Answered step by step

Verified Expert Solution

Question

1 Approved Answer

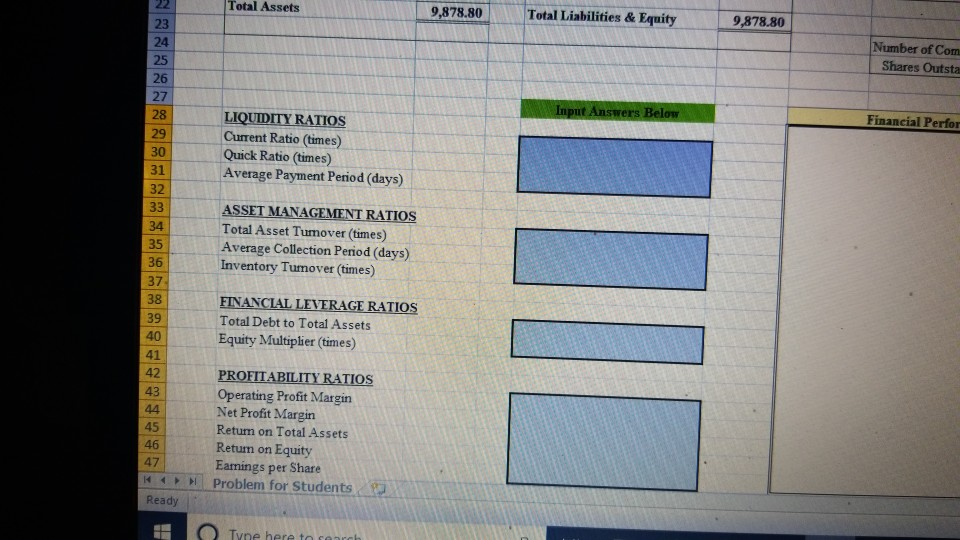

Total Assets 9,878.80 Total Liabilities & Equity 9,878.80 Number of Com Shares Outsta Input Answers Below Financial Perfor LIQUIDITY RATIOS Current Ratio (times) Quick Ratio

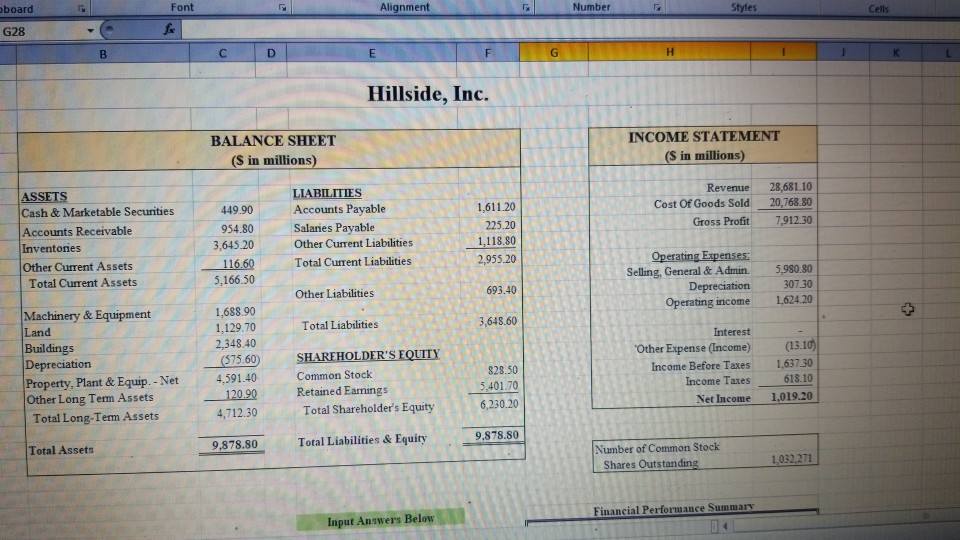

Total Assets 9,878.80 Total Liabilities & Equity 9,878.80 Number of Com Shares Outsta Input Answers Below Financial Perfor LIQUIDITY RATIOS Current Ratio (times) Quick Ratio (times) Average Payment Period (days) ASSET MANAGEMENT RATIOS Total Asset Tumover (times) Average Collection Period (days) Inventory Tumover times) FINANCIAL LEVERAGE RATIOS Total Debt to Total Assets Equity Multiplier (times) PROFITABILITY RATIOS Operating Profit Margin Net Profit Margin Return on Total Assets Retum on Equity Earnings per Share Problem for Students 47 Ready Tyne here to search board Font Alignment Number G28 D Hillside, Inc. BALANCE SHEET (S in millions) INCOME STATEMENT (S in millions) 449.90 1,611.20 225.20 LIABILITIES Accounts Payable Salaries Payable Other Current Liabilities Total Current Liabilities Revenue Cost Of Goods Sold Gross Profit ASSETS Cash & Marketable Securities Accounts Receivable Inventories Other Current Assets Total Current Assets 28,681.10 20,768.80 7,912.30 954.80 3,645.20 116.60 5,166,50 2,955.20 Operating Expenses: Selling, General & Admin Depreciation Operating income Other Liabilities 693.40 30730 1,624 20 Total Liabilities 3,648.60 Machinery & Equipment Land Buildings Depreciation Property, Plant & Equip. - Net Other Long Term Assets Total Long-Term Assets 1,688.90 1,129.70 2,348.40 (575.60 4,591.40 120.00 4,712.30 SHAREHOLDER'S EQUITY Common Stock Retained Earnings Total Shareholder's Equity 828.50 5,401.70 6,230.20 Interest Other Expense (Income) Income Before Taxes Income Taxes Net Income (13.10) 1,63730 618.10 1.019.20 9.878.80 Total Assets 9,878.80 Total Liabilities & Equity Number of Common Stock Shares Outstanding 1,032,271 Financial Performance Summary Input Answers Below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started