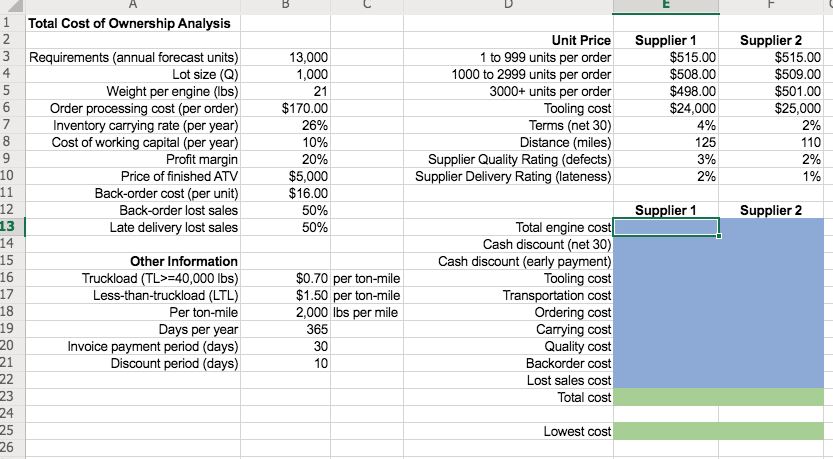

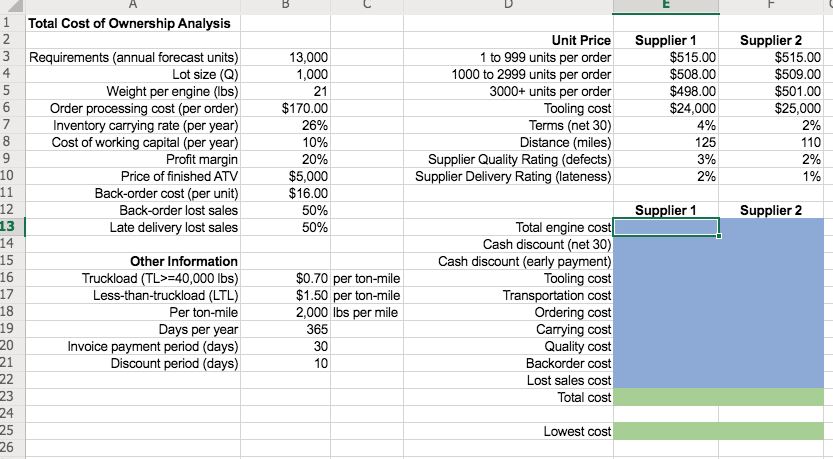

Total Cost of Ownership Analysis 3 Requirements (annual forecast units) Lot size (Q) Weight per engine (lbs) Order processing cost (per order) Inventory carrying rate (per year) Cost of working capital (per year) Profit margin Price of finished ATV Back-order cost (per unit) Back-order lost sales Late delivery lost sales 13,000 1,000 21 $170.00 26% 10% 20% $5,000 $16.00 50% 50% Unit Price 1 to 999 units per order 1000 to 2999 units per order 3000+ units per order Tooling cost Terms (net 30) Distance (miles) Supplier Quality Rating (defects) Supplier Delivery Rating (lateness) Supplier 1 $515.00 $508.00 $498.00 $24,000 4% 125 3% 2% Supplier 2 $515.00 $509.00 $501.00 $25,000 2% 110 2% 1% Supplier 1 Supplier 2 Other Information Truckload (TL>=40,000 lbs) Less-than-truckload (LTL) Per ton-mile Days per year Invoice payment period (days) Discount period (days) $0.70 per ton-mile $1.50 per ton-mile 2,000 lbs per mile 365 30 Total engine cost Cash discount (net 30) Cash discount (early payment) Tooling cost Transportation cost Ordering cost Carrying cost Quality cost Backorder cost Lost sales cost Total cost 10 Lowest cost Excel Online Structured Activity: Total Cost of Ownership Kuantan ATV, Inc. assembles five different models of all-terrain vehicles (ATVs) from various ready-made components to serve the Las Vegas, Nevada, market. The company uses the same engine for all its ATVs. The purchasing manager, Ms. Jane Kim, needs to choose a supplier for engines for the coming year. Due to the size of the warehouse and other administrative restrictions, she must order the engines in lot sizes of 1,000 each. The unique characteristics of the standardized engine require special tooling to be used during the manufacturing process. Kuantan ATV agrees to reimburse the supplier for the tooling. This is a critical purchase, since late delivery of engines would disrupt production and cause 50 percent lost sales and 50 percent back orders of the ATVs. Jane has obtained quotes from two reliable suppliers but needs to know which supplier is more cost-effective. The terms of sale are 4/10 net 30 for Supplier 1 and 2/10 net 30 for Supplier 2. The data related to the costs of ownership associated with two reliable suppliers has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. x2 Open spreadsheet Questions 1. What is the total cost of ownership for each of the suppliers? Assume the buyer will take advantage of the largest discount. Do not round intermediate calculations. Round your answers to the nearest cent. Supplier 1 Supplier 2 Total 2. Which supplier is more cost-effective? Total Cost of Ownership Analysis 3 Requirements (annual forecast units) Lot size (Q) Weight per engine (lbs) Order processing cost (per order) Inventory carrying rate (per year) Cost of working capital (per year) Profit margin Price of finished ATV Back-order cost (per unit) Back-order lost sales Late delivery lost sales 13,000 1,000 21 $170.00 26% 10% 20% $5,000 $16.00 50% 50% Unit Price 1 to 999 units per order 1000 to 2999 units per order 3000+ units per order Tooling cost Terms (net 30) Distance (miles) Supplier Quality Rating (defects) Supplier Delivery Rating (lateness) Supplier 1 $515.00 $508.00 $498.00 $24,000 4% 125 3% 2% Supplier 2 $515.00 $509.00 $501.00 $25,000 2% 110 2% 1% Supplier 1 Supplier 2 Other Information Truckload (TL>=40,000 lbs) Less-than-truckload (LTL) Per ton-mile Days per year Invoice payment period (days) Discount period (days) $0.70 per ton-mile $1.50 per ton-mile 2,000 lbs per mile 365 30 Total engine cost Cash discount (net 30) Cash discount (early payment) Tooling cost Transportation cost Ordering cost Carrying cost Quality cost Backorder cost Lost sales cost Total cost 10 Lowest cost Excel Online Structured Activity: Total Cost of Ownership Kuantan ATV, Inc. assembles five different models of all-terrain vehicles (ATVs) from various ready-made components to serve the Las Vegas, Nevada, market. The company uses the same engine for all its ATVs. The purchasing manager, Ms. Jane Kim, needs to choose a supplier for engines for the coming year. Due to the size of the warehouse and other administrative restrictions, she must order the engines in lot sizes of 1,000 each. The unique characteristics of the standardized engine require special tooling to be used during the manufacturing process. Kuantan ATV agrees to reimburse the supplier for the tooling. This is a critical purchase, since late delivery of engines would disrupt production and cause 50 percent lost sales and 50 percent back orders of the ATVs. Jane has obtained quotes from two reliable suppliers but needs to know which supplier is more cost-effective. The terms of sale are 4/10 net 30 for Supplier 1 and 2/10 net 30 for Supplier 2. The data related to the costs of ownership associated with two reliable suppliers has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. x2 Open spreadsheet Questions 1. What is the total cost of ownership for each of the suppliers? Assume the buyer will take advantage of the largest discount. Do not round intermediate calculations. Round your answers to the nearest cent. Supplier 1 Supplier 2 Total 2. Which supplier is more cost-effective