Answered step by step

Verified Expert Solution

Question

1 Approved Answer

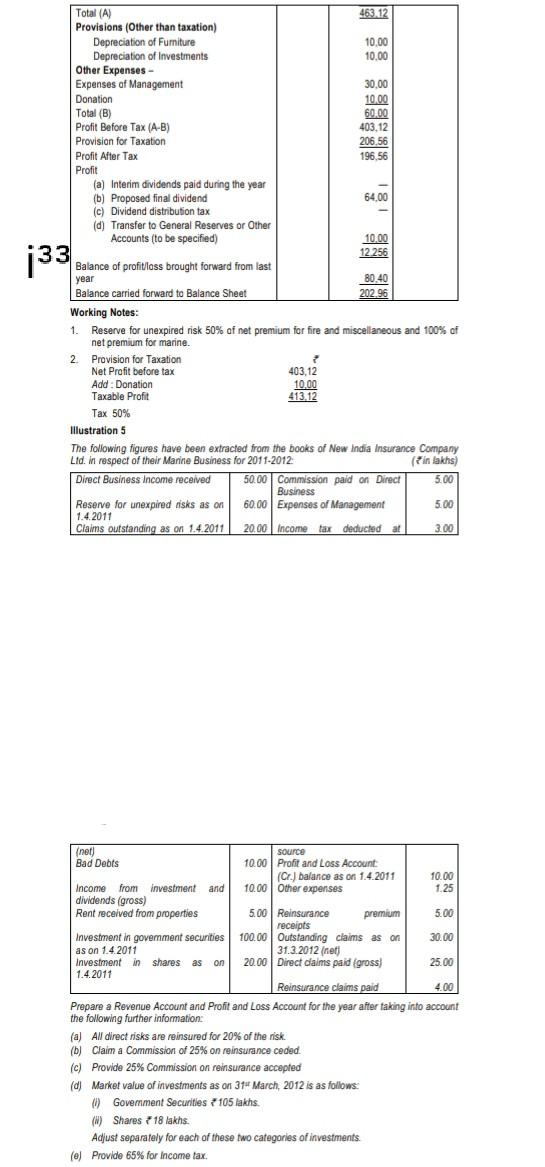

Total (A) 463.12 Provisions (Other than taxation) Depreciation of Furniture 10.00 Depreciation of Investments 10.00 Other Expenses - Expenses of Management 30.00 Donation 10.00 Total

Total (A) 463.12 Provisions (Other than taxation) Depreciation of Furniture 10.00 Depreciation of Investments 10.00 Other Expenses - Expenses of Management 30.00 Donation 10.00 Total (B) 60.00 Profit Before Tax (A-B) 403.12 Provision for Taxation 206,56 Profit After Tax 196.56 Profit (a) Interim dividends paid during the year (b) Proposed final dividend 64.00 (c) Dividend distribution tax (d) Transfer to General Reserves or Other Accounts (to be specified) 10.00 133 12 256 Balance of profit lass brought forward from last year 80.40 Balance carried forward to Balance Sheet 202.96 Working Notes: 1. Reserve for unexpired risk 50% of net premium for fire and miscellaneous and 100% of net premium for marine. . 2 Provision for Taxation 2 Net Profit before tax 403,12 Add : Donation 10.00 Taxable Profit 413.12 Tax 50% Illustrations The following figures have been extracted from the books of New India Insurance Company Lid. in respect of their Marine Business for 2011-2012 (in lakhs) Direct Business Income received 50.00 Commission paid on Direct 5.00 Business Reserve for unexpired nisks as on 60.00 Expenses of Management 5.00 1.4.2011 Claims outstanding as on 1.4.2011 20.00 Income tax deducted at 3.00 (net) source Bad Debts 10.00 Profit and Loss Account (Cr.) balance as on 1.4.2011 10.00 Income from investment and 10.00 Other expenses 1.25 dividends (gross) Rent received from properties 5.00 Reinsurance premium 5.00 receipts Investment in goverment securities 100.00 Outstanding claims as on 30.00 as on 1.4.2011 31.3.2012 (net) Investment in shares as on 20.00 Direct daims paid (gross) 25.00 1.4.2011 Reinsurance claims paid 4.00 Prepare a Revenue Account and Profit and Loss Account for the year after taking into account the following further information: (a) All direct risks are reinsured for 20% of the nisk. (b) Claim a Commission of 25% on reinsurance ceded. (c) Provide 25% Commission on reinsurance accepted (d) Market value of investments as on 314 March, 2012 is as follows: 6) Government Securities 105 lakhs. (8) Shares 18 lakhs. Adjust separately for each of these two categories of investments (e) Provide 65% for Income tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started