Answered step by step

Verified Expert Solution

Question

1 Approved Answer

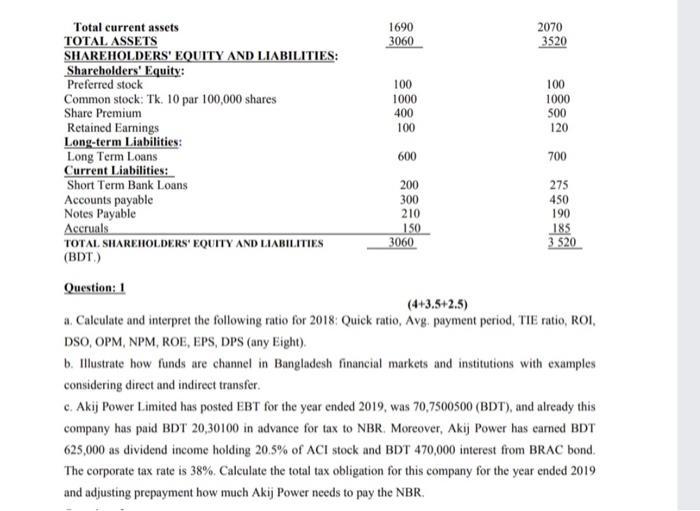

Total current assets TOTAL ASSETS SHAREHOLDERS' EQUITY AND LIABILITIES: Shareholders' Equity: Preferred stock Common stock: Tk. 10 par 100,000 shares Share Premium 1690 2070

Total current assets TOTAL ASSETS SHAREHOLDERS' EQUITY AND LIABILITIES: Shareholders' Equity: Preferred stock Common stock: Tk. 10 par 100,000 shares Share Premium 1690 2070 3060 3520 100 100 1000 1000 400 500 Retained Earnings Long-term Liabilities: Long Term Loans Current Liabilities: Short Term Bank Loans Accounts payable Notes Payable 100 120 600 700 200 275 300 450 210 190 Accruals 150 185 TOTAL SHAREHOLDERS' EQUITY AND LIABILITIES 3060 3.520 (BDT.) Question: 1 (4+3.5+2.5) a. Calculate and interpret the following ratio for 2018: Quick ratio, Avg. payment period, TIE ratio, ROI, DSO, OPM, NPM, ROE, EPS, DPS (any Eight). b. Illustrate how funds are channel in Bangladesh financial markets and institutions with examples considering direct and indirect transfer. c. Akij Power Limited has posted EBT for the year ended 2019, was 70,7500500 (BDT), and already this company has paid BDT 20,30100 in advance for tax to NBR. Moreover, Akij Power has earned BDT 625,000 as dividend income holding 20.5% of ACI stock and BDT 470,000 interest from BRAC bond. The corporate tax rate is 38%. Calculate the total tax obligation for this company for the year ended 2019 and adjusting prepayment how much Akij Power needs to pay the NBR.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

It seems like the given information is a snapshot of a companys balance sheet with details ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started