Answered step by step

Verified Expert Solution

Question

1 Approved Answer

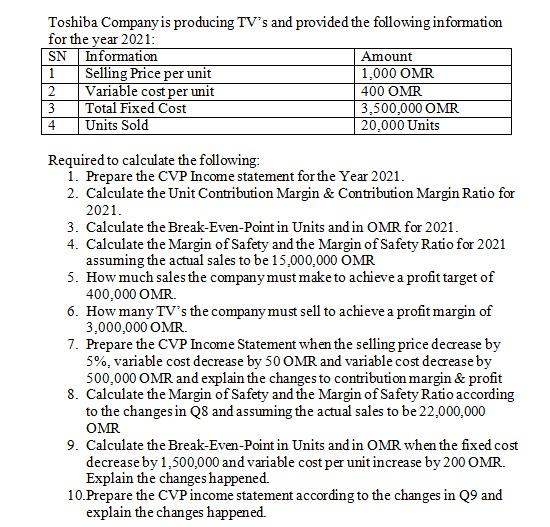

Toshiba Company is producing TV's and provided the following information for the year 2021: SN Information 1 2 3 4 Selling Price per unit

Toshiba Company is producing TV's and provided the following information for the year 2021: SN Information 1 2 3 4 Selling Price per unit Variable cost per unit Total Fixed Cost Units Sold Amount 1,000 OMR 400 OMR 3,500,000 OMR 20,000 Units Required to calculate the following: 1. Prepare the CVP Income statement for the Year 2021. 2. Calculate the Unit Contribution Margin & Contribution Margin Ratio for 2021. 3. Calculate the Break-Even-Point in Units and in OMR for 2021. 4. Calculate the Margin of Safety and the Margin of Safety Ratio for 2021 assuming the actual sales to be 15,000,000 OMR 5. How much sales the company must make to achieve a profit target of 400,000 OMR. 6. How many TV's the company must sell to achieve a profit margin of 3,000,000 OMR. 7. Prepare the CVP Income Statement when the selling price decrease by 5%, variable cost decrease by 50 OMR and variable cost decrease by 500,000 OMR and explain the changes to contribution margin & profit 8. Calculate the Margin of Safety and the Margin of Safety Ratio according to the changes in Q8 and assuming the actual sales to be 22,000,000 OMR 9. Calculate the Break-Even-Point in Units and in OMR when the fixed cost decrease by 1,500,000 and variable cost per unit increase by 200 OMR. Explain the changes happened. 10.Prepare the CVP income statement according to the changes in Q9 and explain the changes happened.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Lets go step by step to address each of the requirements 1 CVP Income Statement for the Year 2021 Sales 20000 units 1000 OMR 20000000 OMR Variable Costs 20000 units 400 OMR 8000000 OMR Fixed Costs 350...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started