Answered step by step

Verified Expert Solution

Question

1 Approved Answer

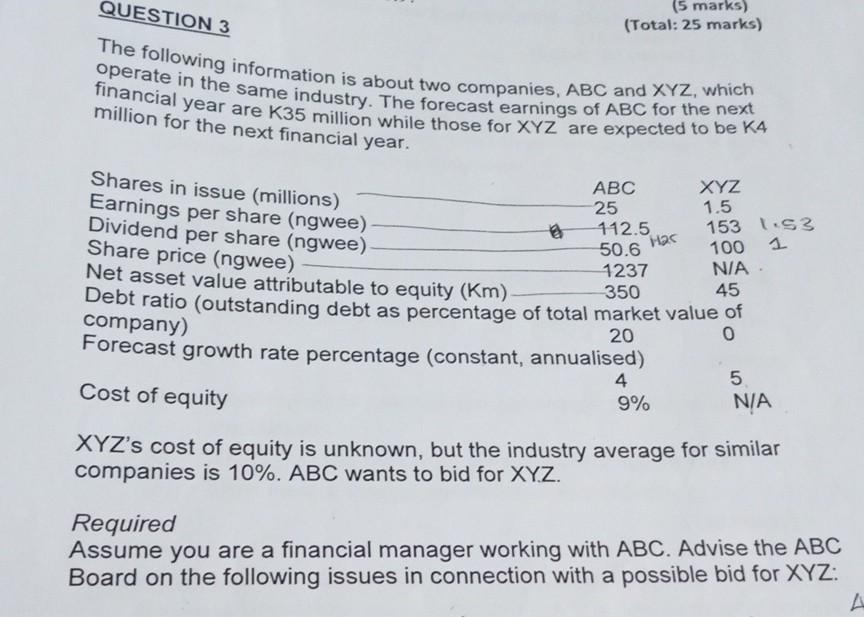

(Total: 25 marks) The following information is about two companies, ( A B C ) and ( X Y Z ), which operate in the

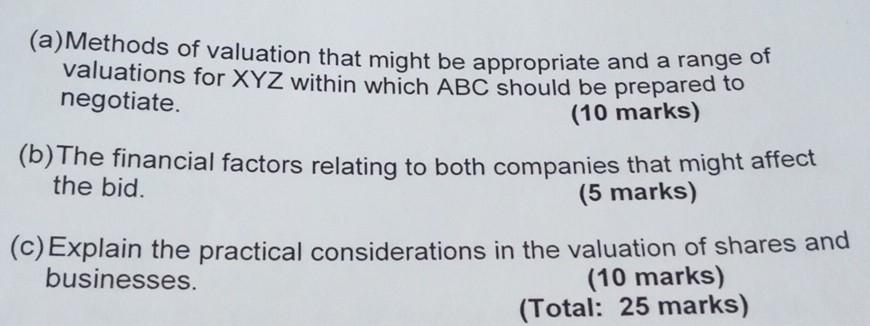

(Total: 25 marks) The following information is about two companies, \\( A B C \\) and \\( X Y Z \\), which operate in the same industry. The forecast earnings of \\( A B C \\) for the next financial year are \\( K 35 \\) million while those for \\( X Y Z \\) are expected to be \\( K 4 \\) million for the next financial year. company) Forecast growth rate percentage (constant, annualised) Cost of equity \\( \\begin{array}{ll}4 & 5 \\\\ 9 \\% & \\text { N/A }\\end{array} \\) \\( X Y Z \\) 's cost of equity is unknown, but the industry average for similar companies is \10. ABC wants to bid for \\( X Y Z \\). Required Assume you are a financial manager working with \\( A B C \\). Advise the \\( A B C \\) Board on the following issues in connection with a possible bid for \\( X Y Z \\) : valuation that might be appropriate and a range of negotiate. (10 marks) (b) The financial factors relating to both companies that might affect the bid. (5 marks) (c) Explain the practical considerations in the valuation of shares and businesses. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started