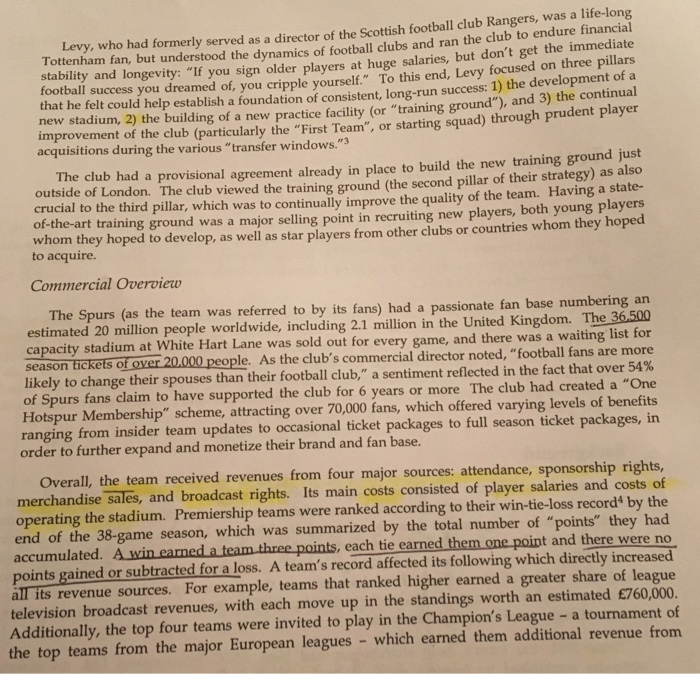

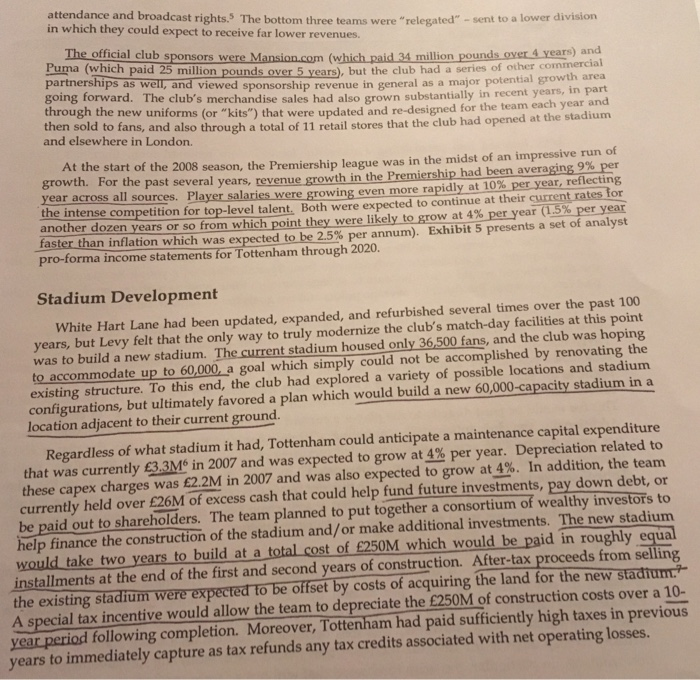

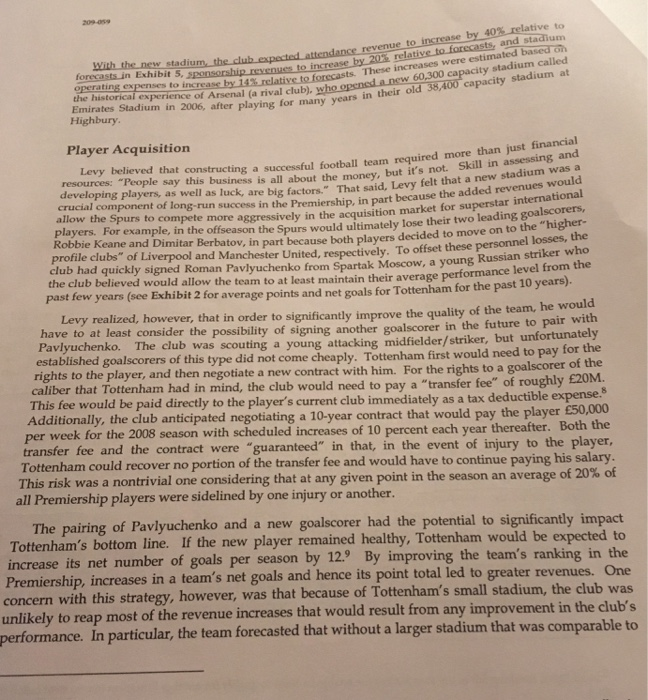

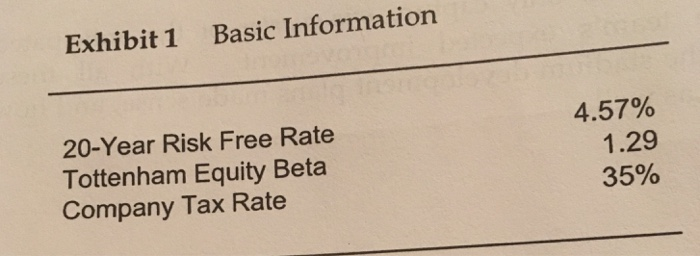

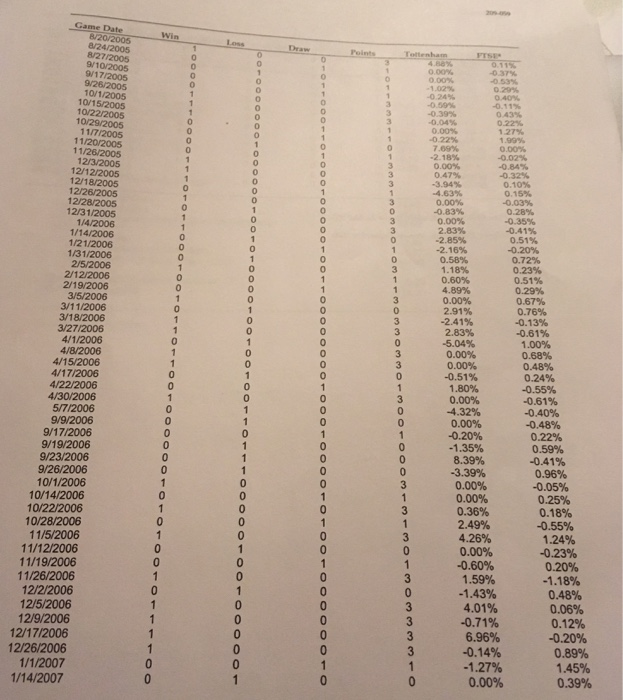

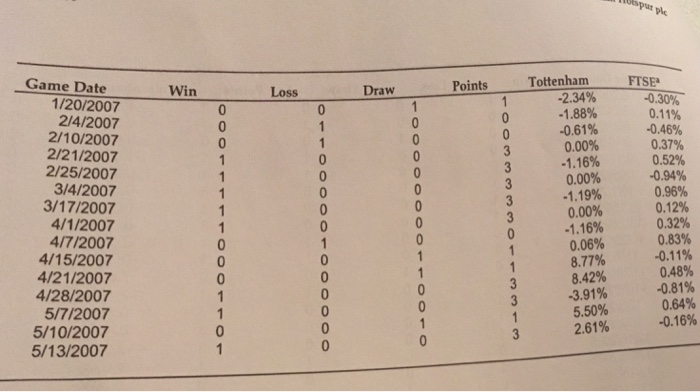

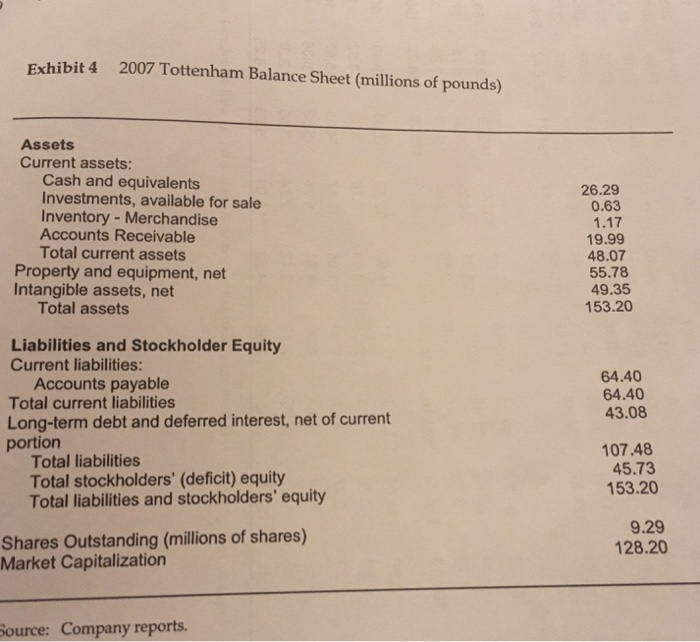

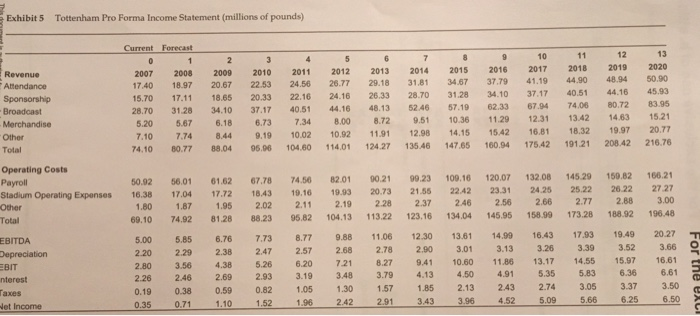

Tottenham Hotspur plo In early 200o8, Daniel Levy, chairman of Tottenham Hotspur Footballi bold move for the organization, one that he hoped would help vault the team into the upper echelon of the English Premier League ("Premiership"). Despite the club's long and storied history, Levy felt that the team's future success likely required a significant investment in physical assets, notably the development of a new stadium. Tottenham currently played in an old stadium called White Hart Lane with a capacity of only 36,500 fans, but had the opportunity to build a new stadium on some adjacent property. Most of their key competitors, such as Arsenal, Manchester United, and Chelsea, had newer or larger stadiums, and were able to leverage the added revenues these stadiums provided to gain a benefits competitive advantage in the cutthroat player acquisition market. Levy had to decide if the of a new stadium were worth the substantial commitment of time and resources that its construction would entail. Background Founded in 1882, the Tottenham Hotspur Football Club was one of the oldest teams in the Premiership. Its rich history featured a successful product on the pitch, as evidenced by major trophies in each of the past six decades-a feat matched only by Manchester United, and a series of innovations off the pitch as well. The club became t when it listed on the London Stock Exchange in 1983, and was also the first to introdu hospitality boxes at their stadium. Tottenham also saw the relationship with football fans worldwide as an important one, being were leaders in Premier League teams in charitable donations.2 ce corporate social responsibility and outreach, often topping the list of company established by Joseph Lewis. Daniel Levy, Lewis's partner at ENIC, had served as chairman of the club since 2001, after ENIC bought a controlling interest in the club. By June of 2007 ENIC had acquired a combined overal shareholder with more than a 3% stake in the club. Since 1981, the team's main shareholder had been ENIC International Ltd, an investment 11 82% beneficial interest in the club, and was the only Levy, who had formerly served as a director of the Scottish football club Rangers Tottenham fan, but understood the dynamics of football clubs and ran the club to endure f stability and longevity: "If you sign older players at huge salaries, but don't ge football success you dreamed of, y that he felt could help establish a foundation of consistent, long-run success: 1) the developme new stadium, 2) the building of a new practice facility (or "training ground"), and 3) the continual improvement of the club (particularly the "First Team", or starting squad) through prudent player acquisitions during the various "transfer windows."3 ou cripple yourself." To this end, Levy focused on three pillars The club had a provisional agreement already in place to build the new training ground just outside of London. The club viewed the training ground (the second pillar of their strategy) as also crucial to the third pillar, which was to continually improve the quality of the team. Having a state- of-the-art training ground was a major selling point in recruiting new players, both young players whom they hoped to develop, as well as star players from other clubs or countries whom they hoped to acquire. Commercial Overview The Spurs (as the team was referred to by its fans) had a passionate fan base numbering an estimated 20 million people worldwide, including 2.1 million in the United Kingdom. The 36.500 capacity stadium at White Hart Lane was sold out for every game, and there was a waiting list for ople. As the club's commercial director noted, "football fans are more ely to change their spouses than their football club," a sentiment reflected in the fact that over 54% of Spurs fans claim to have supported the club for 6 years or more The club had created a "One Hotspur Membership" scheme, attracting over 70,000 fans, which offered varying levels of benefits ranging from insider team updates to occasional ticket packages to full season ticket packages, in order to further expand and monetize their brand and fan base. Overall, the team received revenues from four major sources: attendance, sponsorship rights, merchandise sales, and broadcast rights. Its main costs consisted of player salaries and costs cf operating the stadium. Premiership teams were ranked according to their win-tie-loss records by th end of the 38-game season, which was summarized by the total number of "points" they had accumulated. A win carned a team three points, each tie earned them one point and there were no points gained or subtracted for a loss. A team's record affected its following which directly increased all its revenue sources. For example, teams that ranked higher earned a greater share of league television broadcast revenues, with each move up in the standings worth an estimated 760,000 Additionally, the top four teams were invited to play in the Champion's League- a tournament of the top teams from the major European leagues - which earned them additional revenue from attendance and broadcast rights.5 The bottom three teams were "relegated" sent to a lower division in which they could expect to receive far lower revenues. lansion.com (which paid 34 million pound Puma (which paid 25 million pounds over 5 years), but the club ha partnerships a going forward. The club's merchandise sales had also grown substantially in recent years, through the new uniforms (or "kits") that were updated and re-designed for the team then sold to fans, and also through and elsewhere in London. years) and d a series of other commercial sponsorship revenue in general as a major potential growth area in part year and a total of 11 retail stores that the club had opened at the stadium s we viewed each At the start of the growth. For the past several years, revenue 2008 season, the Premiership league was in the midst of an impressive run of growth in been averaging 9% year across all sources. Player salari the even more rapidly at 10% per r, reflecting rowirn the intense competition for top-level talent. Both were expected to continue at their current rates for nother dozen years or so from which point they were likely to gro at 4%peryear (1.5% peryear 2.5% per annum). Exhibit 5 presents a set of analyst ter than inflation which pro-forma income statements for Tottenham through 2020 was ex cted to be Stadium Development White Hart Lane had been updated, expanded, and refurbished several times over the past 100 ars, but Levy felt that the only way to truly modernize the club's match-day facilities at this point was to build a new stadium. The current stadium housed only 36,500 fans, and the club was hoping to accommodate up to 60,000, a goal which simply could not be accomplished by renovating the existing structure. To this end, the club had explored a variety of possible locations and stadium configurations, but ultimately favored a plan which would build a new 60,000-capacity stadium in a location adjacent to their current ground Regardless of what stadium it had, Tottenham could anticipate a maintenance capital expenditure that was currently 33M6 in 2007 and was expected to grow at 4% per year. Depreciation related to these capex charges was 2.2M in 2007 and was also expected to grow at4%. In addition, the team currently held over $26M of excess cash that could help fund future investments, pay down debt, or be paid out to shareholders. The team planned to put together a consortium of wealthy investors to help finance the construction of the stadium and/or make additional investments. The new stadium would take two years to build at a total cost of 250M which would be paid in roughly equal installments at the end of the first and second years of construction. After-tax proceeds from selling the existing stadium were expected to be offset by costs of acquiring the land for the new stadium.+ A special tax incentive would allow the team to depreciate the 250M of construction costs over a 10- year period following completion. Moreover, Tottenham had paid sufficiently high taxes in previous years to immediately capture as tax refunds any tax credits associated with net operating losses. and stadium based stadium called to forecasts in Exhibit 5 were estimated These increases ating ex penses to increase by 14 relative to forecasts. the historical ex of Arsenal (a rival club). capacity stadium a Emirates Stadium in 2006, after playing for y years in their Player Acquisition Levy believed that resources: "People say this business is all about the money, but it's not developing players, as well as luck, are big factors." That said, Levy felt that a nevw constructing a successful football team required more than just financial Skill in assessing and superstar international to the "higher- o offset these personnel losses, the the club believed would allow the team to at least maintain their average performance level from th crucial component of long-run success i allow the S players. For example, in the offseason the Spurs would ultimately lose their two leading go Robbie Keane and Dimitar Berbatov, in part because both players decided to move on the Premiership, in part because the added revenues would purs to compete more aggressively in the acquisition market for profile clubs" of Liverpool and Manchester United, respectively. T past few years ave to at l ub had quickly signed Roman Pavlyuchenko from Spartak Moscow, a young Rssian striker w (see Exhibit 2 for average points and net goals for Tottenham for the past 10 years realized, however, that in order to significantly improve the quality of the team, he would Pavlyuchenko. The cl established east consider the possibility of signing another goalscorer in the future to pair with ub was scouting a young attacking midfielder/striker, but unfortunately goalscorers of this type did not come cheaply. Tottenham first would need to pay for the ct with him. For the rights to a goalscorer of the pay a "transfer fee" of roughly 20M. Additionally, the club anticipated negotiating a 10-year contract that would pay the player 50,000 t each year thereafter. Both the Tottenham could recover no portion of the transfer fee and would have to continue paying his salary rights to the player, and then negotiate a new contra caliber that Tottenham had in mind, the club would need to This fee would be paid directly to the player's current club immediately as a tax deductible expense per wee transfer fee and the contract were "guaranteed " in that, in the event of injury to the player, This risk was a nontrivial one considering that at any given point in the all Premiership players were sidelined by one injury or another season an average of 20% o The pairing of Pavlyuchenko and a new goalscorer had the potential to significantly impact If the new player remained healthy, Tottenham would be expected to its net number of goals per season by 129 By improving the team's ranking in the Premiership, increases in a team's net goals and hence its point total led to greater revenues. One t because of Tottenham's small stadium, the club was concern with this strategy, however, was tha unlikely to reap performance. most of the revenue increases that would result from any improvement in the club's In particular, the team forecasted that without a larger stadium that was comparable to Exhibit 1 Basic Information 20-Year Risk Free Rate Tottenham Equity Beta Company Tax Rate 457% 1.29 35% Exhibit 2 Team Valuations, Revenues, and Records (December 31, 2007) Operating Income Avg. Points (1998-2007) Avg. Net Goals (1998-2007) Team Enterprise Net Deb/EV Revenue Value (EV) 42.7 38.1 33.9 24.6 0.84 0.53 0.28 0.18 0.46 0.12 0.32 0.16 50 934 588 345 291 167 156 106 90 169 134 154 123 87 75 58 50 Manchester United Arsenal Chelsea 74 67 53 51 49 51 -20 2.3 Newcastle United Tottenham Hotspur Everton Aston Villa -4.9 0.00 75 8 001 1000 -00-000-1-11 04 16 8 .6 6370010 0 0514 33130'103313131- 030000003333313100033003131103013 010100010101-ooooooooooooo-o-oooooooo-o-tooo-o 000101111010100000000101111110000000011100-10000010_00 ca F t 0 0 0 0 0 0 0 0 1 0 1 0 1 0 0 0 1 0 0 0 0 0 0 1 1 1 1 1 0 1 0 0 0 0 1 1 0 0 1 0 1 0 0 0 1 0 0 1 3 128 .4 3 00?0000-01-00-1000-00_0 % 7 0-0000000-0-o10 164 540791 -22-500-010-40-0183000240-01-14-069r0 -1-O-Ch O-07-200-30-002-2-2010402 1 0 1 1 3 3 3 1 1 0 1 3 3 3 1 3 0 3 3 0 1 0 3 1 1 3 0 3 3 0 3 3 0 1 3 0 0 1 0 0 0 3 1 3 1 3 0 1 30 333 310 o 110001-01000100000100110000000010001000010100100000 010 e a , a e o e e o o.oooooe-oe-o 0000100100100110111000001001000001 000011100001110101 1 0 0 0 1 0 1 0 1 0 1 1 0 0 000000101010010111100 A/ 7 spurpe Game Date Points Tottenham FTSE Win Loss Draw -2.34% -1.88% -0.61% 0.00% -1.16% 0.00% -1.19% 0.00% -1.16% 0.06% 8.77% 1/20/2007 0.11% 214/2007 2/10/2007 2/21/2007 2/25/2007 3/4/2007 3/17/2007 4/1/2007 4/7/2007 4/15/2007 4/21/2007 4/28/2007 5/7/2007 5/10/2007 -0.11% 0.48% -3.91% 5.50% 2.61% 0.64% "0.16% 5/13/2007 Exhibit 4 2007 Tottenham Balance Sheet (millions of pounds) Assets Current assets: Cash and equivalents 26.29 Investments, available for sale 0.63 1.17 19.99 48.07 55.78 49.35 153.20 Inventory - Merchandise Accounts Receivable Total current assets Property and equipment, net Intangible assets, net Total assets Liabilities and Stockholder Equity Current liabilities: Accounts payable Total current liabilities Long-term debt and deferred interest, net of current portion 64.40 64.40 43.08 Total liabilities Total stockholders' (deficit) equity Total liabilities and stockholders' equity 107.48 45.73 53.20 Shares Outstanding (millions of shares) Market Capitalization 9.29 128.20 ource: Company reports. Exhibit 5 Tottenham Pro Forma Income Statement (millions of pounds) 12 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1740 18.97 20.67 22.53 24.56 26.77 29.18 3181 3467 37.79 41.19 44.90 48.94 50.90 15.70 17.11 18.65 20.33 22.16 24.16 26.33 28.70 31.28 34.10 37.17 40.51 44.16 45.93 28.70 31.28 34.10 37.17 40.51 44.16 48.13 5246 57.19 62.33 67.94 74.06 80.72 83.95 5.20 5,67 8 6.73 7.34 8.00 8.72 9.51 10.36 1129 12.31 13.42 1463 5.21 Revenue Attendance Sponsorship 7.10 7.74 8.44 919 10.02 10.92 11.91 12.98 14.15 15.42 16.8118.32 19.97 20.77 74.10 80.77 88.04 6 104.60 114.01 124.27 135.46 147.65 160.94 175.42 19121 208.42 216.76 Operating Costs Payroll Stadium Operating Expenses 6.38 1704 17.72 18.43 19.16 19.9320.73 21.56 2242 .1 24.25 25.22 26.22 2727 50.92 56.01 61.6267,78 74.56 82.01 90.21 99.23 109.16 120,07 132.08 145.29 150.82 166.21 1.80 1.87 1.95 202 2.1 2.19 2.28 2.37 246 2.56 2.66 2.77 2.88 3.00 69.10 74.92 81.28 88.23 95.82 104.13 113.22 123.16 134.04 145.95 158.99 173.28 188.92 196.48 5.00 5.85 6.76 7.73 877 9.88 11.06 12.30 13.61 14.99 16.43 17.93 19.49 20.27 T EBITDA Depreciation 2.20 2.29 2.38 2.47 2.57 2.68 2.78 2.90 3.01 3,13 3 3.66 Q 2.80 3.56 4 2.26 2.46 2.69 2.93 3.19 348 3.79 4.13 4.50 4.91 5.35 .83 6.36 6.61 0.19 0.38 0.59 0.82 1.05 1.30 157 185 2.13 2.43 2.74 3.05 3.37 3.50 3.26 3.39 3.52 .38 5.26 6.20 721 8.27 9.41 10.60 11.86 13.17 14.55 15.97 16.61 nterest 1.52 1.96 242 2.91 3.96 4.52 6.50 et Income 0.71 1.10 determine the overall value of Tottenham. At its current stock price of $13.80, is Tottenham fairly valued? Assignment Please answer the following questions with a 1 page write-up plus financial support Using a DCF/NPV approach, provide your recommendation to management regarding each of the following decisions: 1. a. b. c. Build a new stadium Sign a new striker Build a new stadium+ sign a new striker 2. What would be the impacting stock price in scenarios a, b, and c above? 3. If you do not agree with the projections/assumptions in the case or below, what would you change and why? How would it impact the outcome, and ultimately, your recommendation? Some additional notes/hints 1. Keep money in 2, NPV: Enterprise value 3. Assume Net W/C increases at same rate as total revenue 4. Assume market premium-5% 5. Assume interest rate on debt 6.4% 6. For every 1% increase in points, revenue increases by 1.52%. 7, New striker is expected to increase net points by 16%. (note: can ignore other comments related to relative performance, team rankings, etc.) 8. Assume funding available at current cost of capital. We will discuss capital decision making in a couple weeks Tottenham Hotspur plo In early 200o8, Daniel Levy, chairman of Tottenham Hotspur Footballi bold move for the organization, one that he hoped would help vault the team into the upper echelon of the English Premier League ("Premiership"). Despite the club's long and storied history, Levy felt that the team's future success likely required a significant investment in physical assets, notably the development of a new stadium. Tottenham currently played in an old stadium called White Hart Lane with a capacity of only 36,500 fans, but had the opportunity to build a new stadium on some adjacent property. Most of their key competitors, such as Arsenal, Manchester United, and Chelsea, had newer or larger stadiums, and were able to leverage the added revenues these stadiums provided to gain a benefits competitive advantage in the cutthroat player acquisition market. Levy had to decide if the of a new stadium were worth the substantial commitment of time and resources that its construction would entail. Background Founded in 1882, the Tottenham Hotspur Football Club was one of the oldest teams in the Premiership. Its rich history featured a successful product on the pitch, as evidenced by major trophies in each of the past six decades-a feat matched only by Manchester United, and a series of innovations off the pitch as well. The club became t when it listed on the London Stock Exchange in 1983, and was also the first to introdu hospitality boxes at their stadium. Tottenham also saw the relationship with football fans worldwide as an important one, being were leaders in Premier League teams in charitable donations.2 ce corporate social responsibility and outreach, often topping the list of company established by Joseph Lewis. Daniel Levy, Lewis's partner at ENIC, had served as chairman of the club since 2001, after ENIC bought a controlling interest in the club. By June of 2007 ENIC had acquired a combined overal shareholder with more than a 3% stake in the club. Since 1981, the team's main shareholder had been ENIC International Ltd, an investment 11 82% beneficial interest in the club, and was the only Levy, who had formerly served as a director of the Scottish football club Rangers Tottenham fan, but understood the dynamics of football clubs and ran the club to endure f stability and longevity: "If you sign older players at huge salaries, but don't ge football success you dreamed of, y that he felt could help establish a foundation of consistent, long-run success: 1) the developme new stadium, 2) the building of a new practice facility (or "training ground"), and 3) the continual improvement of the club (particularly the "First Team", or starting squad) through prudent player acquisitions during the various "transfer windows."3 ou cripple yourself." To this end, Levy focused on three pillars The club had a provisional agreement already in place to build the new training ground just outside of London. The club viewed the training ground (the second pillar of their strategy) as also crucial to the third pillar, which was to continually improve the quality of the team. Having a state- of-the-art training ground was a major selling point in recruiting new players, both young players whom they hoped to develop, as well as star players from other clubs or countries whom they hoped to acquire. Commercial Overview The Spurs (as the team was referred to by its fans) had a passionate fan base numbering an estimated 20 million people worldwide, including 2.1 million in the United Kingdom. The 36.500 capacity stadium at White Hart Lane was sold out for every game, and there was a waiting list for ople. As the club's commercial director noted, "football fans are more ely to change their spouses than their football club," a sentiment reflected in the fact that over 54% of Spurs fans claim to have supported the club for 6 years or more The club had created a "One Hotspur Membership" scheme, attracting over 70,000 fans, which offered varying levels of benefits ranging from insider team updates to occasional ticket packages to full season ticket packages, in order to further expand and monetize their brand and fan base. Overall, the team received revenues from four major sources: attendance, sponsorship rights, merchandise sales, and broadcast rights. Its main costs consisted of player salaries and costs cf operating the stadium. Premiership teams were ranked according to their win-tie-loss records by th end of the 38-game season, which was summarized by the total number of "points" they had accumulated. A win carned a team three points, each tie earned them one point and there were no points gained or subtracted for a loss. A team's record affected its following which directly increased all its revenue sources. For example, teams that ranked higher earned a greater share of league television broadcast revenues, with each move up in the standings worth an estimated 760,000 Additionally, the top four teams were invited to play in the Champion's League- a tournament of the top teams from the major European leagues - which earned them additional revenue from attendance and broadcast rights.5 The bottom three teams were "relegated" sent to a lower division in which they could expect to receive far lower revenues. lansion.com (which paid 34 million pound Puma (which paid 25 million pounds over 5 years), but the club ha partnerships a going forward. The club's merchandise sales had also grown substantially in recent years, through the new uniforms (or "kits") that were updated and re-designed for the team then sold to fans, and also through and elsewhere in London. years) and d a series of other commercial sponsorship revenue in general as a major potential growth area in part year and a total of 11 retail stores that the club had opened at the stadium s we viewed each At the start of the growth. For the past several years, revenue 2008 season, the Premiership league was in the midst of an impressive run of growth in been averaging 9% year across all sources. Player salari the even more rapidly at 10% per r, reflecting rowirn the intense competition for top-level talent. Both were expected to continue at their current rates for nother dozen years or so from which point they were likely to gro at 4%peryear (1.5% peryear 2.5% per annum). Exhibit 5 presents a set of analyst ter than inflation which pro-forma income statements for Tottenham through 2020 was ex cted to be Stadium Development White Hart Lane had been updated, expanded, and refurbished several times over the past 100 ars, but Levy felt that the only way to truly modernize the club's match-day facilities at this point was to build a new stadium. The current stadium housed only 36,500 fans, and the club was hoping to accommodate up to 60,000, a goal which simply could not be accomplished by renovating the existing structure. To this end, the club had explored a variety of possible locations and stadium configurations, but ultimately favored a plan which would build a new 60,000-capacity stadium in a location adjacent to their current ground Regardless of what stadium it had, Tottenham could anticipate a maintenance capital expenditure that was currently 33M6 in 2007 and was expected to grow at 4% per year. Depreciation related to these capex charges was 2.2M in 2007 and was also expected to grow at4%. In addition, the team currently held over $26M of excess cash that could help fund future investments, pay down debt, or be paid out to shareholders. The team planned to put together a consortium of wealthy investors to help finance the construction of the stadium and/or make additional investments. The new stadium would take two years to build at a total cost of 250M which would be paid in roughly equal installments at the end of the first and second years of construction. After-tax proceeds from selling the existing stadium were expected to be offset by costs of acquiring the land for the new stadium.+ A special tax incentive would allow the team to depreciate the 250M of construction costs over a 10- year period following completion. Moreover, Tottenham had paid sufficiently high taxes in previous years to immediately capture as tax refunds any tax credits associated with net operating losses. and stadium based stadium called to forecasts in Exhibit 5 were estimated These increases ating ex penses to increase by 14 relative to forecasts. the historical ex of Arsenal (a rival club). capacity stadium a Emirates Stadium in 2006, after playing for y years in their Player Acquisition Levy believed that resources: "People say this business is all about the money, but it's not developing players, as well as luck, are big factors." That said, Levy felt that a nevw constructing a successful football team required more than just financial Skill in assessing and superstar international to the "higher- o offset these personnel losses, the the club believed would allow the team to at least maintain their average performance level from th crucial component of long-run success i allow the S players. For example, in the offseason the Spurs would ultimately lose their two leading go Robbie Keane and Dimitar Berbatov, in part because both players decided to move on the Premiership, in part because the added revenues would purs to compete more aggressively in the acquisition market for profile clubs" of Liverpool and Manchester United, respectively. T past few years ave to at l ub had quickly signed Roman Pavlyuchenko from Spartak Moscow, a young Rssian striker w (see Exhibit 2 for average points and net goals for Tottenham for the past 10 years realized, however, that in order to significantly improve the quality of the team, he would Pavlyuchenko. The cl established east consider the possibility of signing another goalscorer in the future to pair with ub was scouting a young attacking midfielder/striker, but unfortunately goalscorers of this type did not come cheaply. Tottenham first would need to pay for the ct with him. For the rights to a goalscorer of the pay a "transfer fee" of roughly 20M. Additionally, the club anticipated negotiating a 10-year contract that would pay the player 50,000 t each year thereafter. Both the Tottenham could recover no portion of the transfer fee and would have to continue paying his salary rights to the player, and then negotiate a new contra caliber that Tottenham had in mind, the club would need to This fee would be paid directly to the player's current club immediately as a tax deductible expense per wee transfer fee and the contract were "guaranteed " in that, in the event of injury to the player, This risk was a nontrivial one considering that at any given point in the all Premiership players were sidelined by one injury or another season an average of 20% o The pairing of Pavlyuchenko and a new goalscorer had the potential to significantly impact If the new player remained healthy, Tottenham would be expected to its net number of goals per season by 129 By improving the team's ranking in the Premiership, increases in a team's net goals and hence its point total led to greater revenues. One t because of Tottenham's small stadium, the club was concern with this strategy, however, was tha unlikely to reap performance. most of the revenue increases that would result from any improvement in the club's In particular, the team forecasted that without a larger stadium that was comparable to Exhibit 1 Basic Information 20-Year Risk Free Rate Tottenham Equity Beta Company Tax Rate 457% 1.29 35% Exhibit 2 Team Valuations, Revenues, and Records (December 31, 2007) Operating Income Avg. Points (1998-2007) Avg. Net Goals (1998-2007) Team Enterprise Net Deb/EV Revenue Value (EV) 42.7 38.1 33.9 24.6 0.84 0.53 0.28 0.18 0.46 0.12 0.32 0.16 50 934 588 345 291 167 156 106 90 169 134 154 123 87 75 58 50 Manchester United Arsenal Chelsea 74 67 53 51 49 51 -20 2.3 Newcastle United Tottenham Hotspur Everton Aston Villa -4.9 0.00 75 8 001 1000 -00-000-1-11 04 16 8 .6 6370010 0 0514 33130'103313131- 030000003333313100033003131103013 010100010101-ooooooooooooo-o-oooooooo-o-tooo-o 000101111010100000000101111110000000011100-10000010_00 ca F t 0 0 0 0 0 0 0 0 1 0 1 0 1 0 0 0 1 0 0 0 0 0 0 1 1 1 1 1 0 1 0 0 0 0 1 1 0 0 1 0 1 0 0 0 1 0 0 1 3 128 .4 3 00?0000-01-00-1000-00_0 % 7 0-0000000-0-o10 164 540791 -22-500-010-40-0183000240-01-14-069r0 -1-O-Ch O-07-200-30-002-2-2010402 1 0 1 1 3 3 3 1 1 0 1 3 3 3 1 3 0 3 3 0 1 0 3 1 1 3 0 3 3 0 3 3 0 1 3 0 0 1 0 0 0 3 1 3 1 3 0 1 30 333 310 o 110001-01000100000100110000000010001000010100100000 010 e a , a e o e e o o.oooooe-oe-o 0000100100100110111000001001000001 000011100001110101 1 0 0 0 1 0 1 0 1 0 1 1 0 0 000000101010010111100 A/ 7 spurpe Game Date Points Tottenham FTSE Win Loss Draw -2.34% -1.88% -0.61% 0.00% -1.16% 0.00% -1.19% 0.00% -1.16% 0.06% 8.77% 1/20/2007 0.11% 214/2007 2/10/2007 2/21/2007 2/25/2007 3/4/2007 3/17/2007 4/1/2007 4/7/2007 4/15/2007 4/21/2007 4/28/2007 5/7/2007 5/10/2007 -0.11% 0.48% -3.91% 5.50% 2.61% 0.64% "0.16% 5/13/2007 Exhibit 4 2007 Tottenham Balance Sheet (millions of pounds) Assets Current assets: Cash and equivalents 26.29 Investments, available for sale 0.63 1.17 19.99 48.07 55.78 49.35 153.20 Inventory - Merchandise Accounts Receivable Total current assets Property and equipment, net Intangible assets, net Total assets Liabilities and Stockholder Equity Current liabilities: Accounts payable Total current liabilities Long-term debt and deferred interest, net of current portion 64.40 64.40 43.08 Total liabilities Total stockholders' (deficit) equity Total liabilities and stockholders' equity 107.48 45.73 53.20 Shares Outstanding (millions of shares) Market Capitalization 9.29 128.20 ource: Company reports. Exhibit 5 Tottenham Pro Forma Income Statement (millions of pounds) 12 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1740 18.97 20.67 22.53 24.56 26.77 29.18 3181 3467 37.79 41.19 44.90 48.94 50.90 15.70 17.11 18.65 20.33 22.16 24.16 26.33 28.70 31.28 34.10 37.17 40.51 44.16 45.93 28.70 31.28 34.10 37.17 40.51 44.16 48.13 5246 57.19 62.33 67.94 74.06 80.72 83.95 5.20 5,67 8 6.73 7.34 8.00 8.72 9.51 10.36 1129 12.31 13.42 1463 5.21 Revenue Attendance Sponsorship 7.10 7.74 8.44 919 10.02 10.92 11.91 12.98 14.15 15.42 16.8118.32 19.97 20.77 74.10 80.77 88.04 6 104.60 114.01 124.27 135.46 147.65 160.94 175.42 19121 208.42 216.76 Operating Costs Payroll Stadium Operating Expenses 6.38 1704 17.72 18.43 19.16 19.9320.73 21.56 2242 .1 24.25 25.22 26.22 2727 50.92 56.01 61.6267,78 74.56 82.01 90.21 99.23 109.16 120,07 132.08 145.29 150.82 166.21 1.80 1.87 1.95 202 2.1 2.19 2.28 2.37 246 2.56 2.66 2.77 2.88 3.00 69.10 74.92 81.28 88.23 95.82 104.13 113.22 123.16 134.04 145.95 158.99 173.28 188.92 196.48 5.00 5.85 6.76 7.73 877 9.88 11.06 12.30 13.61 14.99 16.43 17.93 19.49 20.27 T EBITDA Depreciation 2.20 2.29 2.38 2.47 2.57 2.68 2.78 2.90 3.01 3,13 3 3.66 Q 2.80 3.56 4 2.26 2.46 2.69 2.93 3.19 348 3.79 4.13 4.50 4.91 5.35 .83 6.36 6.61 0.19 0.38 0.59 0.82 1.05 1.30 157 185 2.13 2.43 2.74 3.05 3.37 3.50 3.26 3.39 3.52 .38 5.26 6.20 721 8.27 9.41 10.60 11.86 13.17 14.55 15.97 16.61 nterest 1.52 1.96 242 2.91 3.96 4.52 6.50 et Income 0.71 1.10 determine the overall value of Tottenham. At its current stock price of $13.80, is Tottenham fairly valued? Assignment Please answer the following questions with a 1 page write-up plus financial support Using a DCF/NPV approach, provide your recommendation to management regarding each of the following decisions: 1. a. b. c. Build a new stadium Sign a new striker Build a new stadium+ sign a new striker 2. What would be the impacting stock price in scenarios a, b, and c above? 3. If you do not agree with the projections/assumptions in the case or below, what would you change and why? How would it impact the outcome, and ultimately, your recommendation? Some additional notes/hints 1. Keep money in 2, NPV: Enterprise value 3. Assume Net W/C increases at same rate as total revenue 4. Assume market premium-5% 5. Assume interest rate on debt 6.4% 6. For every 1% increase in points, revenue increases by 1.52%. 7, New striker is expected to increase net points by 16%. (note: can ignore other comments related to relative performance, team rankings, etc.) 8. Assume funding available at current cost of capital. We will discuss capital decision making in a couple weeks