Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tot The following financial statements are taken from the records of Organo Inc. a) Use horizontal analysis techniques to compare the changes between 2020 and

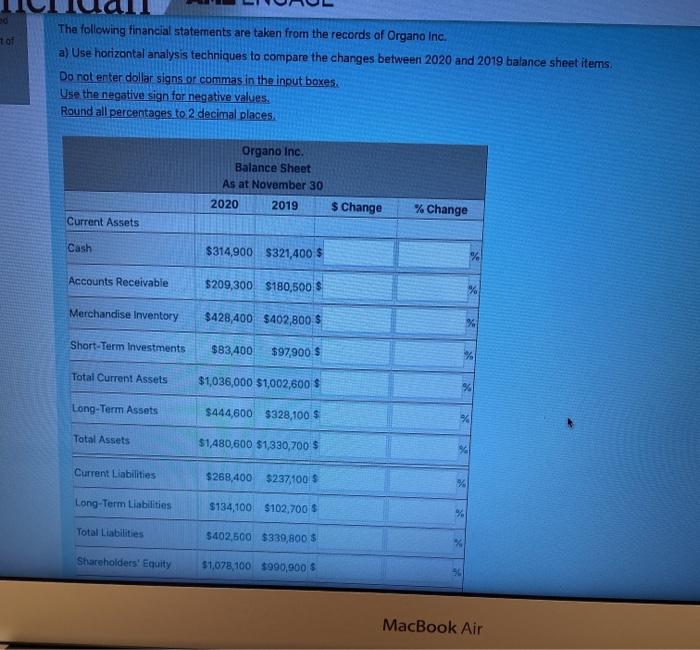

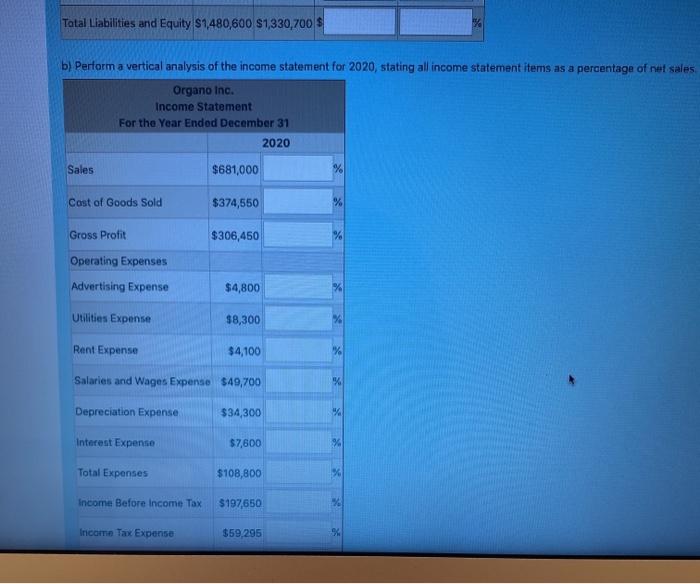

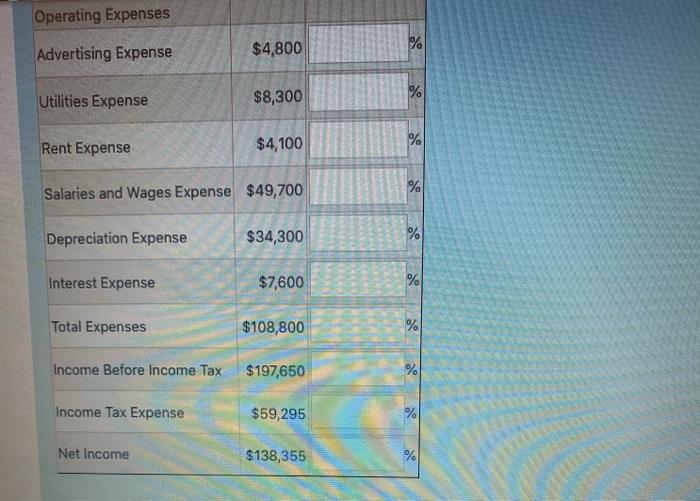

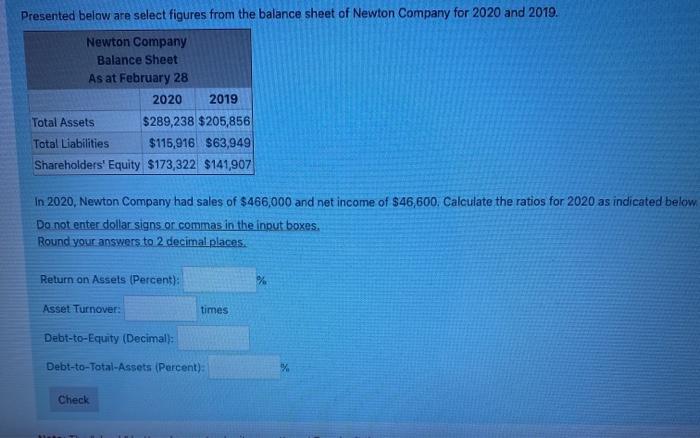

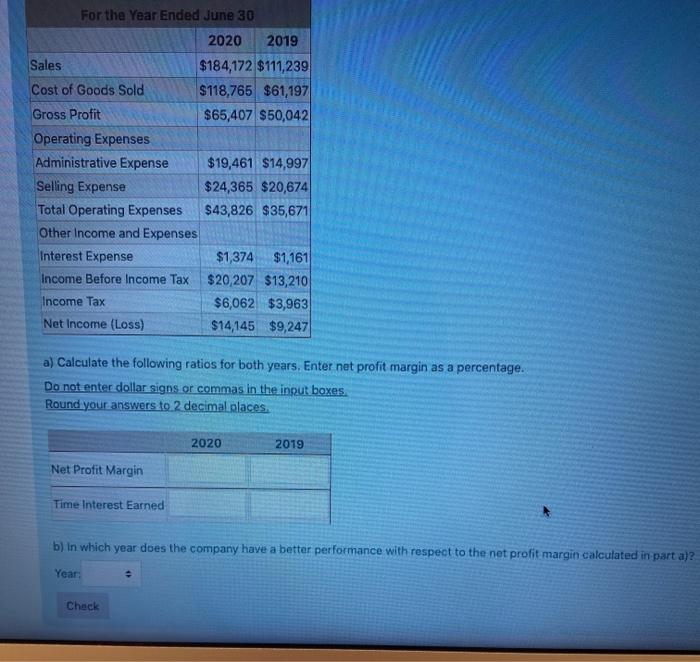

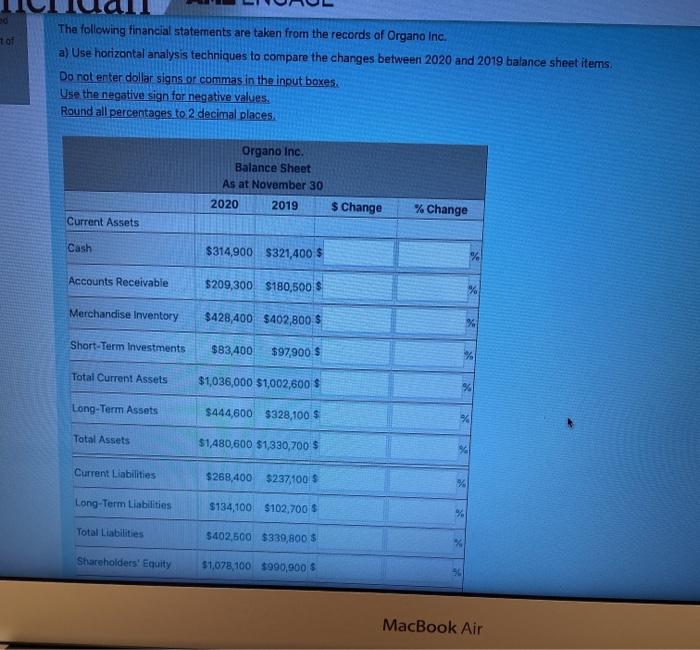

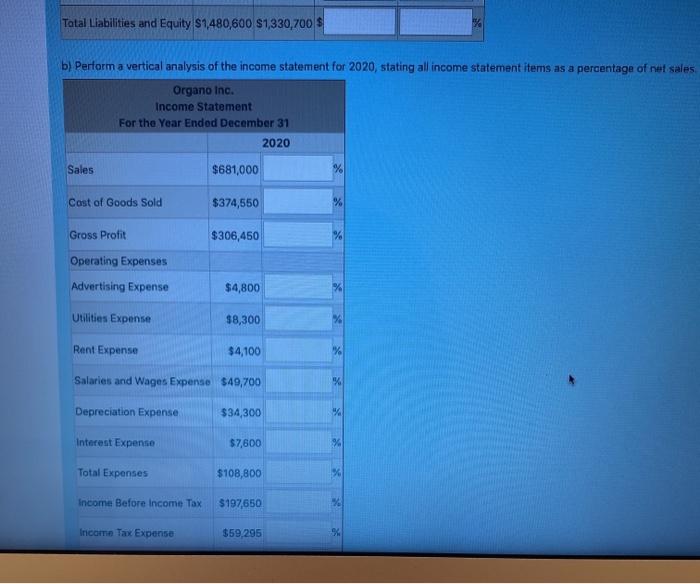

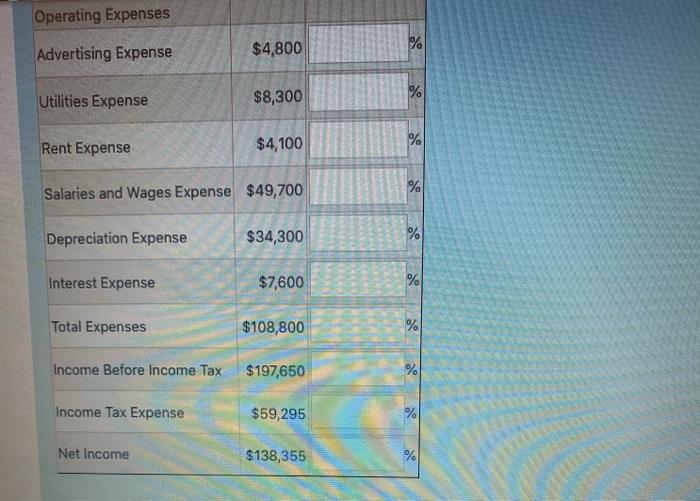

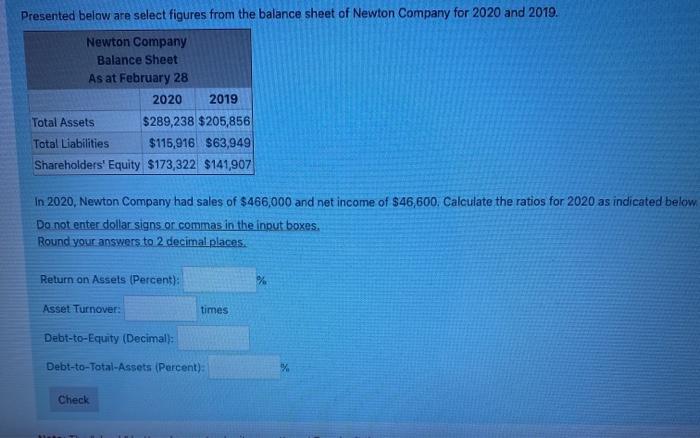

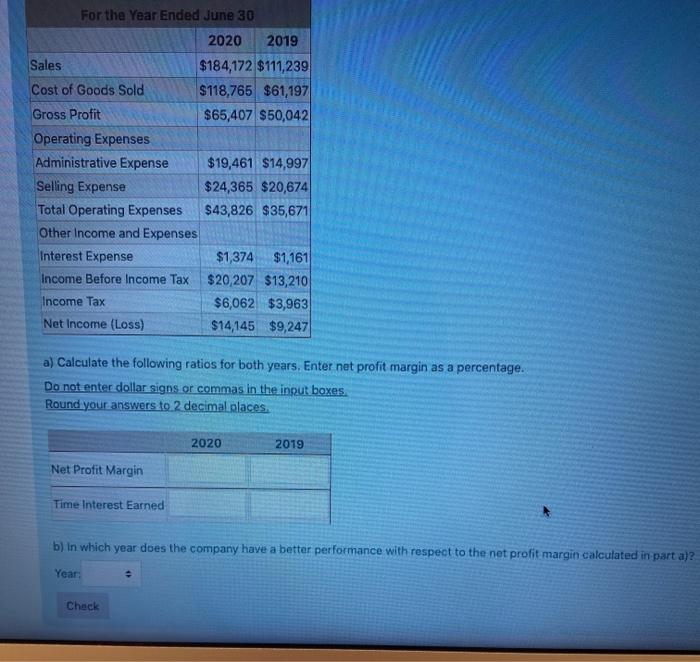

tot The following financial statements are taken from the records of Organo Inc. a) Use horizontal analysis techniques to compare the changes between 2020 and 2019 balance sheet items. Do not enter dollar signs or commas in the input boxes Use the negative sign for negative values. Round all percentages to 2 decimal places Organo Inc. Balance Sheet As at November 30 2020 2019 $ Change % Change Current Assets Cash $314,900 $321,400 $ % Accounts Receivable $209,300 $180,500 $ % Merchandise Inventory $428,400 $402,800 $ % Short-Term Investments $83,400 $97,900 $ % Total Current Assets $1,036,000 $1,002,600 $ 96 Long-Term Assets $444,600 $328,100 $ Total Assets $1,480,600 $1,330,700 $ Current Liabilities $268,400 $237,100 $ Long-Term Liabilities $134,100 $102,700 $ Total Liabilities $402.500 $339,800 $ Shareholders' Equity $1,078,100 $990,900 $ MacBook Air Total Liabilities and Equity S1480,600 $1,330,700 $ b) Perform a vertical analysis of the income statement for 2020, stating all income statement items as a percentage of net sales Organo Inc. Income Statement For the Year Endod December 31 2020 Sales $681,000 Cast of Goods Sold $374,550 % Gross Profit $306,450 Operating Expenses Advertising Expense $4,800 Utilities Expense $8,300 Rent Expense $4,100 Salaries and Wages Expense $49,700 % Depreciation Expense $34,300 % Interest Expense $7,600 94 Total Expenses $108,800 Income Before Income Tax $197,650 Income Tax Expense $59,295 Operating Expenses $4,800 Advertising Expense % $8,300 % Utilities Expense $4,100 % Rent Expense % Salaries and Wages Expense $49,700 $34,300 Depreciation Expense % Interest Expense $7,600 % Total Expenses $108,800 % Income Before Income Tax $197,650 % Income Tax Expense $59,295 % Net Income $138,355 % Presented below are select figures from the balance sheet of Newton Company for 2020 and 2019. Newton Company Balance Sheet As at February 28 2020 2019 Total Assets $289,238 $205,856 Total Liabilities $115,916 $63,949 Shareholders' Equity $173,322 $141,907 In 2020. Newton Company had sales of $466,000 and net income of $46,600. Calculate the ratios for 2020 as indicated below Do not enter dollar signs or commas in the input boxes Round your answers to 2 decimal places. Return on Assets (Percent): % Asset Turnover: times Debt-to-Equity (Decimal): Debt-to-Total-Assets (Percent): Check For the Year Ended June 30 2020 2019 Sales $184,172 $111,239 Cost of Goods Sold $ 118,765 $61,197 Gross Profit $65,407 $50,042 Operating Expenses Administrative Expense $19,461 $14,997 Selling Expense $24,365 $20,674 Total Operating Expenses $43,826 $35,671 Other Income and Expenses Interest Expense $1,374 $1,161 Income Before Income Tax $20,207 $13,210 Income Tax $6,062 $3,963 Net Income (Loss) $14,145 $9,247 a) Calculate the following ratios for both years. Enter net profit margin as a percentage. Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places 2020 2019 Net Profit Margin Time Interest Earned b) in which year does the company have a better performance with respect to the net profit margin calculated in part a)? Year Check

tot The following financial statements are taken from the records of Organo Inc. a) Use horizontal analysis techniques to compare the changes between 2020 and 2019 balance sheet items. Do not enter dollar signs or commas in the input boxes Use the negative sign for negative values. Round all percentages to 2 decimal places Organo Inc. Balance Sheet As at November 30 2020 2019 $ Change % Change Current Assets Cash $314,900 $321,400 $ % Accounts Receivable $209,300 $180,500 $ % Merchandise Inventory $428,400 $402,800 $ % Short-Term Investments $83,400 $97,900 $ % Total Current Assets $1,036,000 $1,002,600 $ 96 Long-Term Assets $444,600 $328,100 $ Total Assets $1,480,600 $1,330,700 $ Current Liabilities $268,400 $237,100 $ Long-Term Liabilities $134,100 $102,700 $ Total Liabilities $402.500 $339,800 $ Shareholders' Equity $1,078,100 $990,900 $ MacBook Air Total Liabilities and Equity S1480,600 $1,330,700 $ b) Perform a vertical analysis of the income statement for 2020, stating all income statement items as a percentage of net sales Organo Inc. Income Statement For the Year Endod December 31 2020 Sales $681,000 Cast of Goods Sold $374,550 % Gross Profit $306,450 Operating Expenses Advertising Expense $4,800 Utilities Expense $8,300 Rent Expense $4,100 Salaries and Wages Expense $49,700 % Depreciation Expense $34,300 % Interest Expense $7,600 94 Total Expenses $108,800 Income Before Income Tax $197,650 Income Tax Expense $59,295 Operating Expenses $4,800 Advertising Expense % $8,300 % Utilities Expense $4,100 % Rent Expense % Salaries and Wages Expense $49,700 $34,300 Depreciation Expense % Interest Expense $7,600 % Total Expenses $108,800 % Income Before Income Tax $197,650 % Income Tax Expense $59,295 % Net Income $138,355 % Presented below are select figures from the balance sheet of Newton Company for 2020 and 2019. Newton Company Balance Sheet As at February 28 2020 2019 Total Assets $289,238 $205,856 Total Liabilities $115,916 $63,949 Shareholders' Equity $173,322 $141,907 In 2020. Newton Company had sales of $466,000 and net income of $46,600. Calculate the ratios for 2020 as indicated below Do not enter dollar signs or commas in the input boxes Round your answers to 2 decimal places. Return on Assets (Percent): % Asset Turnover: times Debt-to-Equity (Decimal): Debt-to-Total-Assets (Percent): Check For the Year Ended June 30 2020 2019 Sales $184,172 $111,239 Cost of Goods Sold $ 118,765 $61,197 Gross Profit $65,407 $50,042 Operating Expenses Administrative Expense $19,461 $14,997 Selling Expense $24,365 $20,674 Total Operating Expenses $43,826 $35,671 Other Income and Expenses Interest Expense $1,374 $1,161 Income Before Income Tax $20,207 $13,210 Income Tax $6,062 $3,963 Net Income (Loss) $14,145 $9,247 a) Calculate the following ratios for both years. Enter net profit margin as a percentage. Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places 2020 2019 Net Profit Margin Time Interest Earned b) in which year does the company have a better performance with respect to the net profit margin calculated in part a)? Year Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started