Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Total Recall (TR) is a firm valued at ( $ 600 ) million and has 20 million shares outstanding, each valued at ( $ 15

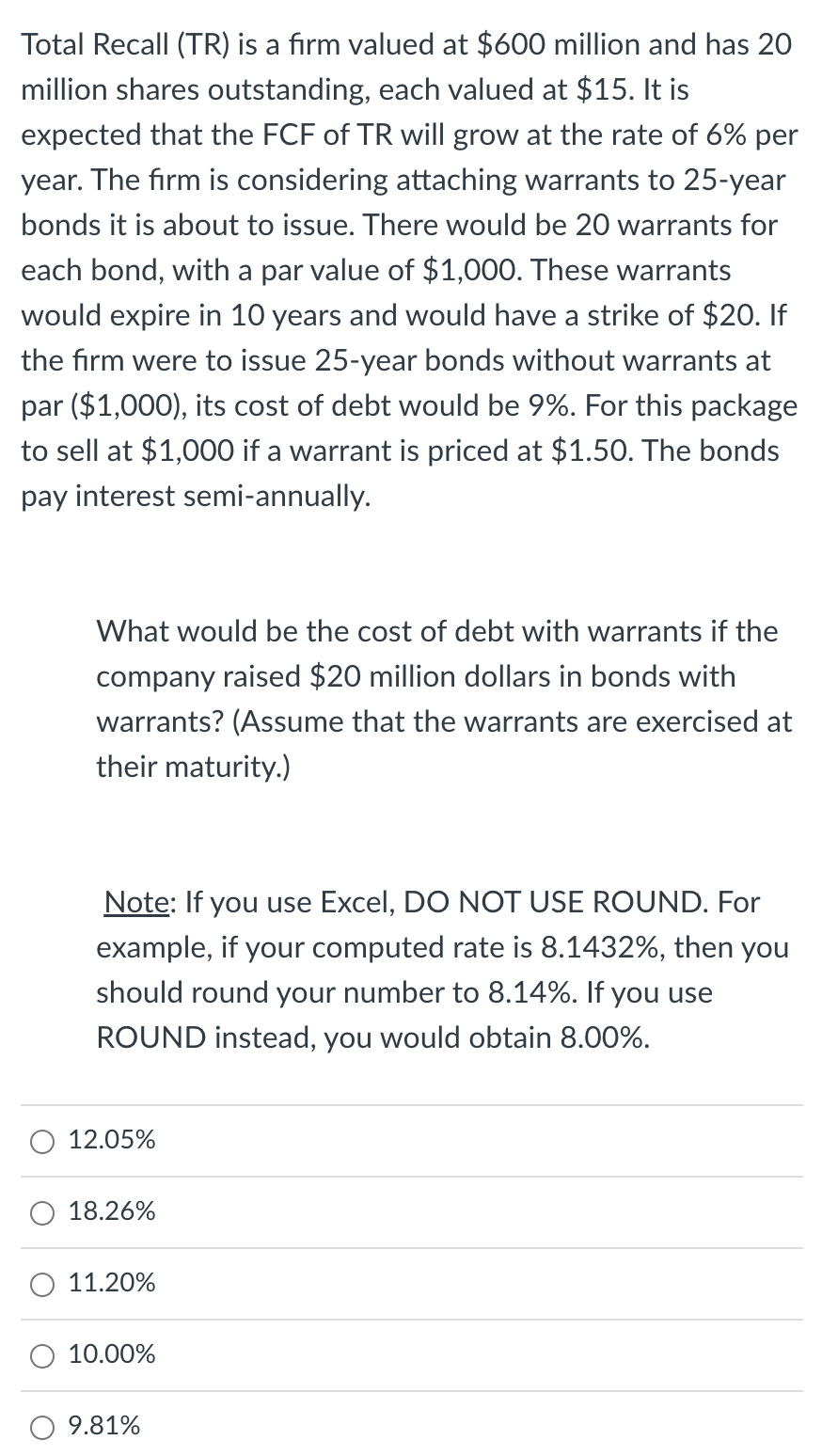

Total Recall (TR) is a firm valued at \\( \\$ 600 \\) million and has 20 million shares outstanding, each valued at \\( \\$ 15 \\). It is expected that the FCF of TR will grow at the rate of \6 per year. The firm is considering attaching warrants to 25-year bonds it is about to issue. There would be 20 warrants for each bond, with a par value of \\( \\$ 1,000 \\). These warrants would expire in 10 years and would have a strike of \\( \\$ 20 \\). If the firm were to issue 25-year bonds without warrants at \\( \\operatorname{par}(\\$ 1,000) \\), its cost of debt would be \9. For this package to sell at \\( \\$ 1,000 \\) if a warrant is priced at \\( \\$ 1.50 \\). The bonds pay interest semi-annually. What would be the cost of debt with warrants if the company raised \\( \\$ 20 \\) million dollars in bonds with warrants? (Assume that the warrants are exercised at their maturity.) Note: If you use Excel, DO NOT USE ROUND. For example, if your computed rate is \8.1432, then you should round your number to \8.14. If you use ROUND instead, you would obtain \8.00. \12.05 \18.26 \11.20 \10.00 \9.81

Total Recall (TR) is a firm valued at \\( \\$ 600 \\) million and has 20 million shares outstanding, each valued at \\( \\$ 15 \\). It is expected that the FCF of TR will grow at the rate of \6 per year. The firm is considering attaching warrants to 25-year bonds it is about to issue. There would be 20 warrants for each bond, with a par value of \\( \\$ 1,000 \\). These warrants would expire in 10 years and would have a strike of \\( \\$ 20 \\). If the firm were to issue 25-year bonds without warrants at \\( \\operatorname{par}(\\$ 1,000) \\), its cost of debt would be \9. For this package to sell at \\( \\$ 1,000 \\) if a warrant is priced at \\( \\$ 1.50 \\). The bonds pay interest semi-annually. What would be the cost of debt with warrants if the company raised \\( \\$ 20 \\) million dollars in bonds with warrants? (Assume that the warrants are exercised at their maturity.) Note: If you use Excel, DO NOT USE ROUND. For example, if your computed rate is \8.1432, then you should round your number to \8.14. If you use ROUND instead, you would obtain \8.00. \12.05 \18.26 \11.20 \10.00 \9.81 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started