Answered step by step

Verified Expert Solution

Question

1 Approved Answer

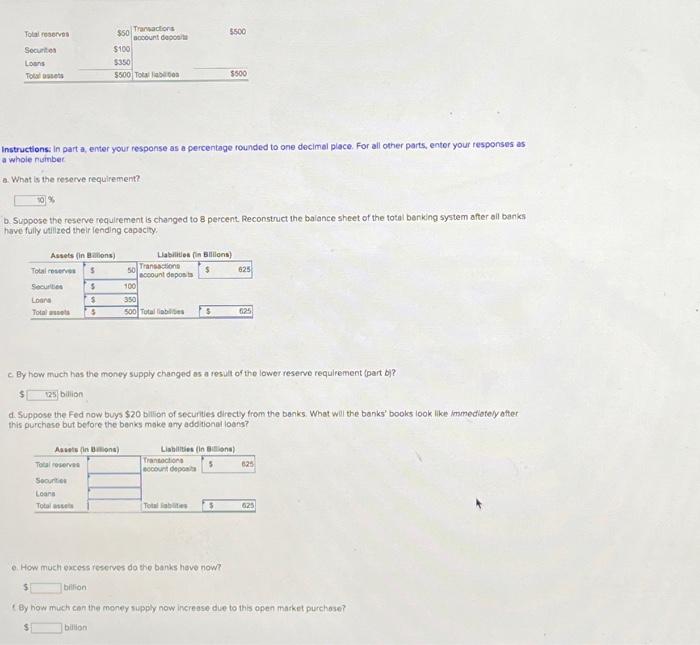

Total reserves Securities Loans Total assets Assets (in Billions) Total reserves S Instructions: In part a, enter your response as a percentage rounded to one

Total reserves Securities Loans Total assets Assets (in Billions) Total reserves S Instructions: In part a, enter your response as a percentage rounded to one decimal place. For all other parts, enter your responses as a whole number. a. What is the reserve requirement? 10 % Securities Loans Total assets b. Suppose the reserve requirement is changed to 8 percent. Reconstruct the balance sheet of the total banking system after all banks have fully utilized their lending capacity. $50 Transactions account deposits $100 $350 $500 Total liabilities $ $ $ Total reserves Securition Loans Total assets Assets (in Billions) billion 50 Transactions account deposits $500 Liabilities (in Billions) $ 100 350 500 Total liabilities $500 $ c. By how much has the money supply changed as a result of the lower reserve requirement (part b)? $ 125 billion d. Suppose the Fed now buys $20 billion of securities directly from the banks. What will the banks' books look like immediately after this purchase but before the banks make any additional loans? Total liabilities $ 825 Liabilities (in Billions) Transactions S account deposits 625 625 625 e. How much excess reserves do the banks have now? $ By how much can the money supply now increase due to this open market purchase? billion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started