Question

Total Revenue was $1,550,000; Cost of goods sold was $1,250,000; Selling and G &A expenses were $110,000; Depreciation expense was $15,000; Interest expense was $25,000;

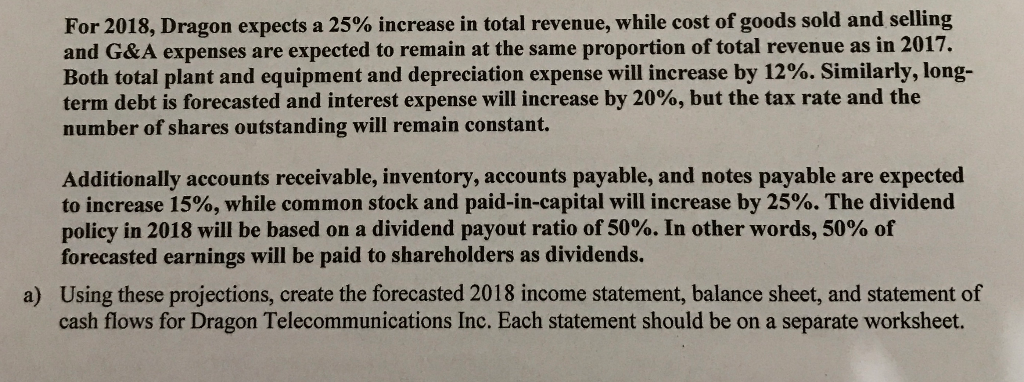

Total Revenue was $1,550,000; Cost of goods sold was $1,250,000; Selling and G &A expenses were $110,000; Depreciation expense was $15,000; Interest expense was $25,000; the average tax rate was 35%, and the number of shares outstanding was 80,000. Also in 2017 Dragon had cash of $20,000; accounts receivable of$120,000; inventory of $220,000; Plant & equipment of $1,150,000 with an accumulated depreciation of $250,000. Accounts payable, notes payable, long-term debt, common stock, additional paid- in-capital, and retained earnings represented 7%,0.5%,20%, 44.5%, 12%, and 16% of total assets respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started