Answered step by step

Verified Expert Solution

Question

1 Approved Answer

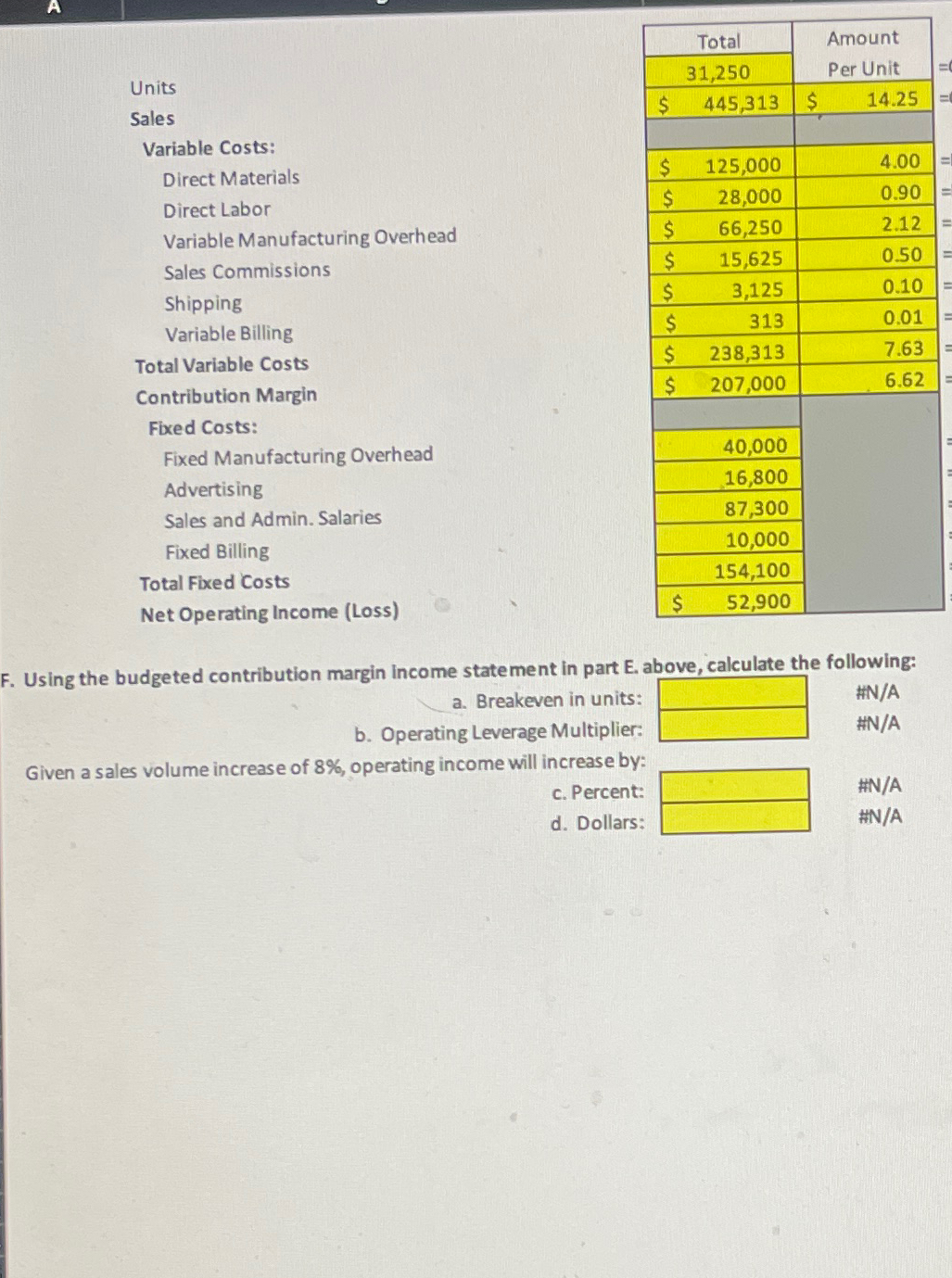

Total Amount Units Sales Variable Costs: 31,250 Per Unit $ 445,313 $ 14.25 Direct Materials $ 125,000 4.00 = Direct Labor $ 28,000 0.90

Total Amount Units Sales Variable Costs: 31,250 Per Unit $ 445,313 $ 14.25 Direct Materials $ 125,000 4.00 = Direct Labor $ 28,000 0.90 = Variable Manufacturing Overhead $ 66,250 2.12 = Sales Commissions $ 15,625 0.50 = Shipping Variable Billing Total Variable Costs $ 3,125 0.10= $ 313 0.01 E $ 238,313 7.63 Contribution Margin $ 207,000 6.62 Fixed Costs: Fixed Manufacturing Overhead Advertising Sales and Admin. Salaries Fixed Billing Total Fixed Costs Net Operating Income (Loss) 40,000 16,800 87,300 10,000 154,100 $ 52,900 F. Using the budgeted contribution margin income statement in part E. above, calculate the following: a. Breakeven in units: b. Operating Leverage Multiplier: Given a sales volume increase of 8%, operating income will increase by: c. Percent: d. Dollars: #N/A #N/A #N/A #N/A

Step by Step Solution

★★★★★

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the breakeven in units and operating leverage multiplier we need to use the provi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started