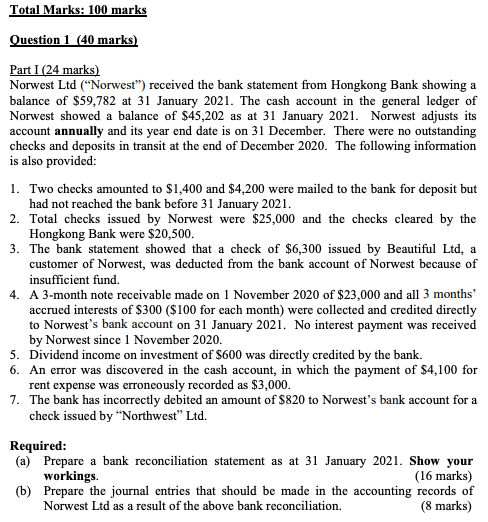

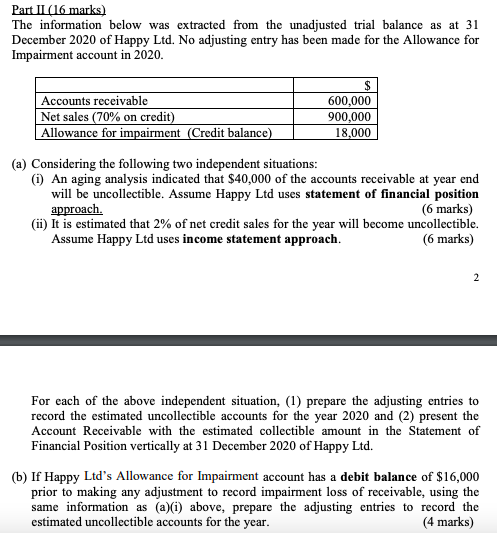

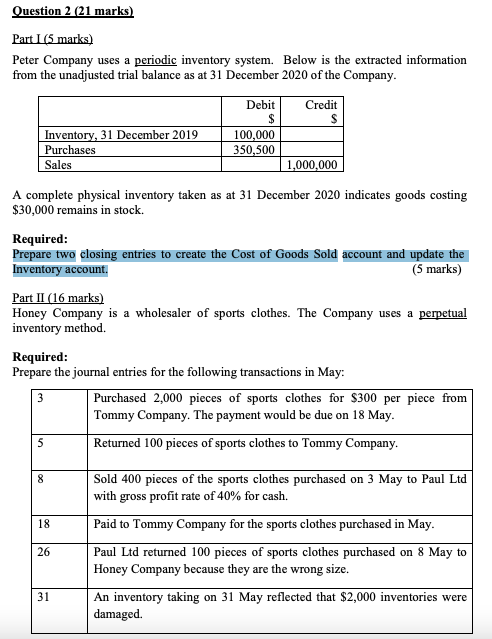

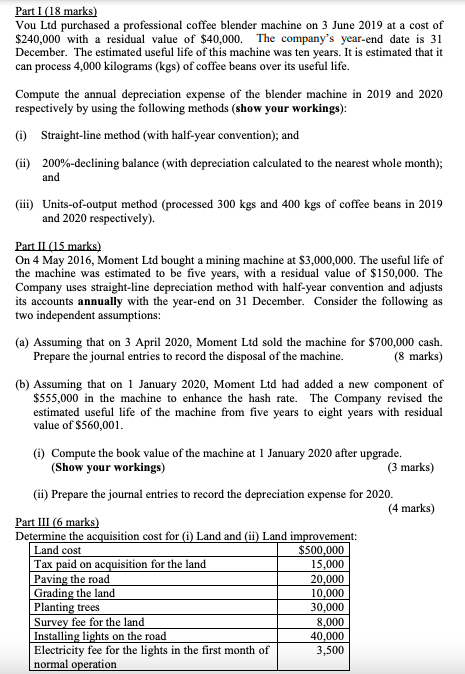

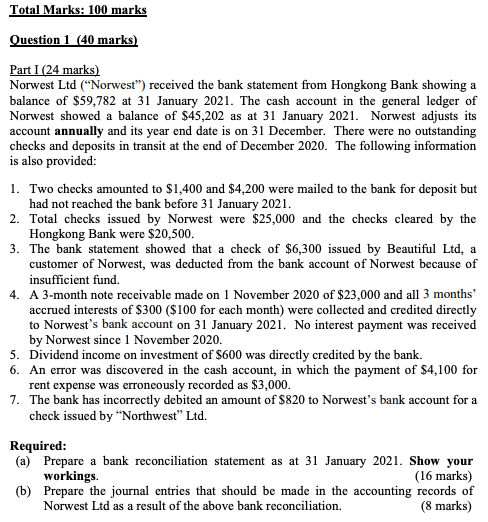

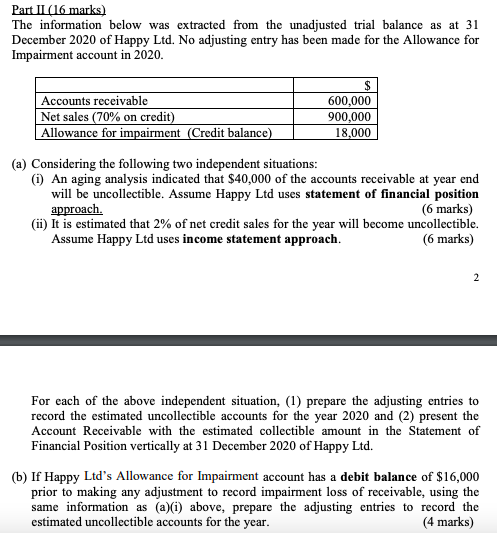

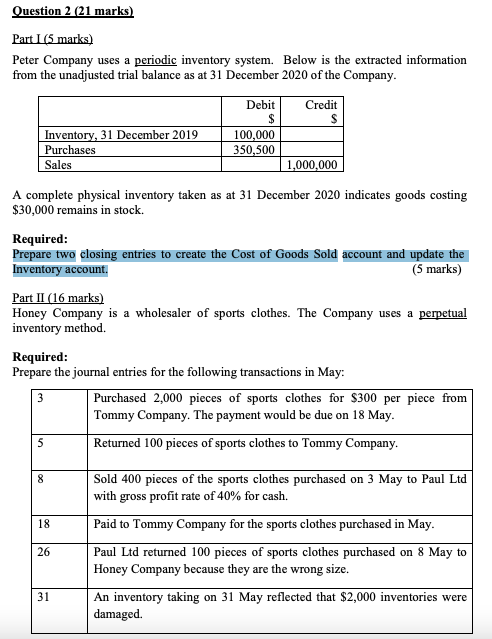

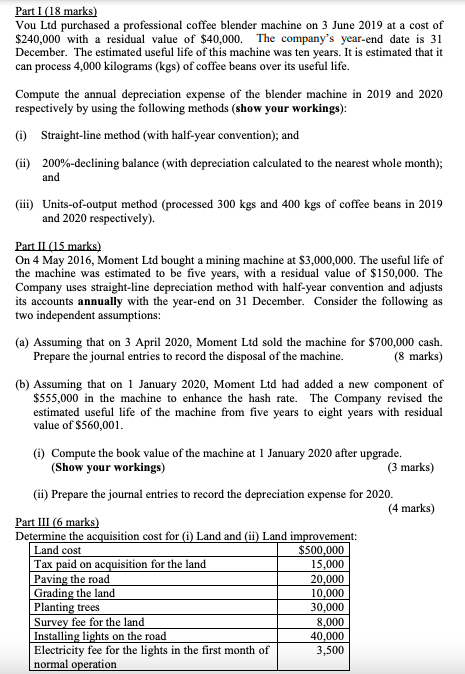

Total Marks: 100 marks Question 1 (40 marks) Part I (24 marks) Norwest Ltd ("Norwest") received the bank statement from Hongkong Bank showing a balance of $59,782 at 31 January 2021. The cash account in the general ledger of Norwest showed a balance of $45,202 as at 31 January 2021. Norwest adjusts its account annually and its year end date is on 31 December. There were no outstanding checks and deposits in transit at the end of December 2020. The following information is also provided: 1. Two checks amounted to $1,400 and $4,200 were mailed to the bank for deposit but had not reached the bank before 31 January 2021. 2. Total checks issued by Norwest were $25,000 and the checks cleared by the Hongkong Bank were $20,500. 3. The bank statement showed that a check of $6,300 issued by Beautiful Ltd, a customer of Norwest, was deducted from the bank account of Norwest because of insufficient fund. 4. A 3- month note receivable made on 1 November 2020 of $23,000 and all 3 months' accrued interests of $300 ($100 for each month) were collected and credited directly to Norwest's bank account on 31 January 2021. No interest payment was received by Norwest since 1 November 2020. 5. Dividend income on investment of $600 was directly credited by the bank. 6. An error was discovered in the cash account, in which the payment of $4,100 for rent expense was erroneously recorded as $3,000. 7. The bank has incorrectly debited an amount of $820 to Norwest's bank account for a check issued by Northwest" Ltd. Required: (a) Prepare a bank reconciliation statement as at 31 January 2021. Show your workings. (16 marks) (b) Prepare the journal entries that should be made in the accounting records of Norwest Ltd as a result of the above bank reconciliation. (8 marks) Part II (16 marks) The information below was extracted from the unadjusted trial balance as at 31 December 2020 of Happy Ltd. No adjusting entry has been made for the Allowance for Impairment account in 2020. Accounts receivable Net sales (70% on credit) Allowance for impairment (Credit balance) 600,000 900,000 18,000 (a) Considering the following two independent situations: (i) An aging analysis indicated that $40,000 of the accounts receivable at year end will be uncollectible. Assume Happy Ltd uses statement of financial position approach. (6 marks) (ii) It is estimated that 2% of net credit sales for the year will become uncollectible. Assume Happy Ltd uses income statement approach. (6 marks) 2 For each of the above independent situation, (1) prepare the adjusting entries to record the estimated uncollectible accounts for the year 2020 and (2) present the Account Receivable with the estimated collectible amount in the Statement of Financial Position vertically at 31 December 2020 of Happy Ltd. (b) If Happy Ltd's Allowance for Impairment account has a debit balance of $16,000 prior to making any adjustment to record impairment loss of receivable, using the same information as (a)(i) above, prepare the adjusting entries to record the estimated uncollectible accounts for the year. (4 marks) Question 2 (21 marks) Part I (5 marks) Peter Company uses a periodic inventory system. Below is the extracted information from the unadjusted trial balance as at 31 December 2020 of the Company. Debit Credit $ $ Inventory. 31 December 2019 100,000 Purchases 350,500 Sales 1,000,000 A complete physical inventory taken as at 31 December 2020 indicates goods costing $30,000 remains in stock. Required: Prepare two closing entries to create the cost of Goods Sold account and update the Inventory account. (5 marks) Part II (16 marks) Honey Company is a wholesaler of sports clothes. The Company uses a perpetual inventory method. Required: Prepare the journal entries for the following transactions in May: 3 Purchased 2,000 pieces of sports clothes for $300 per piece from Tommy Company. The payment would be due on 18 May. Returned 100 pieces of sports clothes to Tommy Company. 5 8 18 26 Sold 400 pieces of the sports clothes purchased on 3 May to Paul Ltd with gross profit rate of 40% for cash. Paid to Tommy Company for the sports clothes purchased in May. Paul Ltd returned 100 pieces of sports clothes purchased on 8 May to Honey Company because they are the wrong size. An inventory taking on 31 May reflected that $2,000 inventories were damaged. 31 Part I (18 marks) Vou Ltd purchased a professional coffee blender machine on 3 June 2019 at a cost of $240,000 with a residual value of $40,000. The company's year-end date is 31 December. The estimated useful life of this machine was ten years. It is estimated that it can process 4,000 kilograms (kgs) of coffee beans over its useful life. Compute the annual depreciation expense of the blender machine in 2019 and 2020 respectively by using the following methods (show your workings): (1) Straight-line method (with half-year convention); and (ii) 200%-declining balance (with depreciation calculated to the nearest whole month); and (iii) Units-of-output method (processed 300 kgs and 400 kgs of coffee beans in 2019 and 2020 respectively). Part II (15 marks) On 4 May 2016, Moment Ltd bought a mining machine at $3,000,000. The useful life of the machine was estimated to be five years, with a residual value of $150,000. The Company uses straight-line depreciation method with half-year convention and adjusts its accounts annually with the year-end on 31 December. Consider the following as two independent assumptions: (a) Assuming that on 3 April 2020, Moment Ltd sold the machine for $700,000 cash. Prepare the journal entries to record the disposal of the machine. (8 marks) (b) Assuming that on 1 January 2020, Moment Ltd had added a new component of $555,000 in the machine to enhance the hash rate. The Company revised the estimated useful life of the machine from five years to eight years with residual value of $560,001. (1) Compute the book value of the machine at 1 January 2020 after upgrade. (Show your workings) (3 marks) (ii) Prepare the journal entries to record the depreciation expense for 2020. (4 marks) Part III (6 marks) Determine the acquisition cost for (i) Land and (ii) Land improvement: Land cost $500,000 Tax paid on acquisition for the land 15,000 Paving the road 20,000 Grading the land 10,000 Planting trees 30,000 Survey fee for the land 8,000 Installing lights on the road 40,000 Electricity fee for the lights in the first month of 3,500 normal operation