Answered step by step

Verified Expert Solution

Question

1 Approved Answer

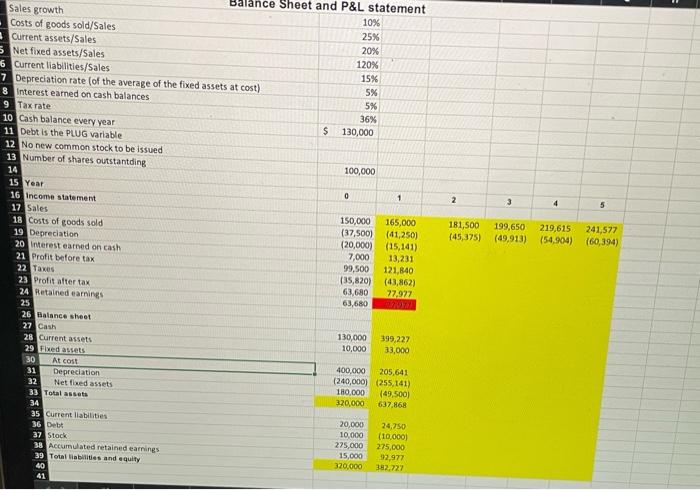

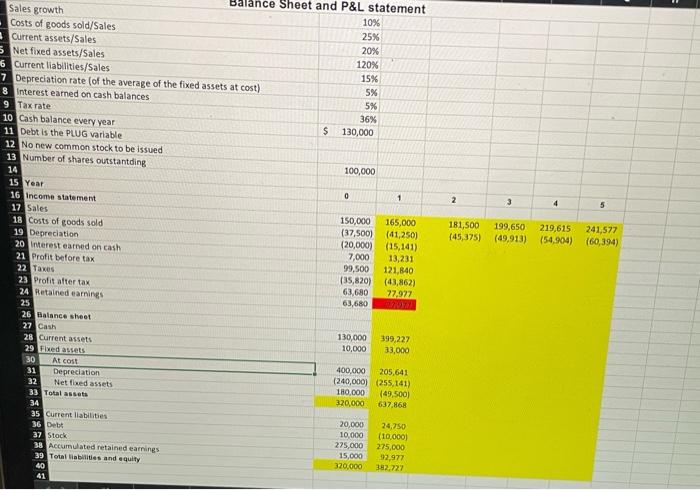

total assets and total liabilites arent equal. cant figure out where i went wrong 2 3 4 5 Balance Sheet and P&L statement Sales growth

total assets and total liabilites arent equal. cant figure out where i went wrong

2 3 4 5 Balance Sheet and P&L statement Sales growth 10% Costs of goods sold/Sales 25% Current assets/Sales 20% 5 Net fixed assets/Sales 120% 6 Current liabilities/Sales 15% 7 Depreciation rate (of the average of the fixed assets at cost) 5% 8 Interest eamed on cash balances 5% 9 Tax rate 36% 10 Cash balance every year $ 130,000 11 Debt is the PLUG variable 12 No new common stock to be issued 13 Number of shares outstantding 100,000 14 15 Year 0 1 16 Income statement 17 Sales 150,000 165,000 18 Costs of goods sold (37,500) (41,250) 19 Depreciation (20,000) (15,141) 20 Interest earned on cash 7,000 13,231 21 Profit before tax 99,500 121,840 22 Taxes (35,820) (43,862) 23 Profit after tax 63,680 27,927 24 Retained earings 63,680 25 26 Balance sheet 27 Cash 130,000 399,227 28 Current assets 10,000 33,000 29 Fixed assets 30 At cost 400,000 205,641 31 Depreciation (240,000) (255,141) 32 Net fixed assets 180,000 (49,500) 33 Total assets 320,000 637,868 34 35 Current liabilities 20.000 24,750 36 Debt 10,000 (10,000) 37 Stock 275,000 275,000 38 Accumulated retained earrings 15,000 12.977 39 Total liabilities and equity 320,000 382,727 40 41 181,500 199,650 (45,375) (49,913) 219,615 241,577 (54.904) (60,394) 2 3 4 5 Balance Sheet and P&L statement Sales growth 10% Costs of goods sold/Sales 25% Current assets/Sales 20% 5 Net fixed assets/Sales 120% 6 Current liabilities/Sales 15% 7 Depreciation rate (of the average of the fixed assets at cost) 5% 8 Interest eamed on cash balances 5% 9 Tax rate 36% 10 Cash balance every year $ 130,000 11 Debt is the PLUG variable 12 No new common stock to be issued 13 Number of shares outstantding 100,000 14 15 Year 0 1 16 Income statement 17 Sales 150,000 165,000 18 Costs of goods sold (37,500) (41,250) 19 Depreciation (20,000) (15,141) 20 Interest earned on cash 7,000 13,231 21 Profit before tax 99,500 121,840 22 Taxes (35,820) (43,862) 23 Profit after tax 63,680 27,927 24 Retained earings 63,680 25 26 Balance sheet 27 Cash 130,000 399,227 28 Current assets 10,000 33,000 29 Fixed assets 30 At cost 400,000 205,641 31 Depreciation (240,000) (255,141) 32 Net fixed assets 180,000 (49,500) 33 Total assets 320,000 637,868 34 35 Current liabilities 20.000 24,750 36 Debt 10,000 (10,000) 37 Stock 275,000 275,000 38 Accumulated retained earrings 15,000 12.977 39 Total liabilities and equity 320,000 382,727 40 41 181,500 199,650 (45,375) (49,913) 219,615 241,577 (54.904) (60,394)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started