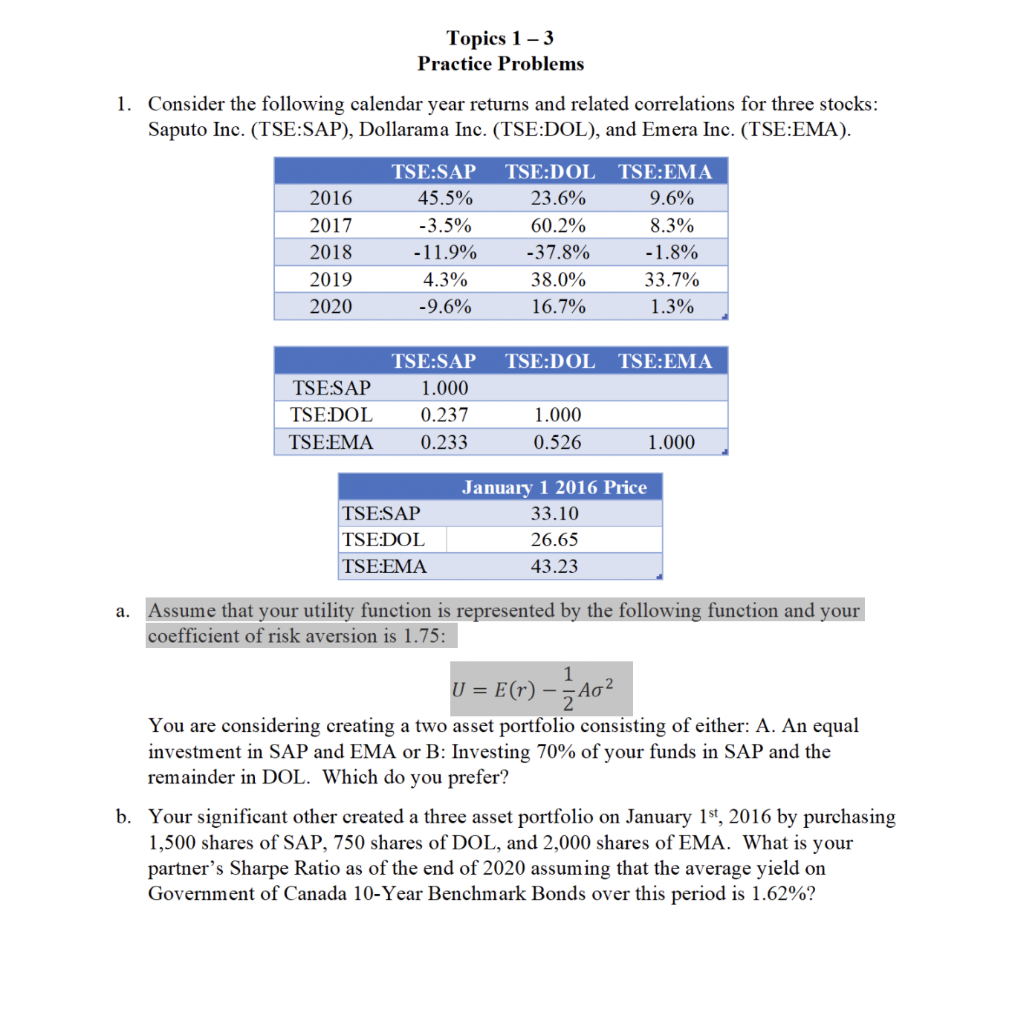

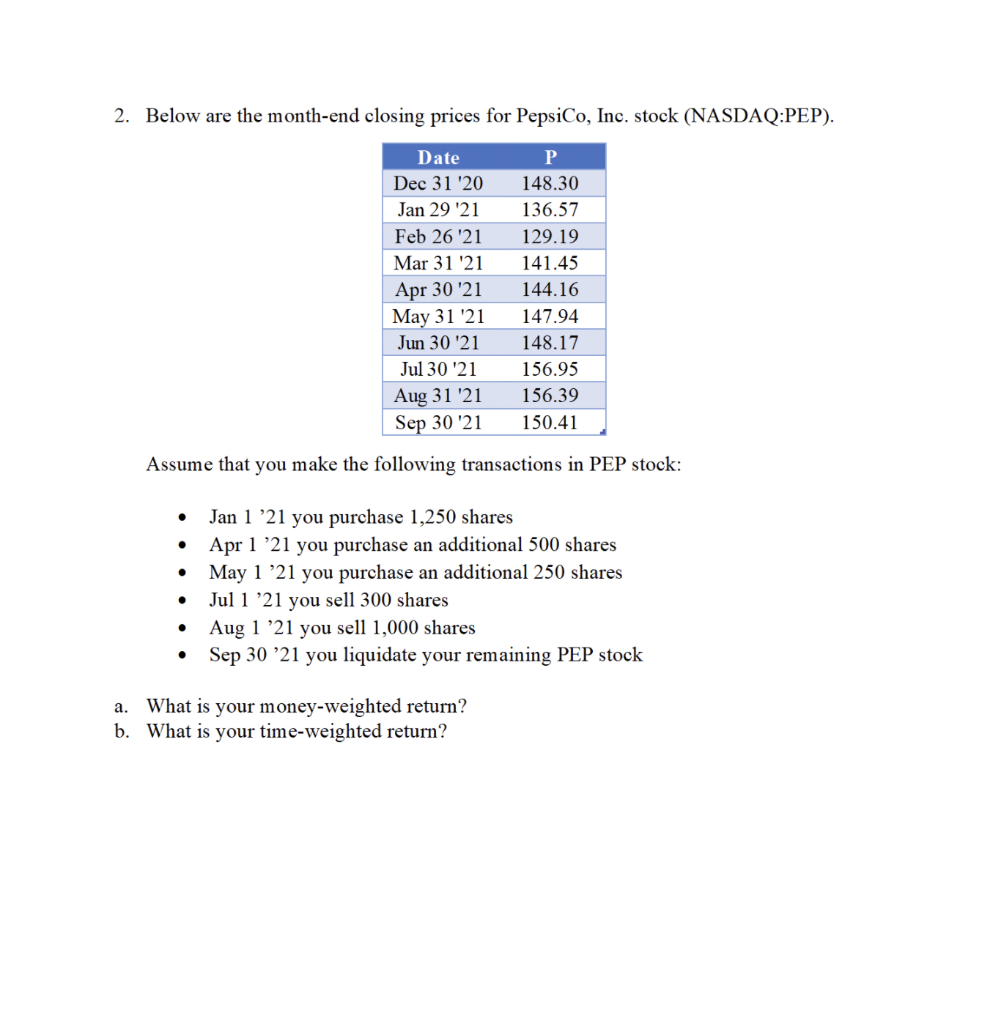

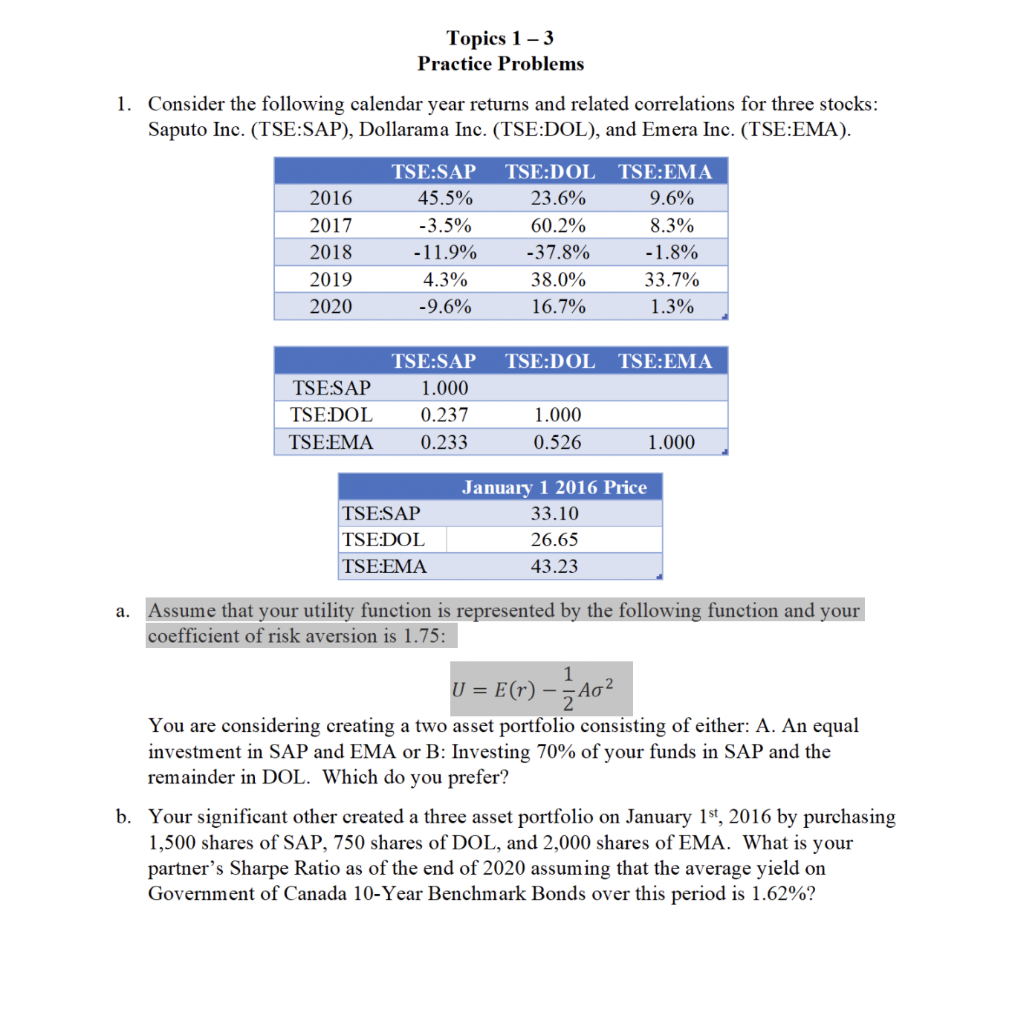

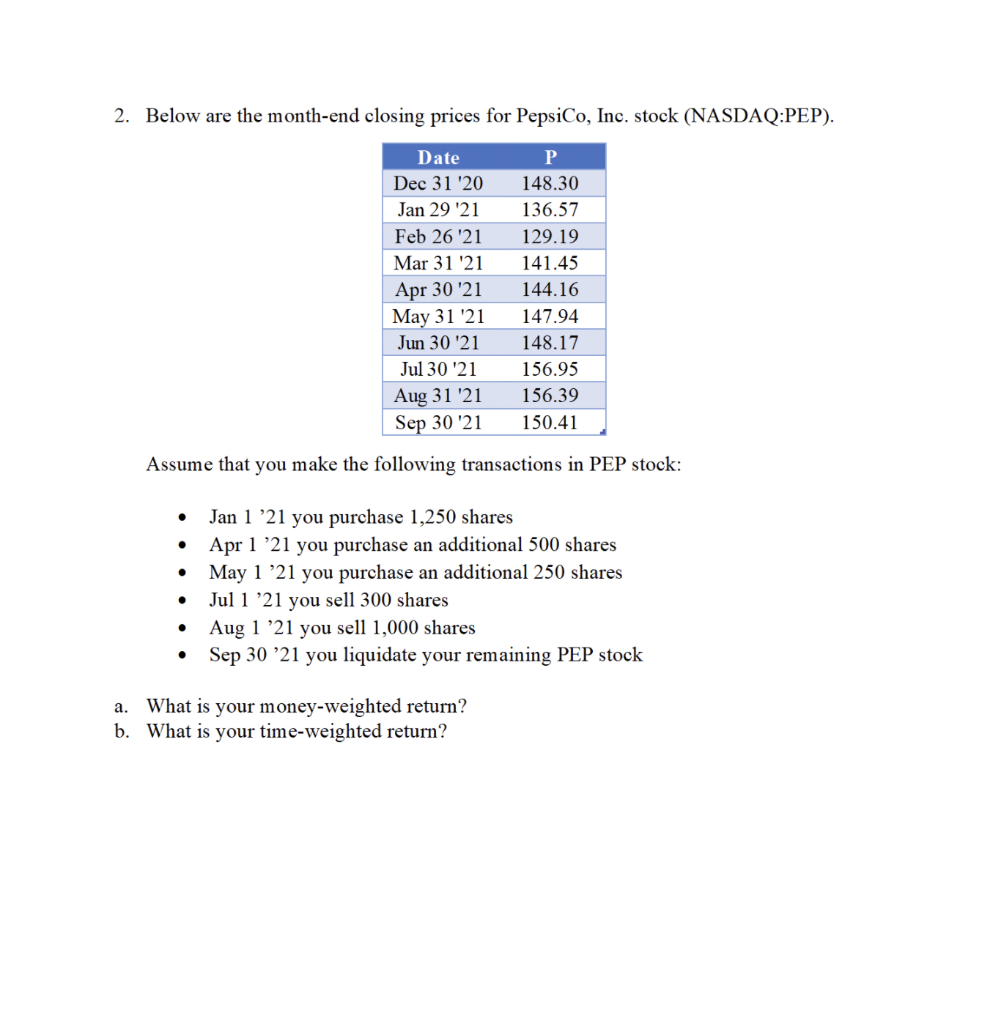

Topics 1 - 3 Practice Problems 1. Consider the following calendar year returns and related correlations for three stocks: Saputo Inc. (TSE:SAP), Dollarama Inc. (TSE:DOL), and Emera Inc. (TSE:EMA). 2016 2017 2018 2019 2020 TSE:SAP 45.5% -3.5% -11.9% 4.3% -9.6% TSE:DOL TSE:EMA 23.6% 9.6% 60.2% 8.3% -37.8% -1.8% 38.0% 33.7% 16.7% 1.3% TSE:DOL TSE:EMA TSE:SAP TSE:DOL TSE:EMA TSE:SAP 1.000 0.237 0.233 1.000 0.526 1.000 TSE:SAP TSE:DOL TSE:EMA January 1 2016 Price 33.10 26.65 43.23 a. Assume that your utility function is represented by the following function and your coefficient of risk aversion is 1.75: 1 - 3402 U = E(r) - You are considering creating a two asset portfolio consisting of either: A. An equal investment in SAP and EMA or B: Investing 70% of your funds in SAP and the remainder in DOL. Which do you prefer? b. Your significant other created a three asset portfolio on January 1st, 2016 by purchasing 1,500 shares of SAP, 750 shares of DOL, and 2,000 shares of EMA. What is your partner's Sharpe Ratio as of the end of 2020 assuming that the average yield on Government of Canada 10-Year Benchmark Bonds over this period is 1.62%? 2. Below are the month-end closing prices for PepsiCo, Inc. stock (NASDAQ:PEP). Date Dec 31 '20 Jan 29 '21 Feb 26 '21 Mar 31 '21 Apr 30 '21 May 31 '21 Jun 30 '21 Jul 30 '21 Aug 31 '21 Sep 30'21 P 148.30 136.57 129.19 141.45 144.16 147.94 148.17 156.95 156.39 150.41 Assume that you make the following transactions in PEP stock: . Jan 1 21 you purchase 1,250 shares Apr 1 '21 you purchase an additional 500 shares May 1 21 you purchase an additional 250 shares Jul 1 21 you sell 300 shares Aug 1 21 you sell 1,000 shares Sep 30 '21 you liquidate your remaining PEP stock . . a. What is your money-weighted return? b. What is your time-weighted return? Topics 1 - 3 Practice Problems 1. Consider the following calendar year returns and related correlations for three stocks: Saputo Inc. (TSE:SAP), Dollarama Inc. (TSE:DOL), and Emera Inc. (TSE:EMA). 2016 2017 2018 2019 2020 TSE:SAP 45.5% -3.5% -11.9% 4.3% -9.6% TSE:DOL TSE:EMA 23.6% 9.6% 60.2% 8.3% -37.8% -1.8% 38.0% 33.7% 16.7% 1.3% TSE:DOL TSE:EMA TSE:SAP TSE:DOL TSE:EMA TSE:SAP 1.000 0.237 0.233 1.000 0.526 1.000 TSE:SAP TSE:DOL TSE:EMA January 1 2016 Price 33.10 26.65 43.23 a. Assume that your utility function is represented by the following function and your coefficient of risk aversion is 1.75: 1 - 3402 U = E(r) - You are considering creating a two asset portfolio consisting of either: A. An equal investment in SAP and EMA or B: Investing 70% of your funds in SAP and the remainder in DOL. Which do you prefer? b. Your significant other created a three asset portfolio on January 1st, 2016 by purchasing 1,500 shares of SAP, 750 shares of DOL, and 2,000 shares of EMA. What is your partner's Sharpe Ratio as of the end of 2020 assuming that the average yield on Government of Canada 10-Year Benchmark Bonds over this period is 1.62%? 2. Below are the month-end closing prices for PepsiCo, Inc. stock (NASDAQ:PEP). Date Dec 31 '20 Jan 29 '21 Feb 26 '21 Mar 31 '21 Apr 30 '21 May 31 '21 Jun 30 '21 Jul 30 '21 Aug 31 '21 Sep 30'21 P 148.30 136.57 129.19 141.45 144.16 147.94 148.17 156.95 156.39 150.41 Assume that you make the following transactions in PEP stock: . Jan 1 21 you purchase 1,250 shares Apr 1 '21 you purchase an additional 500 shares May 1 21 you purchase an additional 250 shares Jul 1 21 you sell 300 shares Aug 1 21 you sell 1,000 shares Sep 30 '21 you liquidate your remaining PEP stock . . a. What is your money-weighted return? b. What is your time-weighted return