Answered step by step

Verified Expert Solution

Question

1 Approved Answer

total corporate operating results change from the $108,000 loss to the results determined in (a? E10-28. Product line Lakeland Financial Services provides outsourcing services for

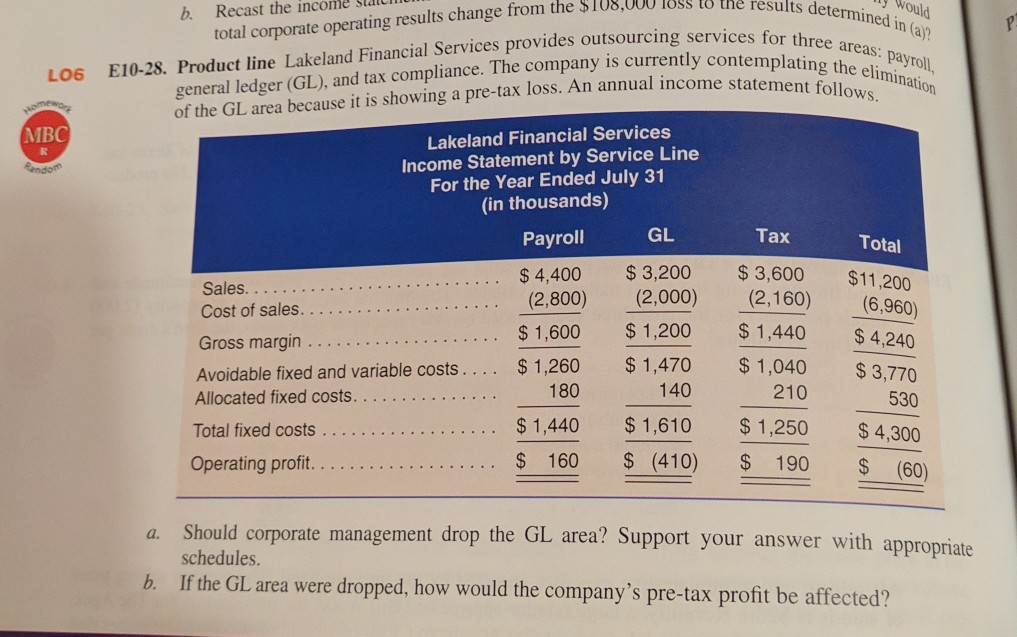

total corporate operating results change from the $108,000 loss to the results determined in (a? E10-28. Product line Lakeland Financial Services provides outsourcing services for three areas: payroll, general ledger (GL), and tax compliance. The company is currently contemplating the elimination of the GL area because it is showing a pre-tax loss. An annual income statement follows. b. Recast the income Would P L06 wameword MBC Random Lakeland Financial Services Income Statement by Service Line For the Year Ended July 31 (in thousands) Payroll GL Tax Total Sales. Cost of sales. $ 4,400 (2,800 $ 3,200 (2,000) $ 1,200 $ 3,600 (2,160) $ 1,440 $ 1,600 $11,200 (6,960 $ 4,240 $ 3,770 Gross margin Avoidable fixed and variable costs Allocated fixed costs. $ 1,260 180 $ 1,470 140 $ 1,040 210 530 Total fixed costs $ 1,440 $ 1,610 $ 4,300 $ 1,250 $ 190 Operating profit $ 160 $ (410) $ (60) a. Should corporate management drop the GL area? Support your answer with appropriate schedules. If the GL area were dropped, how would the company's pre-tax profit be affected? b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started