toledo replace its old machine?

SOLUTION:

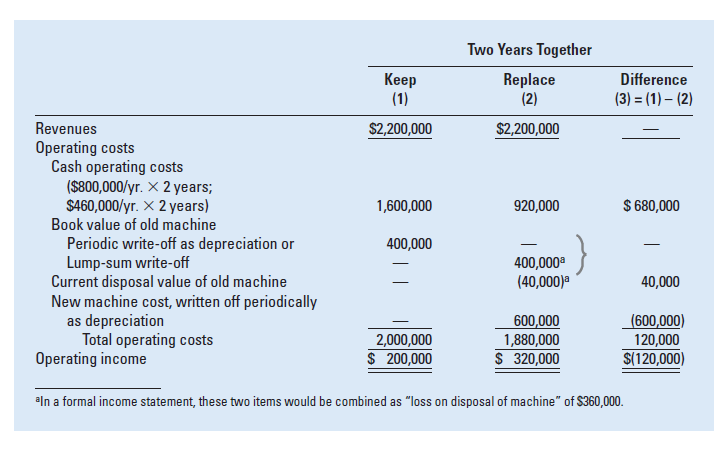

Presented Below is the 2-year summarized income statement if Toledo Company decided to keep or replace the new machinery

Explanation of the above table: shows that the book value of the old machine does not differ between the alternatives and could be ignored for decision-making purposes. No matter what the timing of the write-off whether a lump-sum charge in the current year or depreciation charges over the next two yearsthe total amount is still $400,000 because it is a past (historical) cost. In contrast, the $600,000 cost of the new machine and the current disposal value of $40,000 for the old machine are relevant because they would not arise if Toledos managers decided not to replace the machine. Note that the operating income from replacing is $120,000 higher for the two years together.

MY QUESTION: I understand how revenue and operating expenses were calculated in the above table. I am extremely confused about how the 'book value of old machine' was incorporated into the table. I know how the book value was calculated but I don't know what 'periodic write-off as depreciation or lump-sum write-off means' generally as well as how they are added in the table for the book value. Also, I don't know what 'New machine cost, written off periodically' means. What does written off periodically mean in this context? I need to present this question in class, so, please give a good elaborative explanation so I can explain it in front of my class as well.

Please explain in detail in how every value was added to the table, Starting from revenue, till the operating income, Explain it, in the same way, I will have to explain it in front of my class.

-If you believe that any information is missing, write in the comment section- '

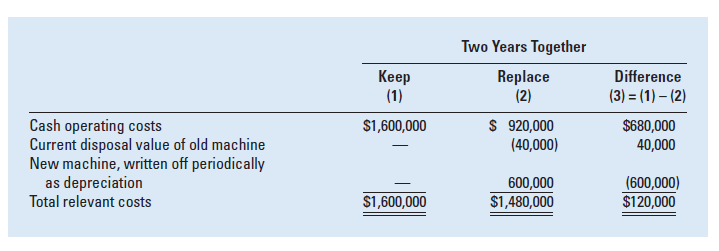

Also here is the incremental analysis of the question:

I don't know what the new machine 'written off periodically' here means either. What does it mean to be written periodically off? PLEASE EXPLAIN EVERYTHING IN DETAIL. I REALLY NEED HELP. I WILL BE GRATEFUL :)

Original cost Useful life Current age Remaining useful life Accumulated depreciation Book value Current disposal value (in cash) Terminal disposal value (in cash 2 years from now) Annual operating costs (maintenance, energy, repairs, coolants, and so on) Old Machine $1,000,000 5 years 3 years 2 years $600,000 $400,000 $40,000 $0 New Machine $600,000 2 years O years 2 years Not acquired yet Not acquired yet Not acquired yet $0 $800,000 $460,000 Keep (1) $2,200,000 Two Years Together Replace (2) $2,200,000 Difference (3) = (1) - (2) 1,600,000 920,000 $ 680,000 Revenues Operating costs Cash operating costs ($800,000/yr. X 2 years; $460,000/yr. X 2 years) Book value of old machine Periodic write-off as depreciation or Lump-sum write-off Current disposal value of old machine New machine cost, written off periodically as depreciation Total operating costs Operating income 400,000 400,000 (40,000) 40,000 2,000,000 $ 200,000 600,000 1,880,000 $ 320,000 (600,000) 120,000 $(120,000) ain a formal income statement, these two items would be combined as loss on disposal of machine" of $360,000. Keep (1) $1,600,000 Two Years Together Replace (2) $ 920,000 (40,000) Difference (3) = (1) (2) $680,000 40,000 Cash operating costs Current disposal value of old machine New machine, written off periodically as depreciation Total relevant costs 600,000 $1,480,000 (600,000) $120,000 $1,600,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started