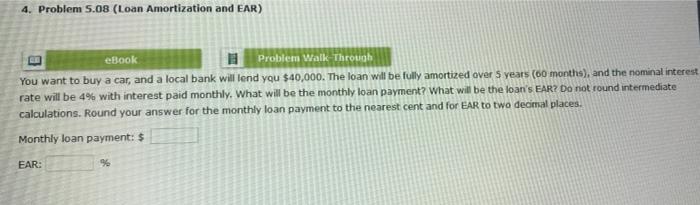

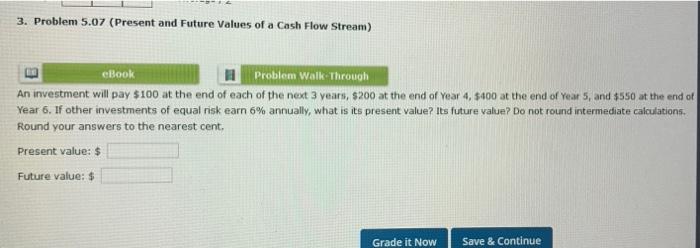

torom ra 4. Problem You want and social and that with Dond Hoc EM Pub Grade it NOW Save & Con 1. Pandur Values of Gashi Anment w 100th of the years, the Year with Doordon Round you with Future vat 4. Problem 5.08 (Loan Amortization and EAR) Problem Walk Through eBook You want to buy a car, and a local bank will lend you $40,000. The loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 4% with interest paid monthly. What will be the monthly loan payment? What will be the loan's EAR? Do not round intermediate calculations. Round your answer for the monthly loan payment to the nearest cent and for EAR to two decimal places. Monthly loan payment: $ EAR: 96 3. Problem 5.07 (Present and Future Values of a Cash Flow Stream) eBook Problem Walk Through An investment will pay $100 at the end of each of the next 3 years, $200 at the end of Year 4, $400 at the end of Year 5, and $550 at the end of Year 6. If other investments of equal risk earn 6% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent, Present value: $ Future value: $ Grade it Now Save & Continue torom ra 4. Problem You want and social and that with Dond Hoc EM Pub Grade it NOW Save & Con 1. Pandur Values of Gashi Anment w 100th of the years, the Year with Doordon Round you with Future vat 4. Problem 5.08 (Loan Amortization and EAR) Problem Walk Through eBook You want to buy a car, and a local bank will lend you $40,000. The loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 4% with interest paid monthly. What will be the monthly loan payment? What will be the loan's EAR? Do not round intermediate calculations. Round your answer for the monthly loan payment to the nearest cent and for EAR to two decimal places. Monthly loan payment: $ EAR: 96 3. Problem 5.07 (Present and Future Values of a Cash Flow Stream) eBook Problem Walk Through An investment will pay $100 at the end of each of the next 3 years, $200 at the end of Year 4, $400 at the end of Year 5, and $550 at the end of Year 6. If other investments of equal risk earn 6% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent, Present value: $ Future value: $ Grade it Now Save & Continue