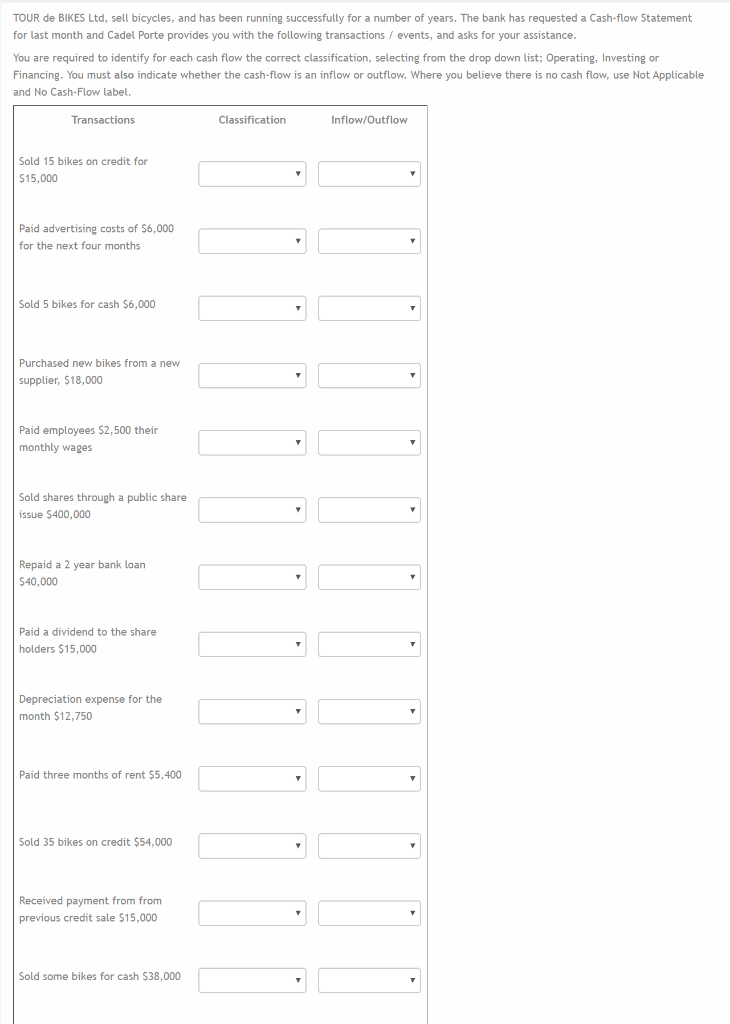

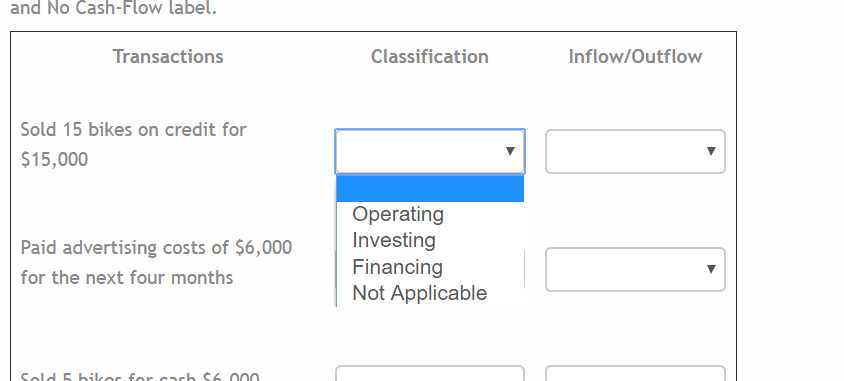

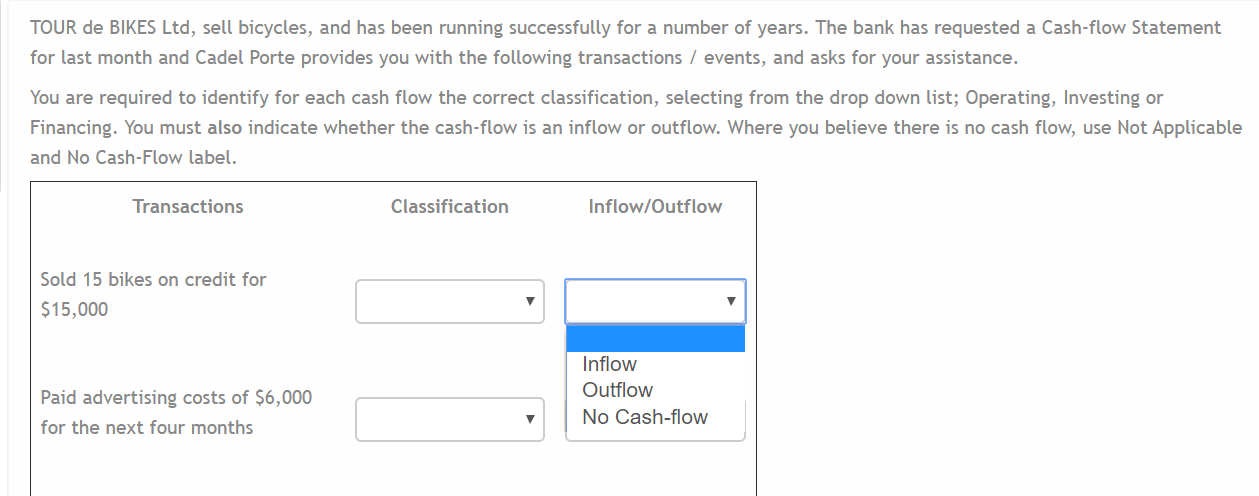

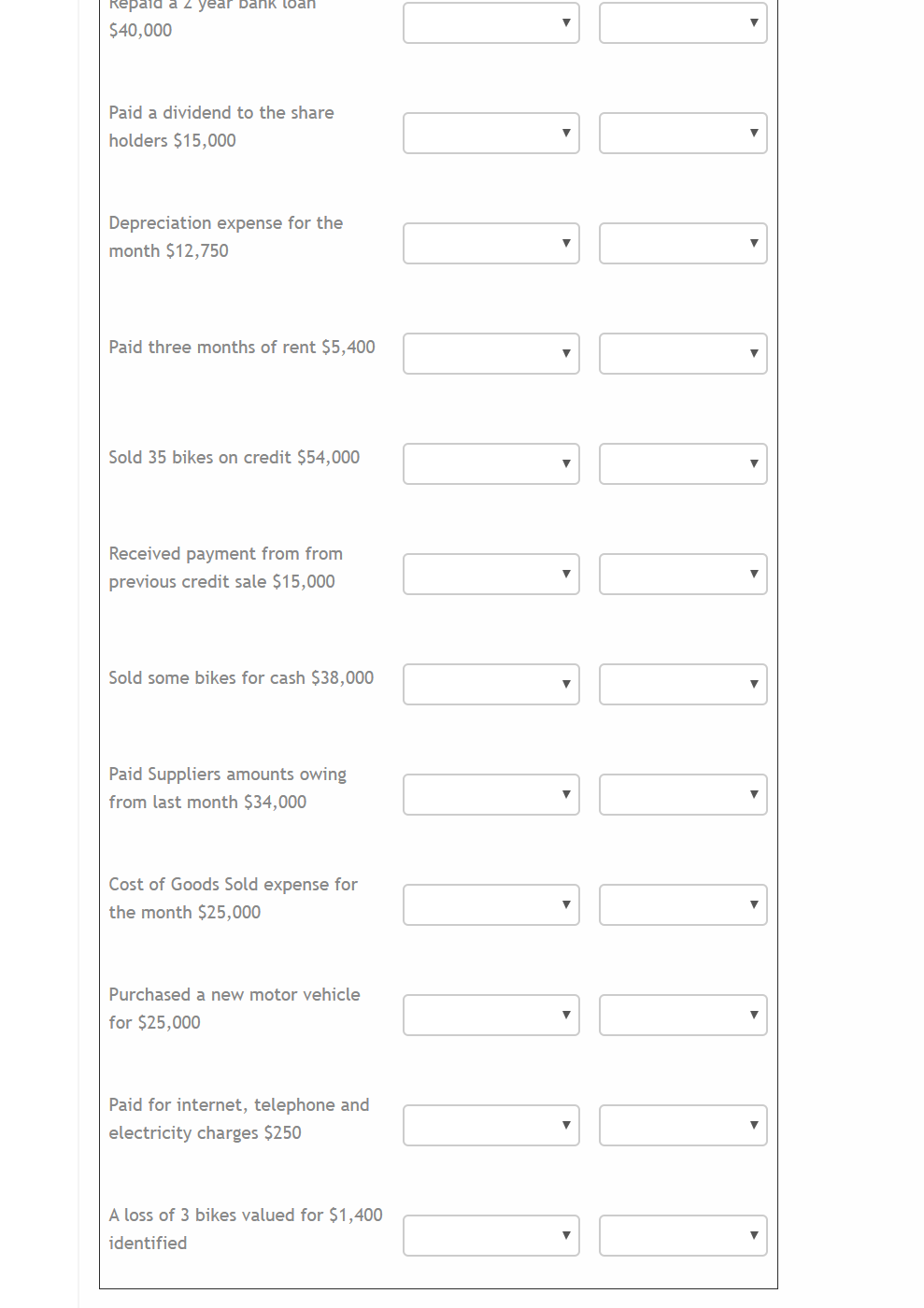

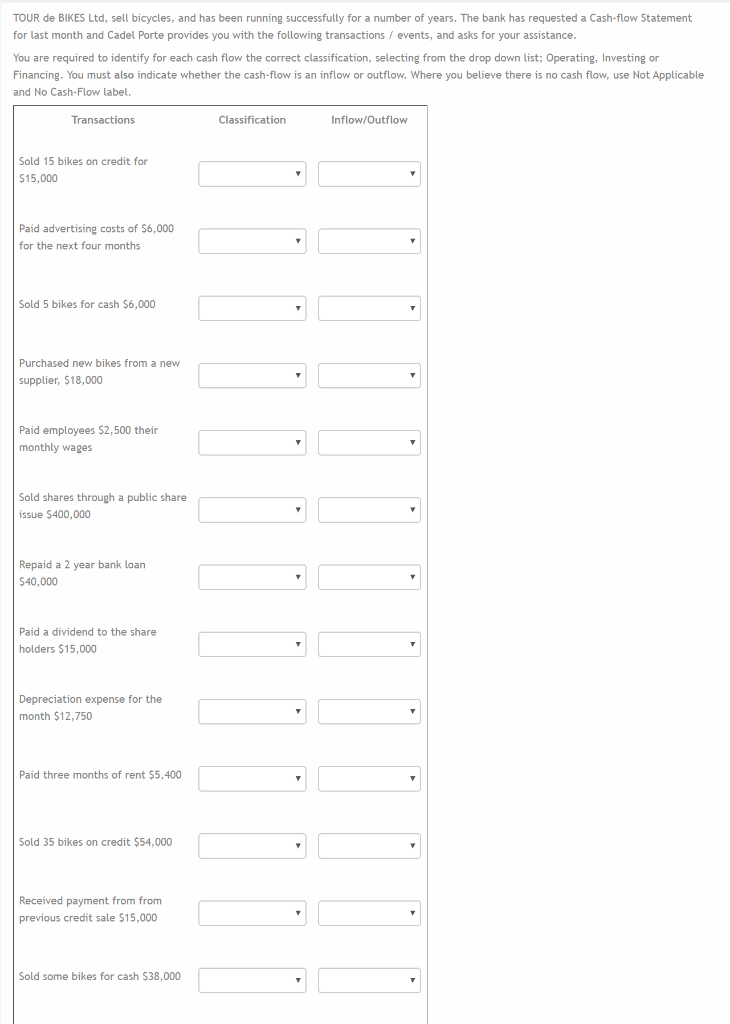

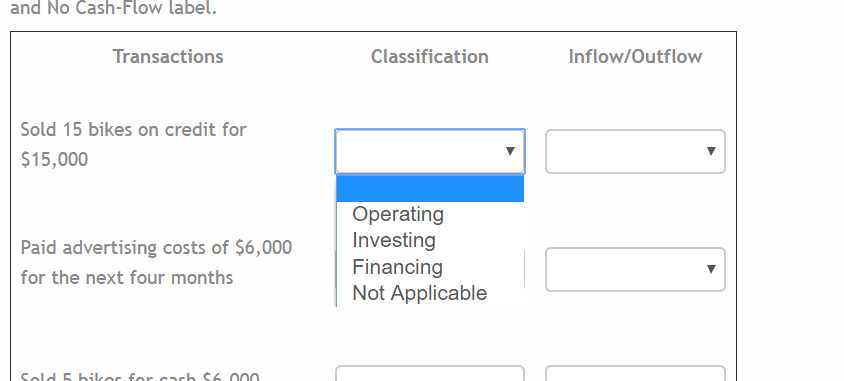

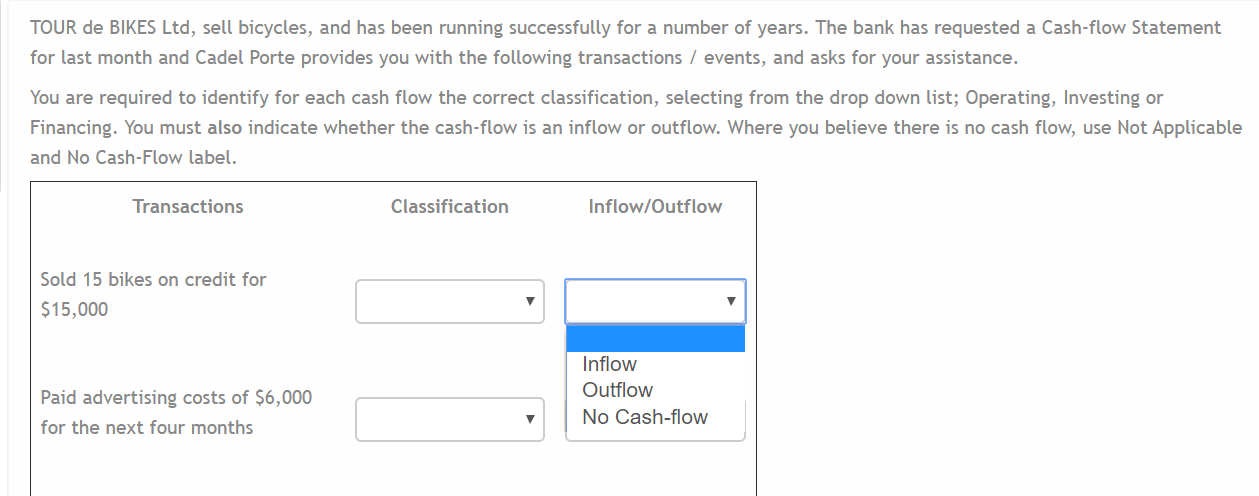

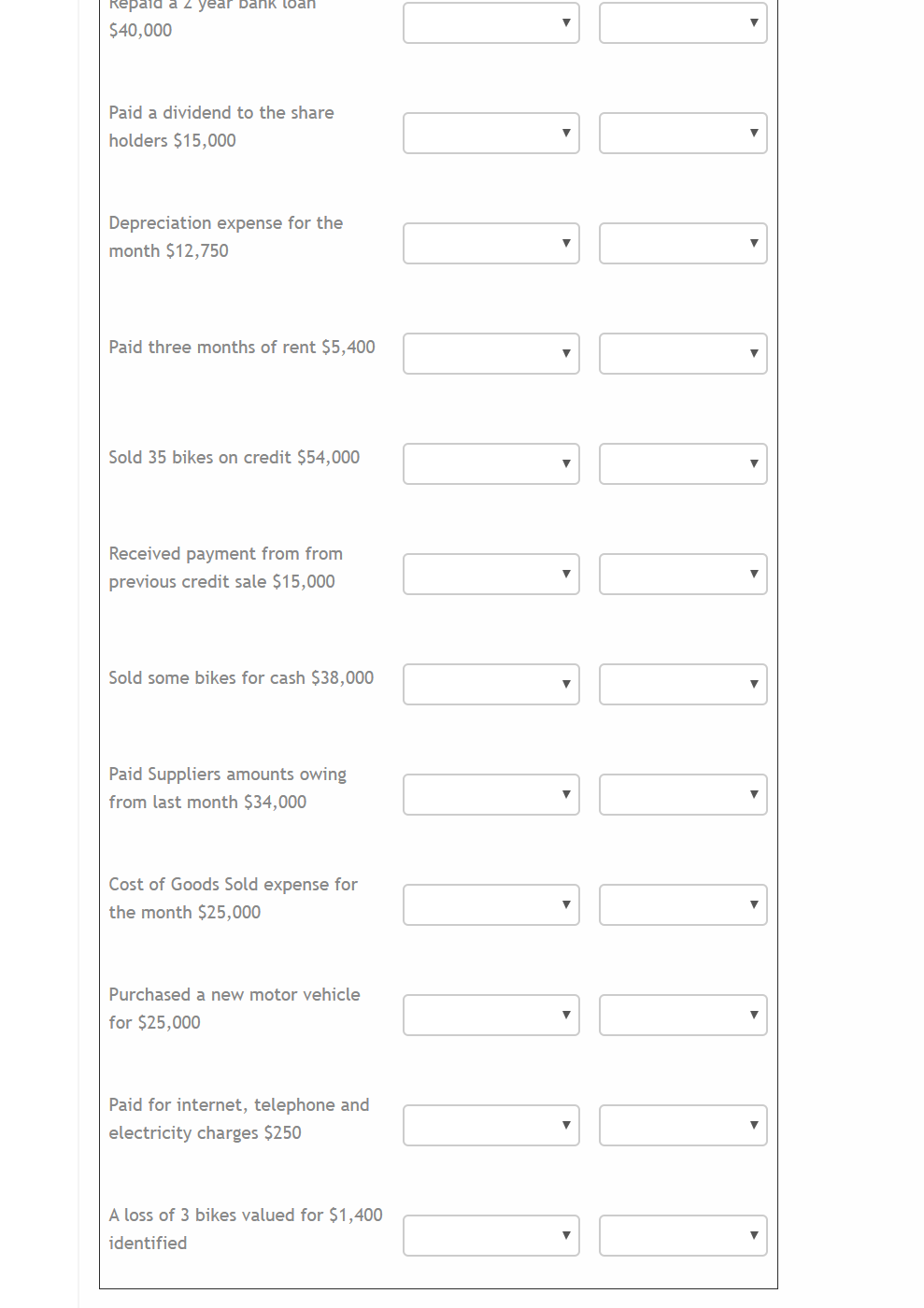

TOUR de BIKES Ltd, sell bicycles, and has been running successfully for a number of years. The bank has requested a Cash-flow Statement for last month and Cadel Porte provides you with the following transactions / events, and asks for your assistance, You are required to identify for each cash flow the correct classification, selecting from the drop down list; Operating, Investing or Financing. You must also indicate whether the cash-flow is an inflow or outflow. Where you believe there is no cash flow, use Not Applicable and No Cash-Flow label. Transactions Classification Inflow/Outflow Sold 15 bikes on credit for $15,000 Paid advertising costs of $6,000 for the next four months Sold 5 bikes for cash $6,000 Purchased new bikes from a new supplier, 518,000 Paid employees $2,500 their monthly wages Sold shares through a public share issue $400,000 Repaid a 2 year bank loan $40,000 Paid a dividend to the share holders $15,000 Depreciation expense for the month $12,750 Paid three months of rent $5,400 Sold 35 bikes on credit $54,000 Received payment from from previous credit sale $15,000 Sold some bikes for cash $38,000 and No Cash-Flow label. Transactions Classification Inflow/Outflow Sold 15 bikes on credit for $15,000 Paid advertising costs of $6,000 for the next four months Operating Investing Financing Not Applicable Sold 5 bikor for each c6 non TOUR de BIKES Ltd, sell bicycles, and has been running successfully for a number of years. The bank has requested a Cash-flow Statement for last month and Cadel Porte provides you with the following transactions / events, and asks for your assistance. You are required to identify for each cash flow the correct classification, selecting from the drop down list; Operating, Investing or Financing. You must also indicate whether the cash-flow is an inflow or outflow. Where you believe there is no cash flow, use Not Applicable and No Cash-Flow label. Transactions Classification Inflow/Outflow Sold 15 bikes on credit for $15,000 Paid advertising costs of $6,000 for the next four months Inflow Outflow No Cash-flow Repaid a 2 year Dank wan $40,000 Paid a dividend to the share holders $15,000 Depreciation expense for the month $12,750 Paid three months of rent $5,400 Sold 35 bikes on credit $54,000 Received payment from from previous credit sale $15,000 Sold some bikes for cash $38,000 Paid Suppliers amounts owing from last month $34,000 Cost of Goods Sold expense for the month $25,000 Purchased a new motor vehicle for $25,000 Paid for internet, telephone and electricity charges $250 A loss of 3 bikes valued for $1,400 identified