Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TOPIC: PORTFOLIO THEORY AND CAPITAL ASSET PRICING MODEL (RETURN AND RISK) c. The department's management of Beyazid Bhd proposes to use Portfolio Theory to determine

TOPIC: PORTFOLIO THEORY AND CAPITAL ASSET PRICING MODEL (RETURN AND RISK)

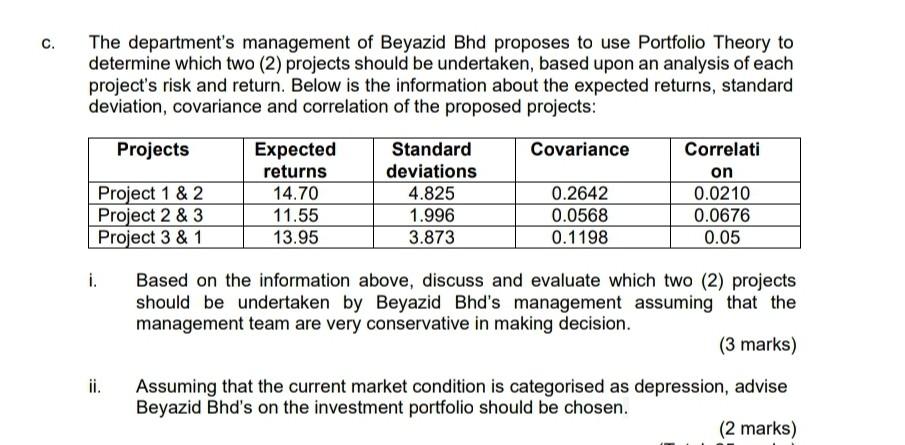

c. The department's management of Beyazid Bhd proposes to use Portfolio Theory to determine which two (2) projects should be undertaken, based upon an analysis of each project's risk and return. Below is the information about the expected returns, standard deviation, covariance and correlation of the proposed projects: Projects Covariance Project 1 & 2 Project 2 & 3 Project 3 & 1 Expected returns 14.70 11.55 13.95 Standard deviations 4.825 1.996 3.873 0.2642 0.0568 0.1198 Correlati on 0.0210 0.0676 0.05 i. Based on the information above, discuss and evaluate which two (2) projects should be undertaken by Beyazid Bhd's management assuming that the management team are very conservative in making decision. (3 marks) ii. Assuming that the current market condition is categorised as depression, advise Beyazid Bhd's on the investment portfolio should be chosen. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started