Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tourist Trinkets, Inc. had a $70,000 cash balance on July 1. Other facts are as follows: Half of all sales are on credit. Of

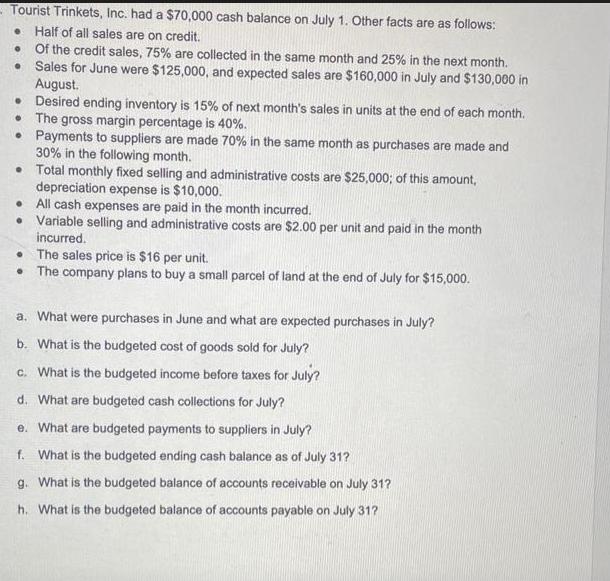

Tourist Trinkets, Inc. had a $70,000 cash balance on July 1. Other facts are as follows: Half of all sales are on credit. Of the credit sales, 75% are collected in the same month and 25% in the next month. Sales for June were $125,000, and expected sales are $160,000 in July and $130,000 in August. Desired ending inventory is 15% of next month's sales in units at the end of each month. The gross margin percentage is 40%. Payments to suppliers are made 70% in the same month as purchases are made and 30% in the following month. Total monthly fixed selling and administrative costs are $25,000; of this amount, depreciation expense is $10,000. All cash expenses are paid in the month incurred. Variable selling and administrative costs are $2.00 per unit and paid in the month incurred. The sales price is $16 per unit. The company plans to buy a small parcel of land at the end of July for $15,000. a. What were purchases in June and what are expected purchases in July? b. What is the budgeted cost of goods sold for July? c. What is the budgeted income before taxes for July? d. What are budgeted cash collections for July? e. What are budgeted payments to suppliers in July? f. What is the budgeted ending cash balance as of July 31? g. What is the budgeted balance of accounts receivable on July 31? h. What is the budgeted balance of accounts payable on July 31?

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate purchases in June we need to first determine Junes cost of goods sold COGS COGS Sales 1 Gross margin percentage 125000 1 040 75000 Sinc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started