Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Topic: Investment in Bonds Please show solutions. On March 1, 2020, WHITE Corporation purchased bonds with face amount of P5,000,000. The entity paid P4,585,000 plus

Topic: Investment in Bonds Please show solutions.

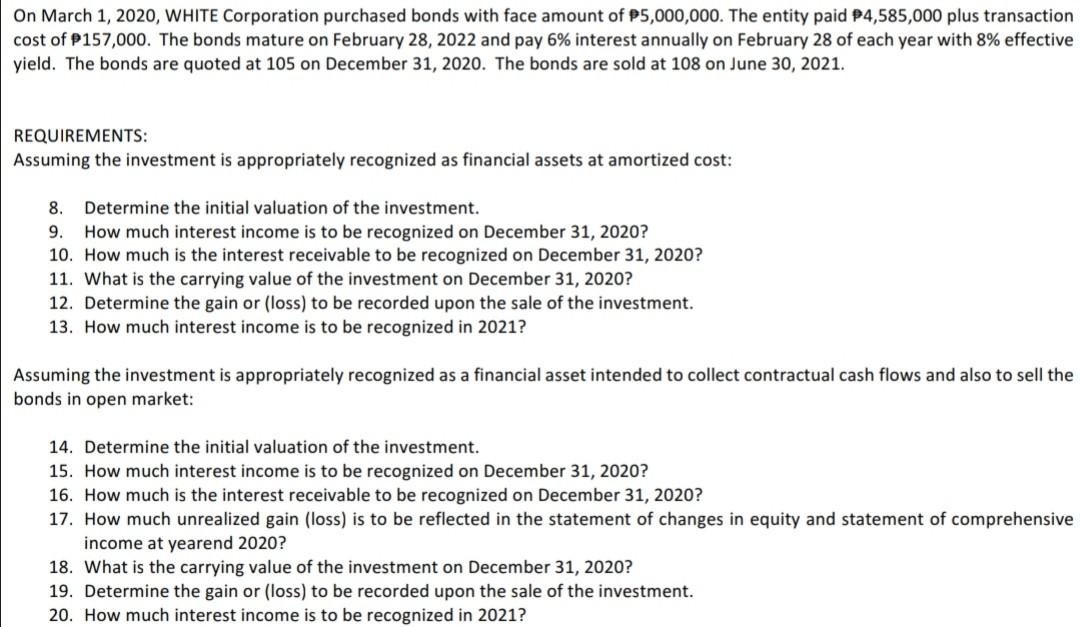

On March 1, 2020, WHITE Corporation purchased bonds with face amount of P5,000,000. The entity paid P4,585,000 plus transaction cost of P157,000. The bonds mature on February 28, 2022 and pay 6% interest annually on February 28 of each year with 8% effective yield. The bonds are quoted at 105 on December 31, 2020. The bonds are sold at 108 on June 30, 2021. REQUIREMENTS: Assuming the investment is appropriately recognized as financial assets at amortized cost: 8. Determine the initial valuation of the investment. 9. How much interest income is to be recognized on December 31, 2020? 10. How much is the interest receivable to be recognized on December 31, 2020? 11. What is the carrying value of the investment on December 31, 2020? 12. Determine the gain or (loss) to be recorded upon the sale of the investment. 13. How much interest income is to be recognized in 2021? Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: 14. Determine the initial valuation of the investment. 15. How much interest income is to be recognized on December 31, 2020? 16. How much is the interest receivable to be recognized on December 31, 2020? 17. How much unrealized gain (loss) is to be reflected in the statement of changes in equity and statement of comprehensive income at yearend 2020? 18. What is the carrying value of the investment on December 31, 2020? 19. Determine the gain or loss) to be recorded upon the sale of the investment. 20. How much interest income is to be recognized in 2021? On March 1, 2020, WHITE Corporation purchased bonds with face amount of P5,000,000. The entity paid P4,585,000 plus transaction cost of P157,000. The bonds mature on February 28, 2022 and pay 6% interest annually on February 28 of each year with 8% effective yield. The bonds are quoted at 105 on December 31, 2020. The bonds are sold at 108 on June 30, 2021. REQUIREMENTS: Assuming the investment is appropriately recognized as financial assets at amortized cost: 8. Determine the initial valuation of the investment. 9. How much interest income is to be recognized on December 31, 2020? 10. How much is the interest receivable to be recognized on December 31, 2020? 11. What is the carrying value of the investment on December 31, 2020? 12. Determine the gain or (loss) to be recorded upon the sale of the investment. 13. How much interest income is to be recognized in 2021? Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: 14. Determine the initial valuation of the investment. 15. How much interest income is to be recognized on December 31, 2020? 16. How much is the interest receivable to be recognized on December 31, 2020? 17. How much unrealized gain (loss) is to be reflected in the statement of changes in equity and statement of comprehensive income at yearend 2020? 18. What is the carrying value of the investment on December 31, 2020? 19. Determine the gain or loss) to be recorded upon the sale of the investment. 20. How much interest income is to be recognized in 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started