Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Total Assets to Debt Ratio Meaning of total assets to debt ratio : This ratio shows the relationship between total assets and long-term debts. This

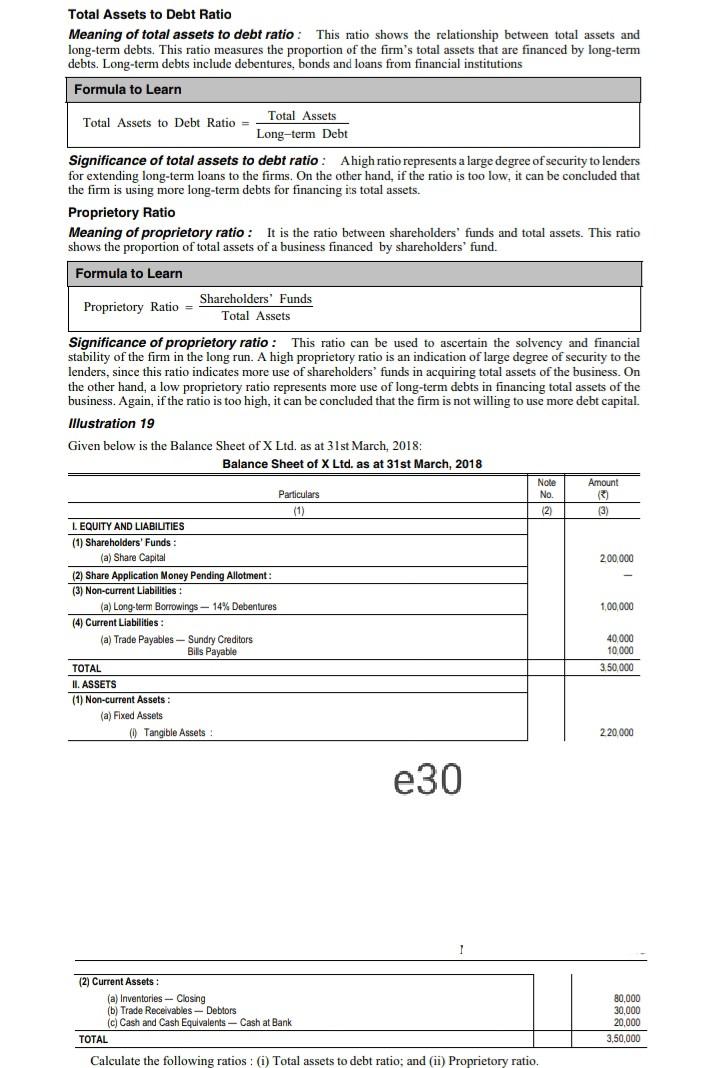

Total Assets to Debt Ratio Meaning of total assets to debt ratio : This ratio shows the relationship between total assets and long-term debts. This ratio measures the proportion of the firm's total assets that are financed by long-term debts. Long-term debts include debentures, bonds and loans from financial institutions Formula to Learn Total Assets to Debt Ratio = Total Assets Long-term Debt Significance of total assets to debt ratio : Ahigh ratio represents a large degree of security to lenders for extending long-term loans to the firms. On the other hand, if the ratio is too low, it can be concluded that the firm is using more long-term debts for financing is total assets. Proprietory Ratio Meaning of proprietory ratio : It is the ratio between shareholders' funds and total assets. This ratio shows the proportion of total assets of a business financed by shareholders' fund. Formula to Learn Proprietory Ratio = Shareholders' Funds Total Assets Note No. Significance of proprietory ratio: This ratio can be used to ascertain the solvency and financial stability of the firm in the long run. A high proprietory ratio is an indication of large degree of security to the lenders, since this ratio indicates more use of shareholders' funds in acquiring total assets of the business. On the other hand, a low proprietory ratio represents more use of long-term debts in financing total assets of the business. Again, if the ratio is too high, it can be concluded that the firm is not willing to use more debt capital. Illustration 19 Given below is the Balance Sheet of X Ltd. as at 31st March, 2018: Balance Sheet of X Ltd. as at 31st March, 2018 Amount Particulars ) (1) (2) 3) 1. EQUITY AND LIABILITIES (1) Shareholders' Funds: (a) Share Capital 200,000 (2) Share Application Money Pending Allotment (3) Non-current Liabilities: (a) Long-term Borrowings -14% Debentures 1.00.000 (4) Current Liabilities: (a) Trade Payables - Sundry Creditors 40.000 Bils Payable 10.000 TOTAL 3.50,000 II. ASSETS (1) Non-current Assets (a) Fixed Assets (Tangible Assets 220.000 e30 (2) Current Assets (a) Inventories -- Closing (b) Trade Receivables-Debtors (c) Cash and Cash Equivalents - Cash at Bank TOTAL 80,000 30,000 20,000 3,50,000 Calculate the following ratios : (i) Total assets to debt ratio; and (ii) Proprietory ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started