Answered step by step

Verified Expert Solution

Question

1 Approved Answer

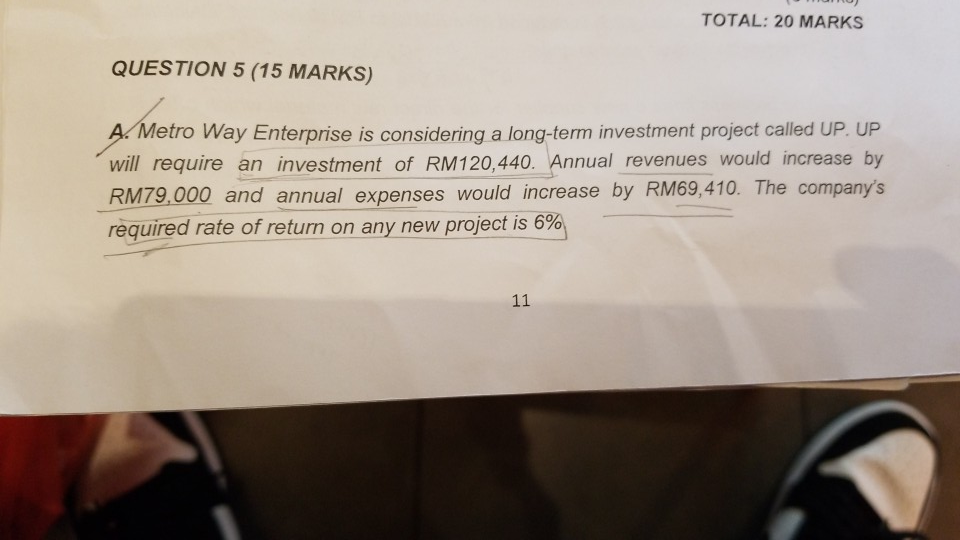

TOTAL: 20 MARKS QUESTION 5 (15 MARKS) A.Metro Way Enterprise is considering a long-term investment project called UP. UP will require an investment of RM120,440.

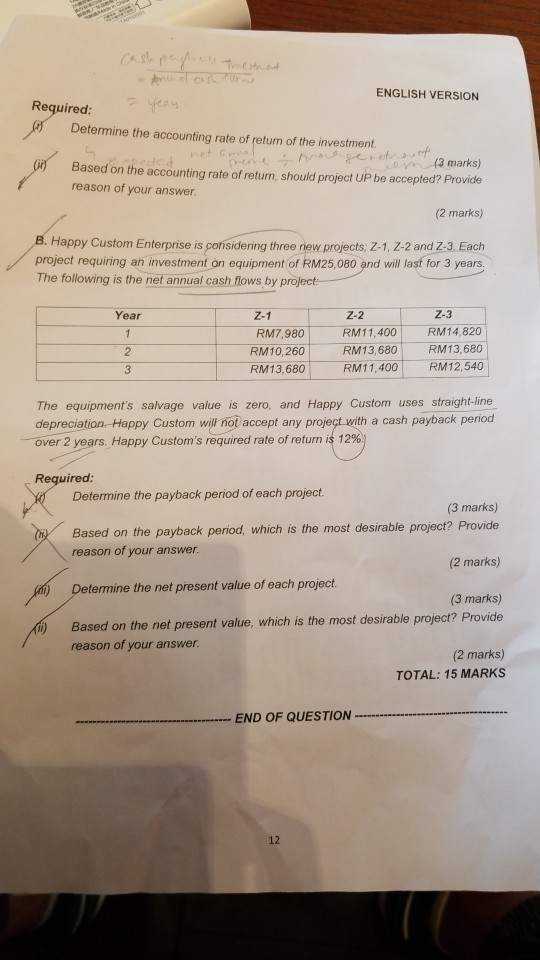

TOTAL: 20 MARKS QUESTION 5 (15 MARKS) A.Metro Way Enterprise is considering a long-term investment project called UP. UP will require an investment of RM120,440. Annual revenues would increase by RM79,000 and annual expenses would increase by RM69,410. The company's required rate of return on any new project is 6% 11 ENGLISH VERSION Required: Determine the accounting rate of return of the investment net Gon ded v 13 marks) Based on the accounting rate of return, should project UP beaccepted? Provide (ity reason of your answer (2 marks) B. Happy Custom Enterprise is considering three rew projects; Z-1, Z-2 and Z-3. Each project requiring an investment on equipment of RM25,080 and will last for 3 years. The following is the net annual cash flows by project Z-3 Year Z-1 Z-2 RM14,820 RM7,980 RM11,400 1 RM13,680 RM13,680 2 RM10,260 RM12,540 RM11,400 3 RM13,680 straight-line The equipment's salvage value is zero, and Happy Custom uses depreciation Happy Custom will not accept any projet with a cash payback period over 2 years. Happy Custom's required rate of return is 12 % . Required: Determine the payback period of each project. (3 marks) Based on the payback period, which is the most desirable project? Provide (n) reason of your answer. (2 marks) Determine the net present value of each project. (3 marks) Based on the net present value, which is the most desirable project? Provide reason of your answer. (2 marks) TOTAL: 15 MARKS END OF QUESTION 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started