Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Total tax of Mr bappi Mr./Mrs. Bappi is a Bangladeshi resident. Compute his/her taxable income, total investments, maximum limit of investment allowance and tax liability

Total tax of Mr bappi

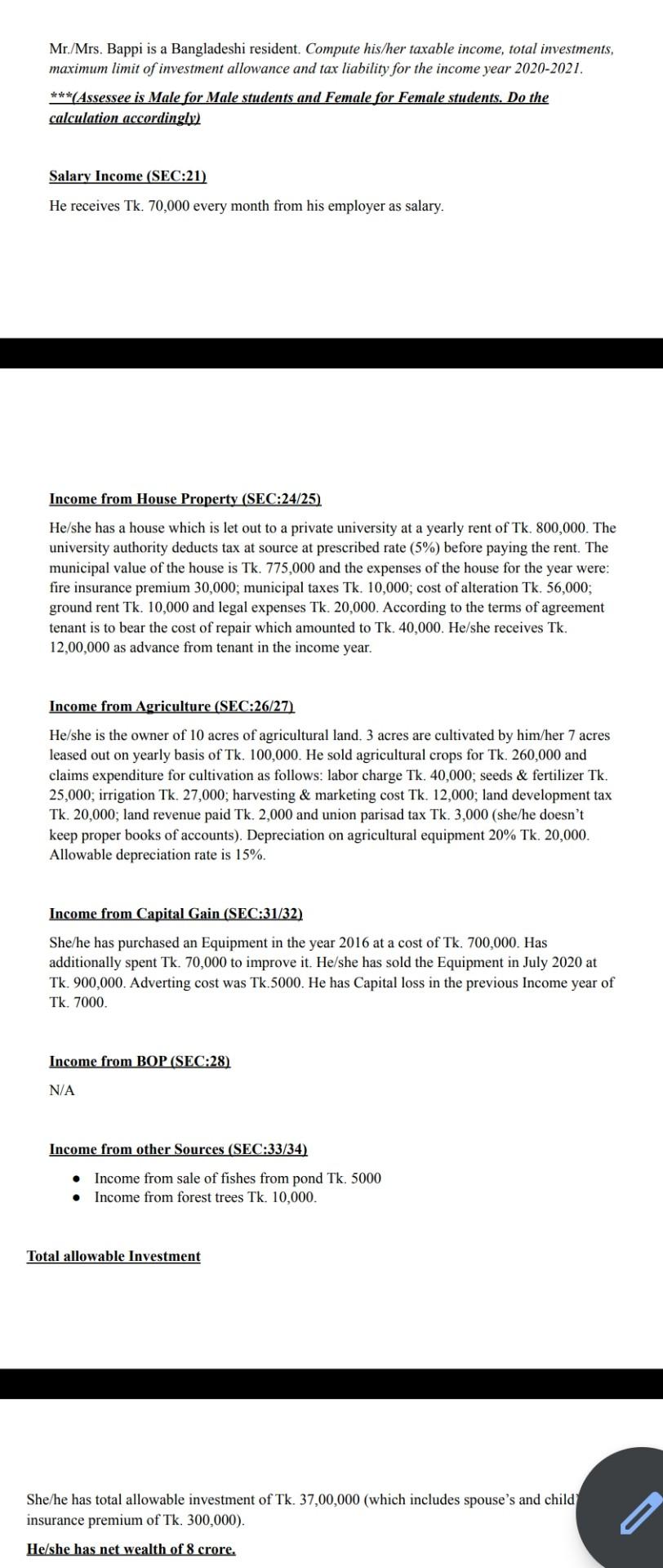

Mr./Mrs. Bappi is a Bangladeshi resident. Compute his/her taxable income, total investments, maximum limit of investment allowance and tax liability for the income year 2020-2021. ***(Assessee is Male for Male students and Female for Female students. Do the calculation accordingly) Salary Income (SEC:21) He receives Tk. 70,000 every month from his employer as salary. Income from House Property (SEC:24/25) He/she has a house which is let out to a private university at a yearly rent of Tk. 800,000. The university authority deducts tax at source at prescribed rate (5%) before paying the rent. The municipal value of the house is Tk. 775,000 and the expenses of the house for the year were: fire insurance premium 30,000; municipal taxes Tk. 10,000; cost of alteration Tk. 56,000; ground rent Tk. 10,000 and legal expenses Tk. 20,000. According to the terms of agreement tenant is to bear the cost of repair which amounted to Tk. 40,000. He/she receives Tk. 12,00,000 as advance from tenant in the income year. Income from Agriculture (SEC:26/27) He/she is the owner of 10 acres of agricultural land. 3 acres are cultivated by him/her 7 acres leased out on yearly basis of Tk. 100,000. He sold agricultural crops for Tk. 260,000 and claims expenditure for cultivation as follows: labor charge Tk. 40,000; seeds & fertilizer Tk. 25,000; irrigation Tk. 27,000; harvesting & marketing cost Tk. 12,000; land development tax Tk. 20,000; land revenue paid Tk. 2,000 and union parisad tax Tk. 3,000 (she/he doesn't keep proper books of accounts). Depreciation on agricultural equipment 20% Tk. 20,000. Allowable depreciation rate is 15%. Income from Capital Gain (SEC:31/32) She/he has purchased an Equipment in the year 2016 at a cost of Tk. 700,000. Has additionally spent Tk. 70,000 to improve it. He/she has sold the Equipment in July 2020 at Tk. 900,000. Adverting cost was Tk.5000. He has Capital loss in the previous Income year of Tk. 7000. Income from BOP (SEC:28) N/A Income from other sources (SEC:33/34) . Income from sale of fishes from pond Tk. 5000 Income from forest trees Tk. 10,000. . Total allowable Investment She/he has total allowable investment of Tk. 37,00,000 (which includes spouse's and child insurance premium of Tk. 300,000). He/she has net wealth of 8 croreStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started