Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Total costs and expenses Net Income Budget input from key personnel: SALES MANAGER The Sales Manager is in charge of sales of wire shelving in

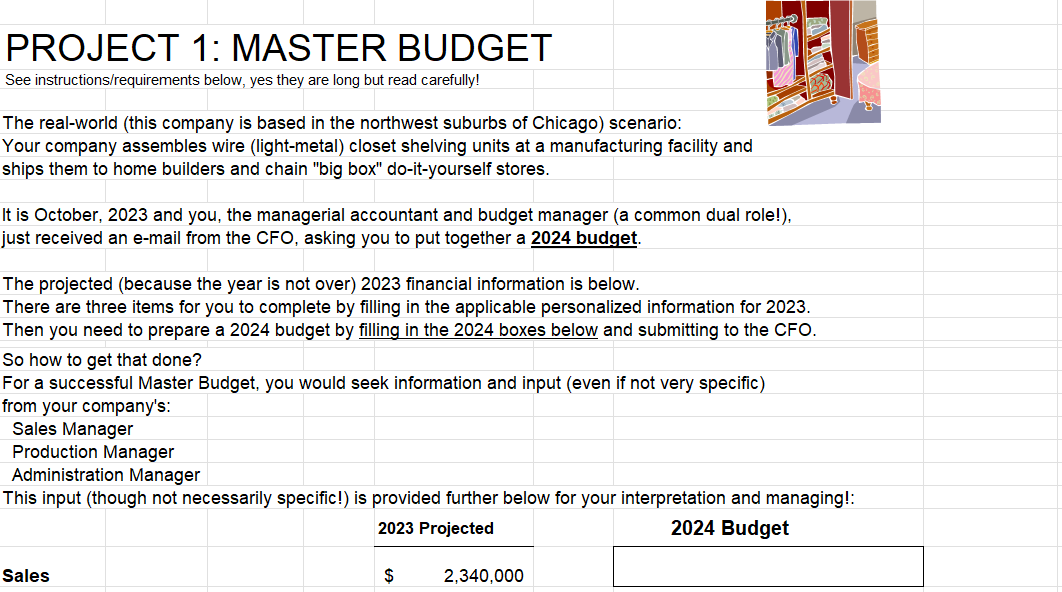

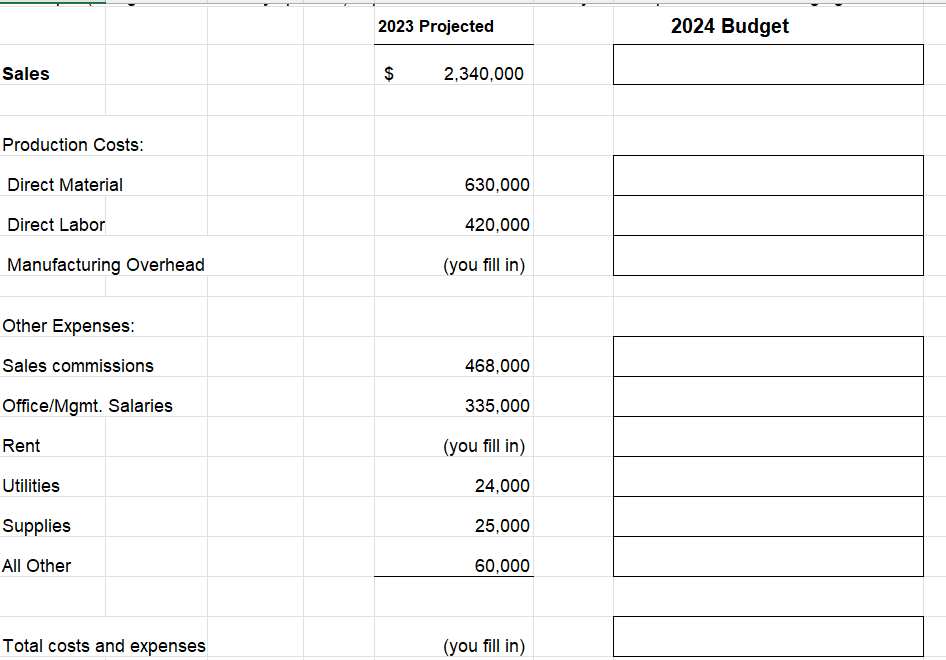

Total costs and expenses Net Income Budget input from key personnel: SALES MANAGER The Sales Manager is in charge of sales of wire shelving in linear feet (the key metric for this business). with the role of soliciting and receiving orders from home builders and chain stores The following is projected sales data for (full year) 2023 : 150,000 linear feet to the home builders market at a sales price of $10 per linear foot. 60,000 linear feet to the chain store market at a sales price of $14 per linear foot. In 2024, predicted rising interest rates is causing an expected moderate decrease in sales in the home builders market. However, in 2024 it is also predicted that inflated travel/vacation prices is going to cause a small increase in sales to the chain store market (as more people "staycation" and work on home improvement projects) However, in each of the salary scenarios above, the production manager wants a raise in 2024 ! Reminder: we have covered the cost behavior of direct material and direct labor - An appropriate budget would be based on expected cost per linear feet produced. ADMINISTRATION MANAGER The administration manager is in charge of basically everything at your facility except sales and production. A couple of the issues the administrative manager is working on include: Hiring an administrative assistant to help implement the new accounts payable software. Negotiating with the landlord - your lease is up in December and the landlord plans to increase the rent in 2024. The 2023 full year rent is as follows (Use ONLY the amount shown for you!): PROJECT 1: MASTER BUDGET See instructions/requirements below, yes they are long but read carefully! The real-world (this company is based in the northwest suburbs of Chicago) scenario: Your company assembles wire (light-metal) closet shelving units at a manufacturing facility and ships them to home builders and chain "big box" do-it-yourself stores. It is October, 2023 and you, the managerial accountant and budget manager (a common dual role!), just received an e-mail from the CFO, asking you to put together a 2024 budget. The projected (because the year is not over) 2023 financial information is below. There are three items for you to complete by filling in the applicable personalized information for 2023 . Then you need to prepare a 2024 budget by filling in the 2024 boxes below and submitting to the CFO. So how to get that done? For a successful Master Budget, you would seek information and input (even if not very specific) from your company's: Sales Manager Production Manager Administration Manager This input (though not necessarily specific!) is provided further below for your interpretation and managing!: 2024 Budget Sales \begin{tabular}{l|l} \hline 3,000 \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Project Requirements: Using either this Excel document or a separate format (for example, a pdf document, but NOT GoogleDocs or ".numbers"!), Prepare a 2024 Master Budget by completing where applicable for 2023 and then filling in all the boxes as applicable for 202 In addition, provide a 200300 word description (either within the same document or a separate document such as Word, or in text submission area, your choice!) that describes specifically how you determined the 2024 Sales Budget (for each of the two markets) and your assumptions, and specifically how you determined the budget for all of the costs and expenses budgeted for 2024 . (hint; are the costs as we know them, fixed or variable?) In other words, clearly show how you arrived at all of the numbers that you entered into the 2024 boxes, do NOT make The production manager earns an annual salary (which is the entire manufacturing overhead). as follows: (Use ONLY the amount shown for you!) Sales prices (what is charged to the customers) may be changed if considered appropriate. (but you would want to consider a change in sales price's effect on volume of sales) Salespersons are compensated fully on commission based on sales dollars (and the 2024 commission rate is expected to be the same as 2023) PRODUCTION MANAGER The production manager is in charge of assembly of these units in the assembly facility adjacent to the office. Production at the company facility is based on the assembly of the shelving by the linear foot. You assemble what you need to fill orders, since there is no space for unsold inventory. The production manager is also responsible for procurement of the raw materials (metal). You currently pay at a rate of $3 per linear foot, but your supplier is planning a price increase. The production manager is also responsible for the assemblers that she directly supervises. They are paid by production at $2 per linear foot. The production manager earns an annual salary (which is the entire manufacturing overhead)

Total costs and expenses Net Income Budget input from key personnel: SALES MANAGER The Sales Manager is in charge of sales of wire shelving in linear feet (the key metric for this business). with the role of soliciting and receiving orders from home builders and chain stores The following is projected sales data for (full year) 2023 : 150,000 linear feet to the home builders market at a sales price of $10 per linear foot. 60,000 linear feet to the chain store market at a sales price of $14 per linear foot. In 2024, predicted rising interest rates is causing an expected moderate decrease in sales in the home builders market. However, in 2024 it is also predicted that inflated travel/vacation prices is going to cause a small increase in sales to the chain store market (as more people "staycation" and work on home improvement projects) However, in each of the salary scenarios above, the production manager wants a raise in 2024 ! Reminder: we have covered the cost behavior of direct material and direct labor - An appropriate budget would be based on expected cost per linear feet produced. ADMINISTRATION MANAGER The administration manager is in charge of basically everything at your facility except sales and production. A couple of the issues the administrative manager is working on include: Hiring an administrative assistant to help implement the new accounts payable software. Negotiating with the landlord - your lease is up in December and the landlord plans to increase the rent in 2024. The 2023 full year rent is as follows (Use ONLY the amount shown for you!): PROJECT 1: MASTER BUDGET See instructions/requirements below, yes they are long but read carefully! The real-world (this company is based in the northwest suburbs of Chicago) scenario: Your company assembles wire (light-metal) closet shelving units at a manufacturing facility and ships them to home builders and chain "big box" do-it-yourself stores. It is October, 2023 and you, the managerial accountant and budget manager (a common dual role!), just received an e-mail from the CFO, asking you to put together a 2024 budget. The projected (because the year is not over) 2023 financial information is below. There are three items for you to complete by filling in the applicable personalized information for 2023 . Then you need to prepare a 2024 budget by filling in the 2024 boxes below and submitting to the CFO. So how to get that done? For a successful Master Budget, you would seek information and input (even if not very specific) from your company's: Sales Manager Production Manager Administration Manager This input (though not necessarily specific!) is provided further below for your interpretation and managing!: 2024 Budget Sales \begin{tabular}{l|l} \hline 3,000 \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Project Requirements: Using either this Excel document or a separate format (for example, a pdf document, but NOT GoogleDocs or ".numbers"!), Prepare a 2024 Master Budget by completing where applicable for 2023 and then filling in all the boxes as applicable for 202 In addition, provide a 200300 word description (either within the same document or a separate document such as Word, or in text submission area, your choice!) that describes specifically how you determined the 2024 Sales Budget (for each of the two markets) and your assumptions, and specifically how you determined the budget for all of the costs and expenses budgeted for 2024 . (hint; are the costs as we know them, fixed or variable?) In other words, clearly show how you arrived at all of the numbers that you entered into the 2024 boxes, do NOT make The production manager earns an annual salary (which is the entire manufacturing overhead). as follows: (Use ONLY the amount shown for you!) Sales prices (what is charged to the customers) may be changed if considered appropriate. (but you would want to consider a change in sales price's effect on volume of sales) Salespersons are compensated fully on commission based on sales dollars (and the 2024 commission rate is expected to be the same as 2023) PRODUCTION MANAGER The production manager is in charge of assembly of these units in the assembly facility adjacent to the office. Production at the company facility is based on the assembly of the shelving by the linear foot. You assemble what you need to fill orders, since there is no space for unsold inventory. The production manager is also responsible for procurement of the raw materials (metal). You currently pay at a rate of $3 per linear foot, but your supplier is planning a price increase. The production manager is also responsible for the assemblers that she directly supervises. They are paid by production at $2 per linear foot. The production manager earns an annual salary (which is the entire manufacturing overhead) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started