Answered step by step

Verified Expert Solution

Question

1 Approved Answer

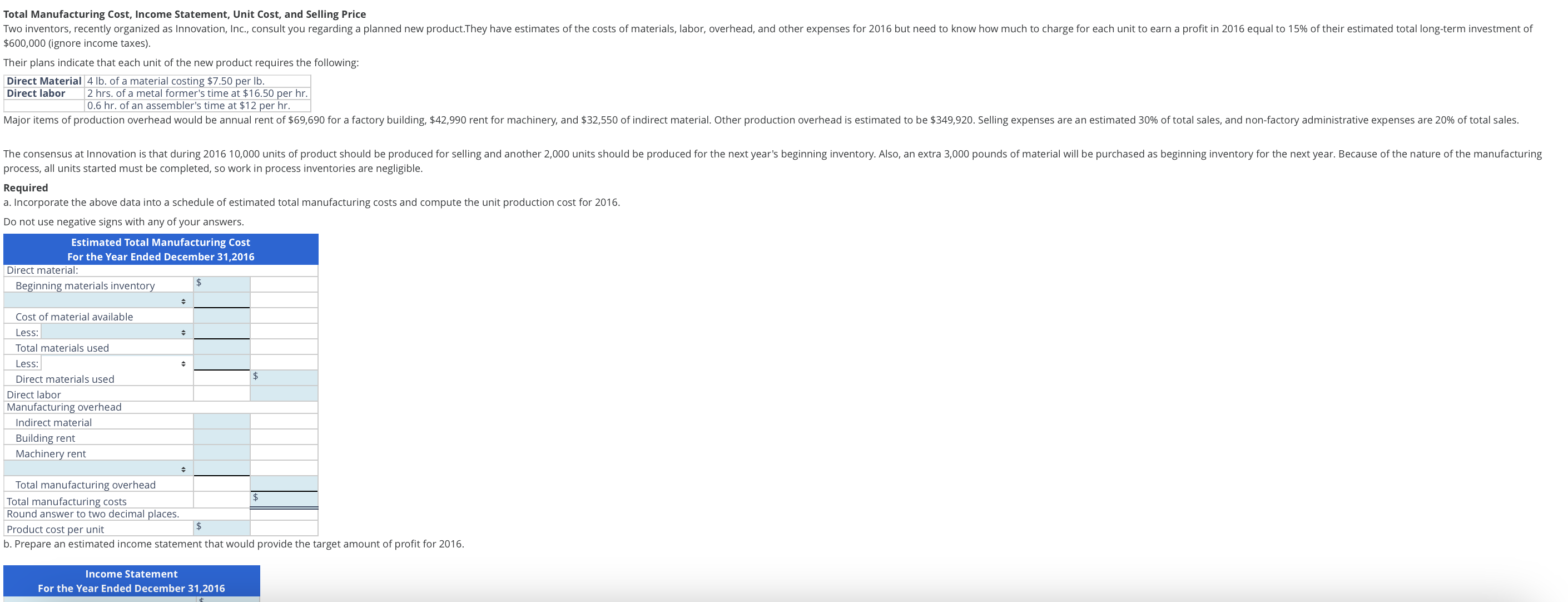

Total Manufacturing Cost, Income Statement, Unit Cost, and Selling Price $600,000 (ignore income taxes). Their plans indicate that each unit of the new product requires

Total Manufacturing Cost, Income Statement, Unit Cost, and Selling Price $600,000 (ignore income taxes). Their plans indicate that each unit of the new product requires the following: Direct Material 4lb. of a material costing $7.50 per lb. Direct labor 2 hrs. of a metal former's time at $16.50 per hr. 0.6hr. of an assembler's time at $12 per hr. process, all units started must be completed, so work in process inventories are negligible. Required a. Incorporate the above data into a schedule of estimated total manufacturing costs and compute the unit production cost for 2016. Do not use negative signs with any of your answers. Estimated Total Manufacturing Cost For the Year Ended December 31,2016 Direct material: \begin{tabular}{|l|l|l|} \hline Beginning materials inventory & \\ \hline Cost of material available & \\ \hline Less: & & \\ \hline Total materials used & & \\ \hline Less: & & \\ \hline Direct materials used & & \\ \hline Direct labor & & \\ \hline Manufacturing overhead & & \\ \hline Indirect material & & \\ \hline Building rent & & \\ \hline Machinery rent & & \\ \hline Total manufacturing overhead & & \\ \hline Total manufacturing costs & & \\ \hline Round answer to two decimal places. & \\ \hline Product cost per unit & $ & \\ \hline \end{tabular} Product cost per unit b. Prepare an estimated income statement that would provide the target amount of profit for 2016 Income Statement For the Year Ended December 31,2016

Total Manufacturing Cost, Income Statement, Unit Cost, and Selling Price $600,000 (ignore income taxes). Their plans indicate that each unit of the new product requires the following: Direct Material 4lb. of a material costing $7.50 per lb. Direct labor 2 hrs. of a metal former's time at $16.50 per hr. 0.6hr. of an assembler's time at $12 per hr. process, all units started must be completed, so work in process inventories are negligible. Required a. Incorporate the above data into a schedule of estimated total manufacturing costs and compute the unit production cost for 2016. Do not use negative signs with any of your answers. Estimated Total Manufacturing Cost For the Year Ended December 31,2016 Direct material: \begin{tabular}{|l|l|l|} \hline Beginning materials inventory & \\ \hline Cost of material available & \\ \hline Less: & & \\ \hline Total materials used & & \\ \hline Less: & & \\ \hline Direct materials used & & \\ \hline Direct labor & & \\ \hline Manufacturing overhead & & \\ \hline Indirect material & & \\ \hline Building rent & & \\ \hline Machinery rent & & \\ \hline Total manufacturing overhead & & \\ \hline Total manufacturing costs & & \\ \hline Round answer to two decimal places. & \\ \hline Product cost per unit & $ & \\ \hline \end{tabular} Product cost per unit b. Prepare an estimated income statement that would provide the target amount of profit for 2016 Income Statement For the Year Ended December 31,2016 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started