Answered step by step

Verified Expert Solution

Question

1 Approved Answer

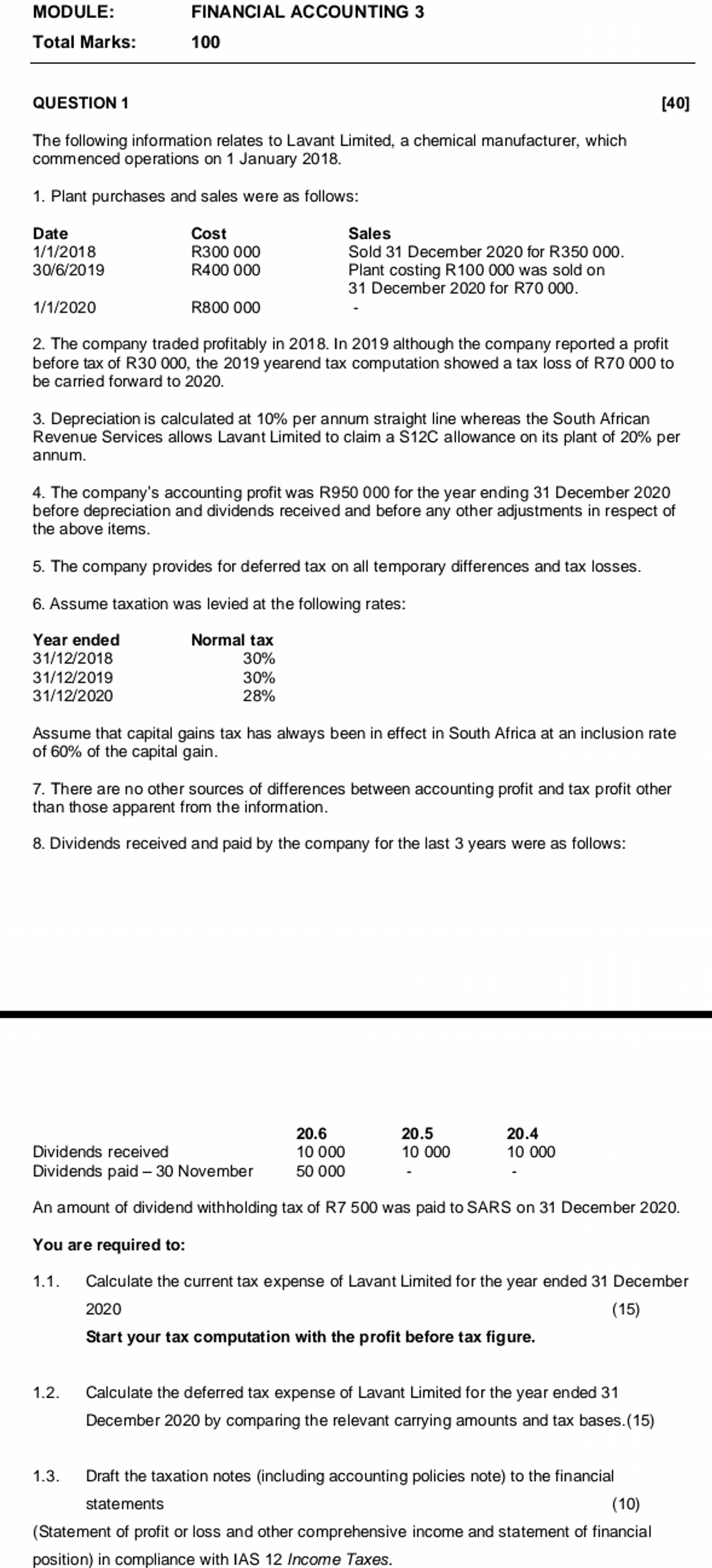

Total Marks: 1 0 0 QUESTION 1 The following information relates to Lavant Limited, a chemical manufacturer, which commenced operations on 1 January 2 0

Total Marks:

QUESTION

The following information relates to Lavant Limited, a chemical manufacturer, which

commenced operations on January

Plant purchases and sales were as follows:

The company traded profitably in In although the company reported a profit

before tax of R the yearend tax computation showed a tax loss of R to

be carried forward to

Depreciation is calculated at per annum straight line whereas the South African

Revenue Services allows Lavant Limited to claim a SC allowance on its plant of per

annum.

The company's accounting profit was R for the year ending December

before depreciation and dividends received and before any other adjustments in respect of

the above items.

The company provides for deferred tax on all temporary differences and tax losses.

Assume taxation was levied at the following rates:

Assume that capital gains tax has always been in effect in South Africa at an inclusion rate

of of the capital gain.

There are no other sources of differences between accounting profit and tax profit other

than those apparent from the information.

Dividends received and paid by the company for the last years were as follows:

Dividends received

An amount of dividend withholding tax of R was paid to SARS on December

You are required to:

Calculate the current tax expense of Lavant Limited for the year ended December

Start your tax computation with the profit before tax figure.

Calculate the deferred tax expense of Lavant Limited for the year ended

December by comparing the relevant carrying amounts and tax bases.

Draft the taxation notes including accounting policies note to the financial

statements

Statement of profit or loss and other comprehensive income and statement of financial

position in compliance with IAS Income Taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started