Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Topic: Islamic Accounting Please note that I will rate the question as helpful Question 1: Answer the following section. Section 2 : Table 2 shows

Topic: Islamic Accounting

Please note that I will rate the question as helpful

Question 1: Answer the following section.

Section 2 :

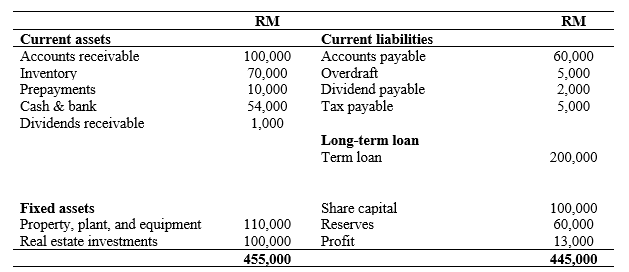

Table 2 shows the statement of financial position of AAM Company as of December 31, 2019.

The following have not been adjusted:

- Inventory includes work in progress and raw materials valued at RM10,000 and RM5,000, respectively.

- Prepayment is related to insurance and road tax.

- Included in the bank is a fixed deposit used to secure a financing facility from Bank A amounting to RM10,000.

- Within the term loan, RM25,000 is loan payable during the next year. This has not been reclassified.

- One customer was declared bankrupt. He owed RM5,000.

Required:

Calculate zakat payable using:

- The net assets method.

- The net invested funds method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started