Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Toshiba classified its inventory into two categories. Goods were classified as sales inventory after the manufactured goods were inspected for quality and moved into

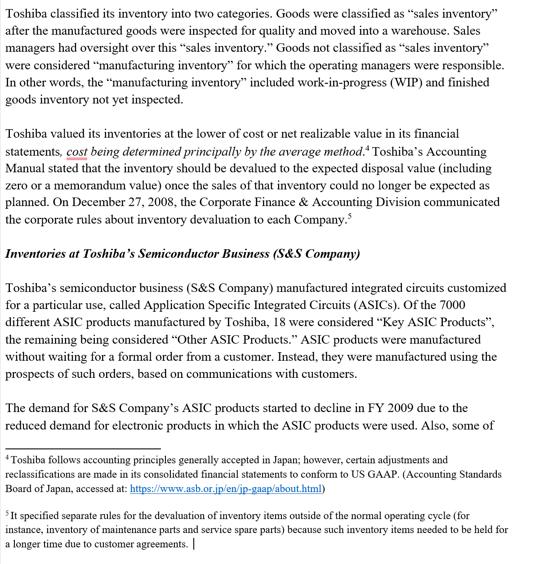

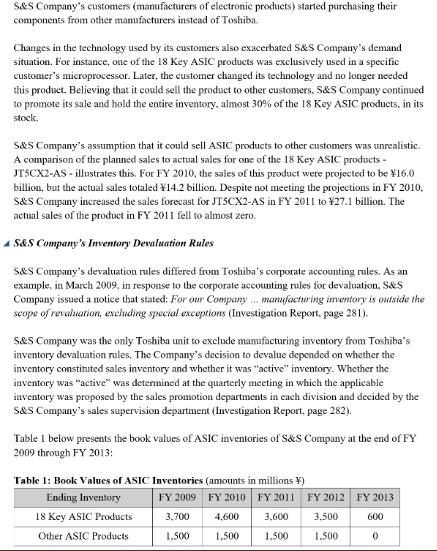

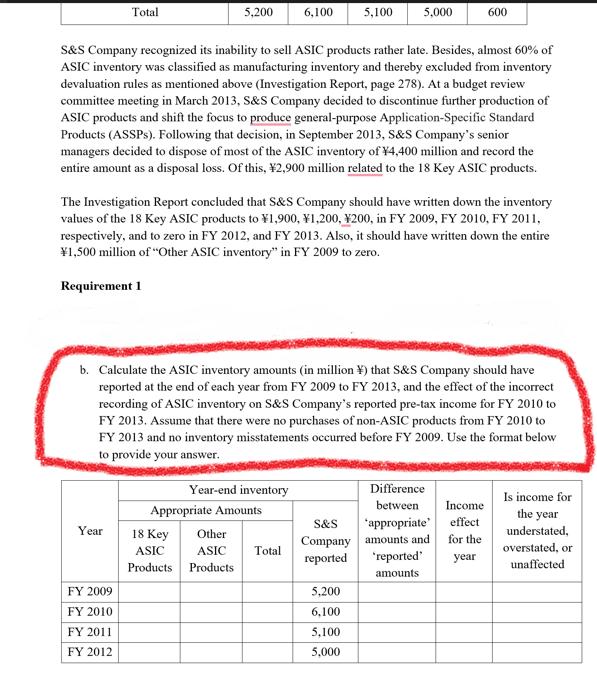

Toshiba classified its inventory into two categories. Goods were classified as "sales inventory" after the manufactured goods were inspected for quality and moved into a warehouse. Sales managers had oversight over this "sales inventory." Goods not classified as "sales inventory" were considered "manufacturing inventory" for which the operating managers were responsible. In other words, the "manufacturing inventory" included work-in-progress (WIP) and finished goods inventory not yet inspected. Toshiba valued its inventories at the lower of cost or net realizable value in its financial statements, cost being determined principally by the average method.* Toshiba's Accounting Manual stated that the inventory should be devalued to the expected disposal value (including zero or a memorandum value) once the sales of that inventory could no longer be expected as planned. On December 27, 2008, the Corporate Finance & Accounting Division communicated the corporate rules about inventory devaluation to each Company. Inventories at Toshiba's Semiconductor Business (S&S Company) Toshiba's semiconductor business (S&S Company) manufactured integrated circuits customized for a particular use, called Application Specific Integrated Circuits (ASICs). Of the 7000 different ASIC products manufactured by Toshiba, 18 were considered "Key ASIC Products", the remaining being considered "Other ASIC Products." ASIC products were manufactured without waiting for a formal order from a customer. Instead, they were manufactured using the prospects of such orders, based on communications with customers. The demand for S&S Company's ASIC products started to decline in FY 2009 due to the reduced demand for electronic products in which the ASIC products were used. Also, some of *Toshiba follows accounting principles generally accepted in Japan; however, certain adjustments and reclassifications are made in its consolidated financial statements to conform to US GAAP. (Accounting Standards Board of Japan, accessed at: https://www.asb.or.jp/en/ip-gaap/about.html) It specified separate rules for the devaluation of inventory items outside of the normal operating cycle (for instance, inventory of maintenance parts and service spare parts) because such inventory items needed to be held for a longer time due to customer agreements. | S&S Company's customers (manufacturers of electronic products) started purchasing their components from other manufacturers instead of Toshiba. Changes in the technology used by its customers also exacerbated S&S Company's demand situation. For instance, one of the 18 Key ASIC products was exclusively used in a specific customer's microprocessor. Later, the customer changed its technology and no longer needed this product. Believing that it could sell the product to other customers, S&S Company continued to promote its sale and hold the entire inventory, almost 30% of the 18 Key ASIC products, in its stock. S&S Company's assumption that it could sell ASIC products to other customers was unrealistic. A comparison of the planned sales to actual sales for one of the 18 Key ASIC products - JTSCX2-AS - illustrates this. For FY 2010, the sales of this product were projected to be 16.0 billion, but the actual sales totaled 14.2 billion. Despite not meeting the projections in FY 2010. S&S Company increased the sales forecast for JT5CX2-AS in FY 2011 to 27.1 billion. The actual sales of the product in FY 2011 fell to almost zero. 4 S&S Company's Inventory Devaluation Rules S&S Company's devaluation rules differed from Toshiba's corporate accounting rules. As an example, in March 2009, in response to the corporate accounting rules for devaluation, S&S Company issued a notice that stated: For our Company... manufacturing inventory is outside the scope of revaluation, excluding special exceptions (Investigation Report, page 281). S&S Company was the only Toshiba unit to exclude manufacturing inventory from Toshiba's inventory devaluation rules. The Company's decision to devalue depended on whether the inventory constituted sales inventory and whether it was "active" inventory. Whether the inventory was "active" was determined at the quarterly meeting in which the applicable inventory was proposed by the sales promotion departments in each division and decided by the S&S Company's sales supervision department (Investigation Report, page 282). Table I below presents the book values of ASIC inventories of S&S Company at the end of FY 2009 through FY 2013: Table 1: Book Values of ASIC Inventories (amounts in millions ) Ending Inventory 18 Key ASIC Products Other ASIC Products FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 3,700 4,600 3,600 3,500 600 1,500 1,500 1,500 1,500 0 Total Year 5,200 FY 2009 FY 2010 FY 2011 FY 2012 S&S Company recognized its inability to sell ASIC products rather late. Besides, almost 60% of ASIC inventory was classified as manufacturing inventory and thereby excluded from inventory devaluation rules as mentioned above (Investigation Report, page 278). At a budget review committee meeting in March 2013, S&S Company decided to discontinue further production of ASIC products and shift the focus to produce general-purpose Application-Specific Standard Products (ASSPs). Following that decision, in September 2013, S&S Company's senior managers decided to dispose of most of the ASIC inventory of 4,400 million and record the entire amount as a disposal loss. Of this, 2,900 million related to the 18 Key ASIC products. The Investigation Report concluded that S&S Company should have written down the inventory values of the 18 Key ASIC products to 1,900, 1,200, 200, in FY 2009, FY 2010, FY 2011, respectively, and to zero in FY 2012, and FY 2013. Also, it should have written down the entire 1,500 million of "Other ASIC inventory" in FY 2009 to zero. Requirement 1 b. Calculate the ASIC inventory amounts (in million) that S&S Company should have reported at the end of each year from FY 2009 to FY 2013, and the effect of the incorrect recording of ASIC inventory on S&S Company's reported pre-tax income for FY 2010 to FY 2013. Assume that there were no purchases of non-ASIC products from FY 2010 to FY 2013 and no inventory misstatements occurred before FY 2009. Use the format below to provide your answer. Year-end inventory 6,100 5,100 Appropriate Amounts 18 Key Other ASIC ASIC Products Products Total 5,000 5,200 6,100 5,100 5,000 600 Difference between Income 'appropriate' effect for the year S&S Company amounts and reported "reported' amounts Is income for the year understated, overstated, or unaffected.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the ASIC inventory amounts that SS Company shoul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started