Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amazon.com, Inc. is offering $1,000,000,000 of their 0.400% notes due 2023 (the 2023 notes), $1,250,000,000 of their 0.800% notes due 2025 (the 2025 notes),

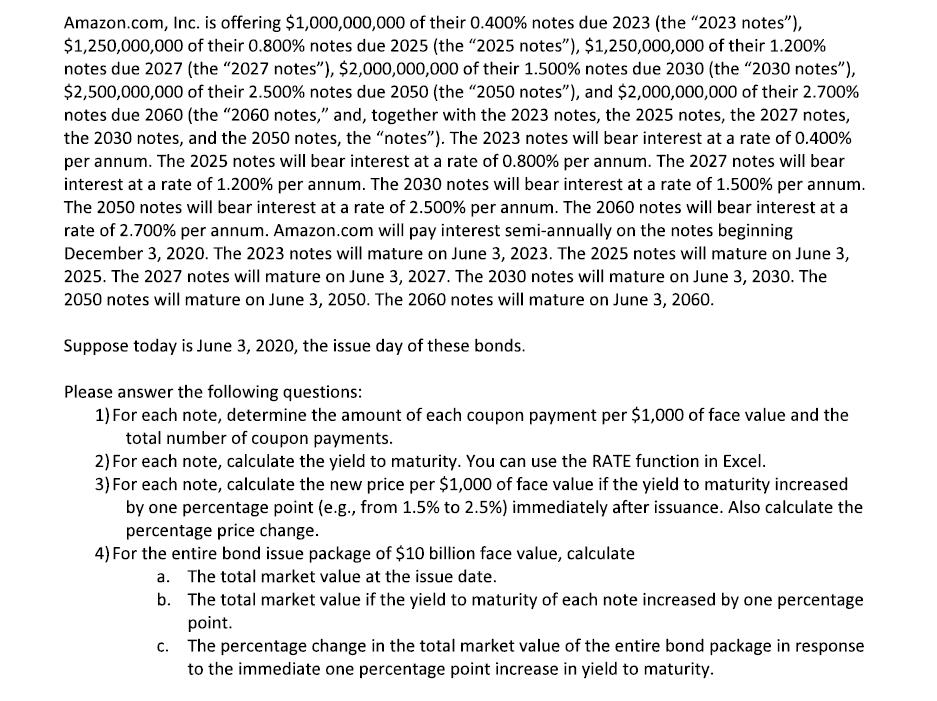

Amazon.com, Inc. is offering $1,000,000,000 of their 0.400% notes due 2023 (the "2023 notes"), $1,250,000,000 of their 0.800% notes due 2025 (the "2025 notes"), $1,250,000,000 of their 1.200% notes due 2027 (the "2027 notes"), $2,000,000,000 of their 1.500% notes due 2030 (the "2030 notes"), $2,500,000,000 of their 2.500% notes due 2050 (the "2050 notes"), and $2,000,000,000 of their 2.700% notes due 2060 (the "2060 notes," and, together with the 2023 notes, the 2025 notes, the 2027 notes, the 2030 notes, and the 2050 notes, the "notes"). The 2023 notes will bear interest at a rate of 0.400% per annum. The 2025 notes will bear interest at a rate of 0.800% per annum. The 2027 notes will bear interest at a rate of 1.200% per annum. The 2030 notes will bear interest at a rate of 1.500% per annum. The 2050 notes will bear interest at a rate of 2.500% per annum. The 2060 notes will bear interest at a rate of 2.700% per annum. Amazon.com will pay interest semi-annually on the notes beginning December 3, 2020. The 2023 notes will mature on June 3, 2023. The 2025 notes will mature on June 3, 2025. The 2027 notes will mature on June 3, 2027. The 2030 notes will mature on June 3, 2030. The 2050 notes will mature on June 3, 2050. The 2060 notes will mature on June 3, 2060. Suppose today is June 3, 2020, the issue day of these bonds. Please answer the following questions: 1) For each note, determine the amount of each coupon payment per $1,000 of face value and the total number of coupon payments. 2) For each note, calculate the yield to maturity. You can use the RATE function in Excel. 3) For each note, calculate the new price per $1,000 of face value if the yield to maturity increased by one percentage point (e.g., from 1.5% to 2.5% ) immediately after issuance. Also calculate the percentage price change. 4) For the entire bond issue package of $10 billion face value, calculate a. The total market value at the issue date. b. The total market value if the yield to maturity of each note increased by one percentage point. c. The percentage change in the total market value of the entire bond package in response to the immediate one percentage point increase in yield to maturity. Total face value Price Bond Maturity date First coupon payment Interest (per annum) ($ in thousands) (per $1,000 face value) 0.4000% 1,000,000 $998.60 0.8000% 1,250,000 $999.61 1.2000% 1,250,000 $999.67 1.5000% 2,000,000 $998.89 2.5000% 2,500,000 $989.77 2.7000% 2,000,000 $988.16 10,000,000 2023 notes June 3, 2023 2025 notes June 3, 2025 2027 notes June 3, 2027 2030 notes June 3, 2030 2050 notes June 3, 2050 2060 notes June 3, 2060 Total December 3, 2020 December 3, 2020 December 3, 2020 December 3, 2020 December 3, 2020 December 3, 2020

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Coupon payment per 1000 of face value and total number of coupon payments for each note 2023 notes Coupon payment 1000 0400 400 Total number of coup...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started