Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Total contribution margin is defined as A. selling price times units sold. B. cost to produce goods times units sold. C. total sales

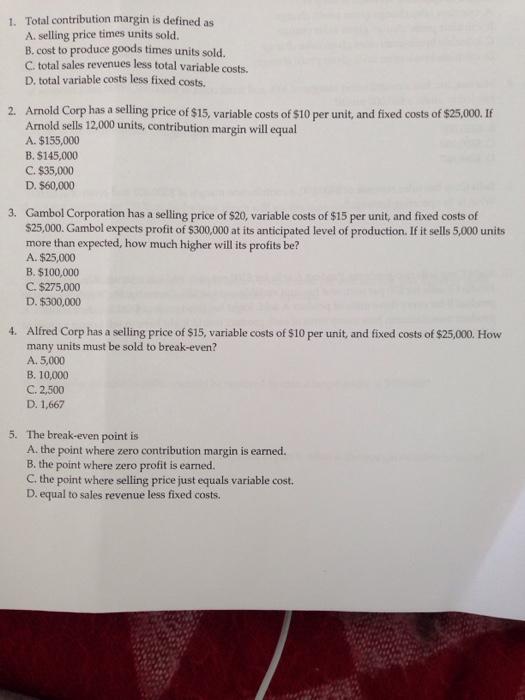

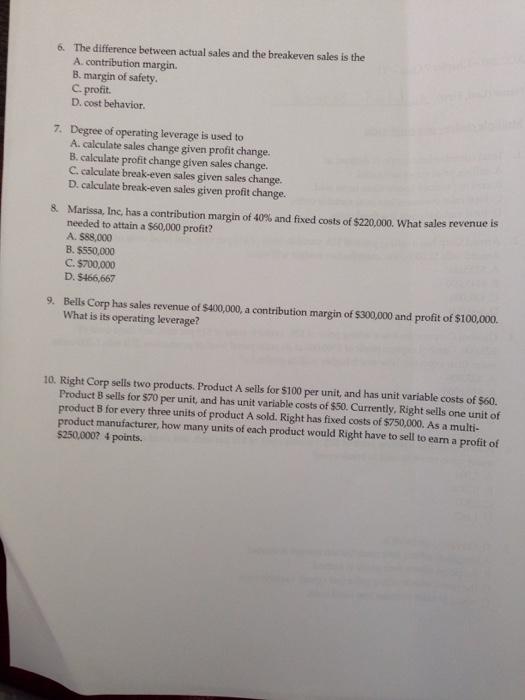

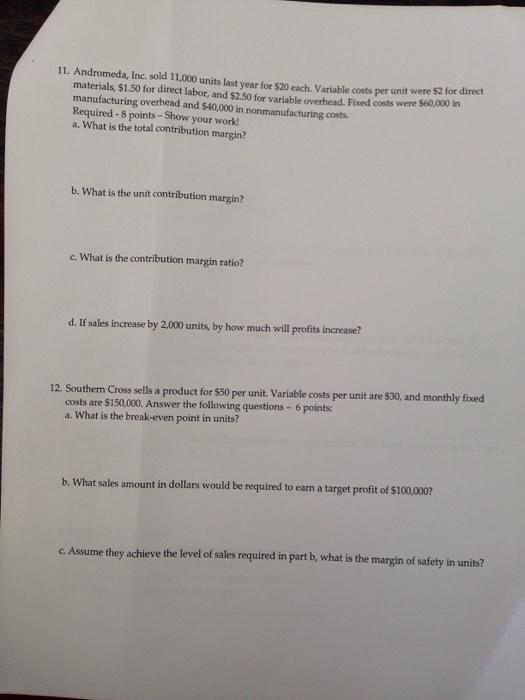

1. Total contribution margin is defined as A. selling price times units sold. B. cost to produce goods times units sold. C. total sales revenues less total variable costs. D. total variable costs less fixed costs. 2. Arnold Corp has a selling price of $15, variable costs of $10 per unit, and fixed costs of $25,000. If Arnold sells 12,000 units, contribution margin will equal A. $155,000 B. $145,000 C. $35,000 D. $60,000 3. Gambol Corporation has a selling price of $20, variable costs of $15 per unit, and fixed costs of $25,000. Gambol expects profit of $300,000 at its anticipated level of production. If it sells 5,000 units more than expected, how much higher will its profits be? A. $25,000 B. $100,000 C. $275,000 D. $300,000 4. Alfred Corp has a selling price of $15, variable costs of $10 per unit, and fixed costs of $25,000. How many units must be sold to break-even? A. 5,000 B. 10,000 C. 2,500 D. 1,667 5. The break-even point is A. the point where zero contribution margin is earned. B. the point where zero profit is earned. C. the point where selling price just equals variable cost. D. equal to sales revenue less fixed costs. 6. The difference between actual sales and the breakeven sales is the A. contribution margin. B. margin of safety. C. profit. D. cost behavior. 7. Degree of operating leverage is used to A. calculate sales change given profit change. B. calculate profit change given sales change. C. calculate break-even sales given sales change. D. calculate break-even sales given profit change. 8. Marissa, Inc, has a contribution margin of 40% and fixed costs of $220.000, What sales revenue is needed to attain a $60,000 profit? A. $88,000 B. $550,000 C. $700,000 D. S466,667 9. Bells Corp has sales revenue of $400,000, a contribution margin of $300,000 and profit of $100,000. What is its operating leverage? 10. Right Corp sells two products. Product A sells for $100 per unit, and has unit variable costs of S60, Product B sells for $70 per unit, and has unit variable costs of $50. Currently, Right sells one unit of product B for every three units of product A sold. Right has fixed costs of $750,000. As a multi- product manufacturer, how many units of each product would Right have to sell to earm a profit of $250,000? 4 points. 11. Andromeda, Inc. sold 11,000 units last vear for $20 cach. Variable costs per unit were $2 for direct materials, $1.50 for direct labor, and $2.50 for variable overbead. Fixed costs were S60,000 in manufacturing overhead and $40,000 in nonmanufacturing costs. Required -8 points-Show your work! a. What is the total contribution margin? b. What is the unit contribution margin? c. What is the contribution margin ratio? d. If sales increase by 2,000 units, by how much will profits increase? 12. Southem Cross sells a product for $50 per unit. Variable costs per unit are $30, and monthly fixed costs are $150,000. Answer the following questions - 6 points: a. What is the break-even point in units? b. What sales amount in dollars would be required to earn a target profit of $100,000? c. Assume they achieve the level of sales required in part b, what is the margin of safety in units?

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started